Marco View:

The Eurozone’s economy remains stagnant with slow disinflation, driven by weak industrial production and unfavorable inflation results in Germany, France, and Spain. Consumer inflation expectations remain high. Additionally, Italy faces fiscal concerns, potentially increasing pressure on BTP yields and widening sovereign spreads. Rising global yields could exacerbate this trend. Geopolitical risks in the Middle East add uncertainty to oil and gas prices. In summary, the Euro (EUR) continues its bearish trend due to weak economic activity, higher energy prices, and recent geopolitical events in the Middle East. ING maintains a bearish view on EUR/USD, projecting it to trade around 1.04 by year-end. Goldman Sachs suggests a short EUR/CAD position with a target of 1.42, citing similar concerns. On the other hand, the Canadian Dollar (CAD) might benefit from surging oil prices amid Middle East tensions and market expectations of a 25bps rate hike by the Bank of Canada in October.

FX View:

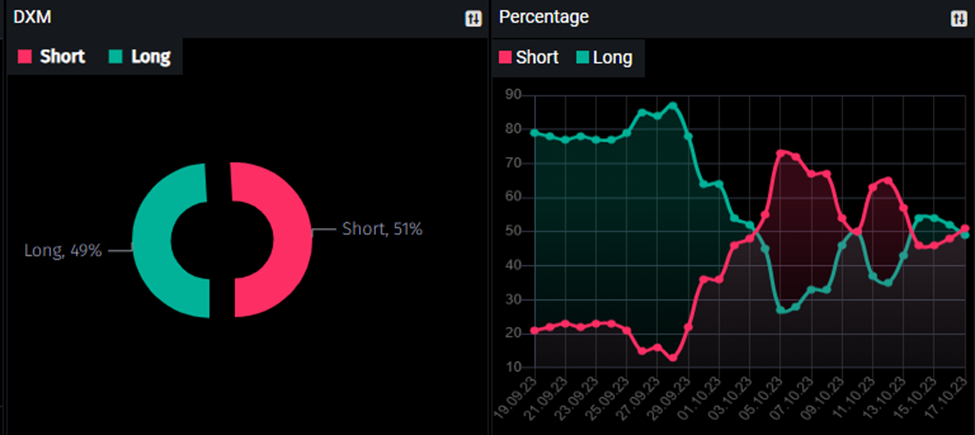

According to DXM Order Stream data, 49% of retail traders have long positions on EUR/CAD, while 51% have short positions, indicating a relatively balanced market sentiment. Additionally, the current DXM data suggests a neutral view. Considering that retail traders typically do not have a significant impact on the market and assessing the current fundamental context, the bearish bias is still on hold for now.

