Markets:

- NZD leads, JPY lags

- Gold down $5 to $1908

- WTI crude oil down 6-cents to $88.78

- US 10-year yields down 0.1 bps to 4.25%

- S&P 500 up 0.2%

What a disappointment. The entire market had been discussing the Consumer Price Index (CPI) for a week leading up to its release, but when it finally arrived, it had minimal impact on the markets. The month-on-month core CPI figure showed some strength, but overall, the data was in line with expectations. The U.S. dollar experienced fluctuations in both directions before settling slightly lower.

Subsequently, the swings in the stock and bond markets took center stage, but they too had little lasting effect on the market. Commodity currencies initially gained after the stock market opened as sentiment improved but later surrendered those gains as sentiment deteriorated, leaving them virtually unchanged for the day.

The euro presented an interesting scenario as it surged early in the Asian trading session following a leak regarding the ECB’s forecasts. However, it couldn’t sustain those gains and ended the day at levels similar to those before the leak, indicating apprehension ahead of the ECB’s interest rate decision scheduled for tomorrow. Current pricing suggests a 64% likelihood of a rate hike.

USD/JPY briefly rose as high as 147.72 immediately after the CPI release but quickly retraced its gains without challenging the highs from the previous week, which were just above that level. Nevertheless, it marked the pair’s second consecutive day of gains, and the gap lower observed on Monday has now been eliminated.

US August CPI +0.6% m/m versus +0.6% m/m expected

- Prior m/m +0.2%

- CPI m/m +0.6% versus +0.6% expected

- CPI y/y 3.7% versus 3.6% expected

- Prior y/y 3.2%

Core measures:

- Core CPI m/m +0.3% versus +0.2% expected. Last month 0.2%

- Unrounded core at +0.278%

- Core CPI y/y 4.3% versus 4.3% expected. Last month was 4.7%

- Shelter +0.3% versus +0.4% last month. Year on year 7.3% versus 7.7% last month

- Services less rent and shelter +0.5% m/m vs +0.2% prior

- Real weekly earnings -0.1% vs 0.0% prior

Before the data release, the market had factored in a 9% likelihood of a rate hike next week. However, this probability increased to 53% for December. Following the release, the odds of a September hike dropped to 5%, but the December probabilities remained steady.

The numbers from the CPI report were slightly higher than expected, with the headline figure being influenced by a 10.6% month-on-month increase in gasoline prices, while the core CPI was driven up by a 4.9% rise in airline fares. On the downside, used vehicle prices decreased by 1.2% month-on-month.

In the foreign exchange (FX) market, the U.S. dollar experienced fluctuations, but it has now returned to a level close to where it was before the data was released.

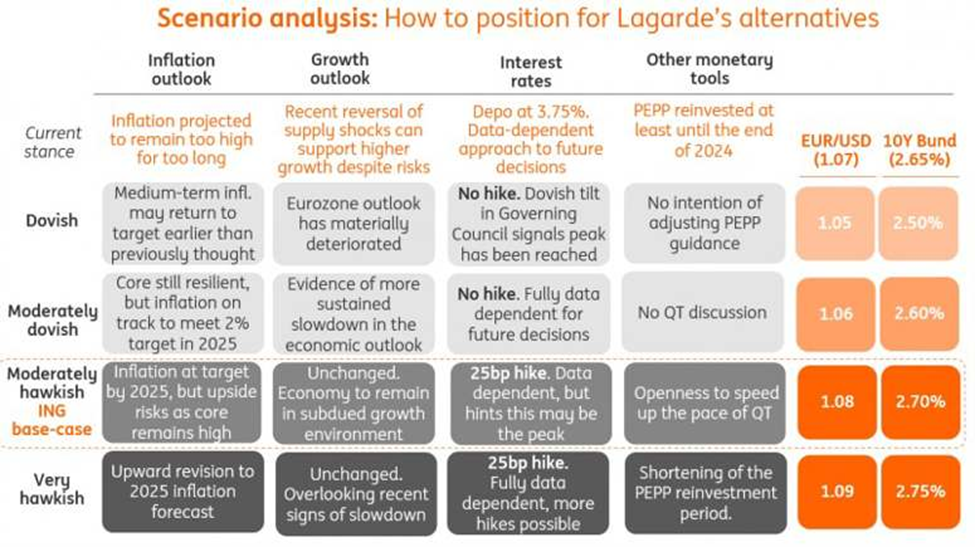

Here’s a “cheat sheet” for the European Central Bank meeting – scenarios & how to position

ING thinks the Bank will hike by 25bp:

- we suspect that convincing markets that this is not the peak will be very hard, and dovish dissenters may get in the way. The upside for EUR rates and the euro may not be that big and above all, quite short-lived.

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.