The WTI Futures (NYMEX: CL) are in flux, responding to pivotal macroeconomic data expected from China and the United States, the world’s largest oil consumers. China’s Balance of Trade has defied expectations, surging from $70.62 billion to $80.6 billion, contradicting a projected drop to $70.6 billion. Exports have slipped 2.1%, reaching -14.5% from -12.4%, and imports have sharply fallen by 5.6% to -12.4%, contrary to an anticipated 1.8% increase. These figures underscore concerns about demand but could supply cuts from Saudi Arabia, and Russia offset weaker demand?

Simultaneously, the US Balance of Trade’s release looms, carrying the potential to strain demand further should it decline, although forecasts lean towards an increase. The impending inflation figures for both nations could further contribute to the intricate puzzle, potentially influencing the trajectory of oil prices.

Technical

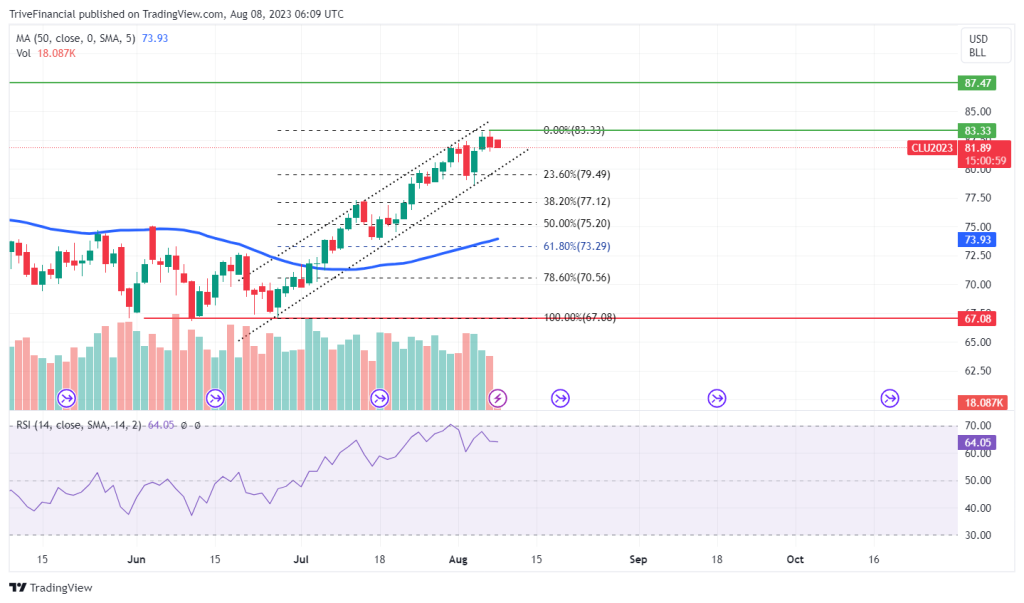

The WTI Futures are trading within an ascending channel pattern on the 1D Chart. Major support and resistance were established at $67.08 per barrel (BLL) and $87.47/BLL, respectively. The Futures have flattened due to potential demand constraints from the two biggest oil consumers, which could encourage a pullback towards the $79.49/BLL support at the 23.60% Fibonacci level.

However, supply cuts from Saudi Arabia and Russia could offset demand constraints, which could drive upward momentum towards the $83.33/BLL resistance. If a breakout from this resistance level occurs, the Futures may be encouraged to retest the $87.47/BLL major resistance.

Summary

The WTI Futures have flattened ahead of key economic data from the two largest consumers of oil. If economic data puts pressure on demand, the price action may be encouraged to retest the $79.49/BLL support. However, supply cuts from Saudi Arabia and Russia could negate demand-side pressure, encouraging a leg up towards the $87.47/BLL major resistance.

Sources: TradingView, Reuters

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaims liability towards any user and other recipients of this report.