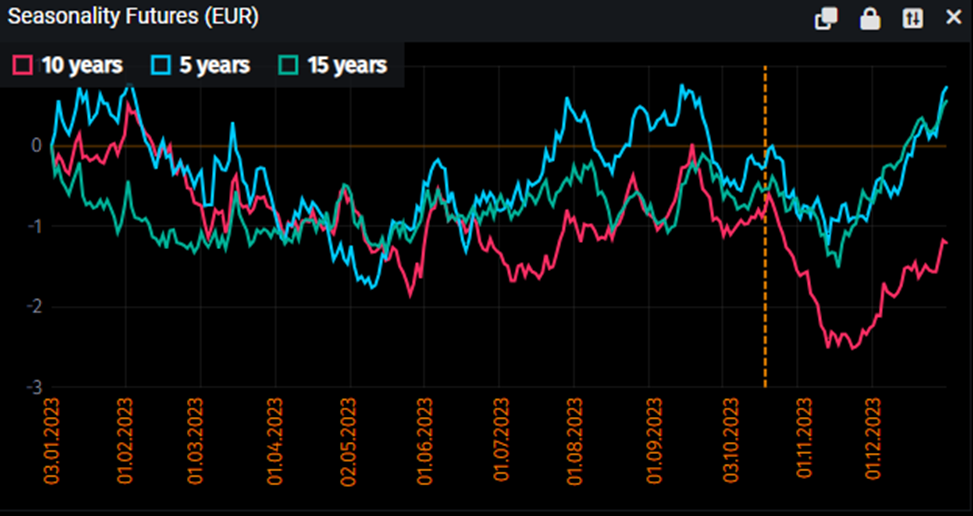

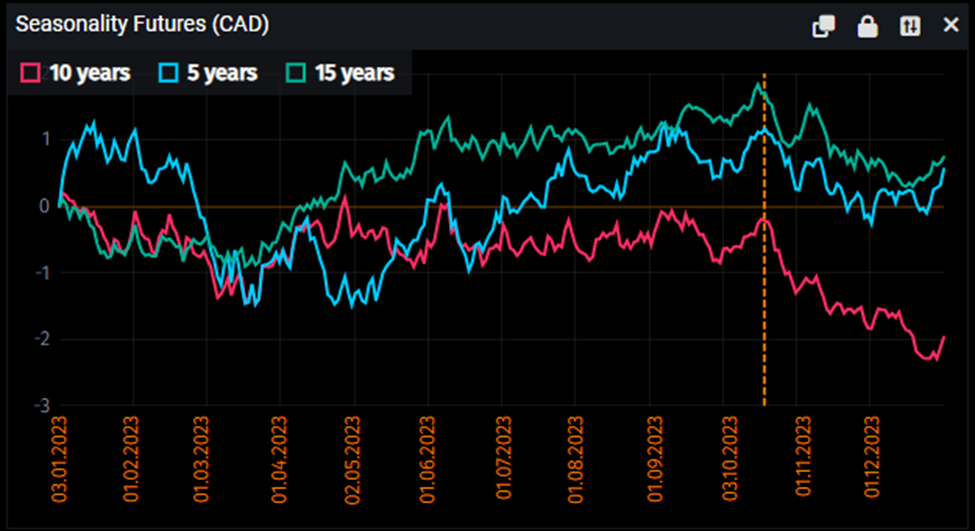

Seasonal patterns indicate a bearish outlook for both EUR and CAD until early November. However, it’s crucial to evaluate the broader context and current fundamentals to identify the stronger currency. It’s essential to note that seasonality doesn’t factor in new economic developments and changes, but it can provide a useful reference for decision-making purposes. Therefore, while seasonal patterns suggest bearish signals for both EUR and CAD, a comprehensive analysis of the current economic factors is necessary to make informed trading decisions.

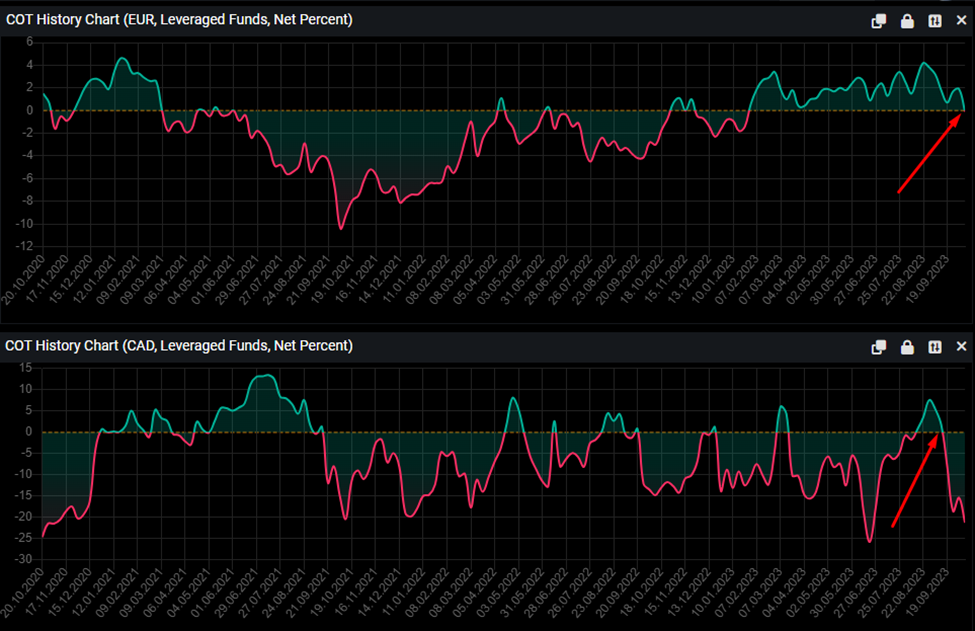

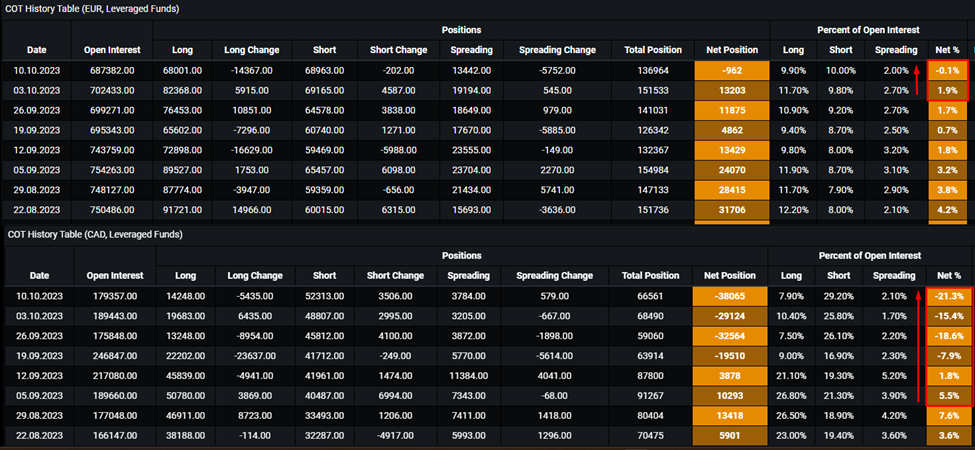

Analyzing the Commitment of Traders (COT) data provides intriguing insights into both EUR and CAD. Both currencies have undergone a significant flip in their net percentages. Specifically, both EUR and CAD displayed a negative flip, transitioning from 1.9% to -0.1% for EUR and 1.8% to -21.3% for CAD. This suggests a shift among hedge funds towards selling both currencies.

Notably, CAD’s net positions have almost reached an extreme level, indicating a potential rebound (buying CAD) in the next few weeks or months. On the other hand, EUR has recently experienced a negative flip, indicating that hedge funds have started selling EUR. These trends highlight the evolving dynamics in the market and provide valuable information for traders.

Trade Recommendation: Short EUR/CAD Position

Entry: Market order

Take-Profit: 1.42000

Stop-Loss: 1.44480

Risk-to-Rewards: 1:3.2

Author: Jacky.T

Sources: PMT

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.