AUDUSD

The Australian dollar (AUD) rebounded against the US dollar (USD) on Tuesday, rising 0.1% to 0.6430. The move coincided with a rebound in the Chinese yuan, which appreciated from 7.34 to 7.30 against the USD. The improved sentiment towards the AUD was also supported by a more stable risk environment, as evidenced by US futures maintaining gains of approximately 0.2%.

Despite the rebound, the technical indicators for AUD/USD remain unfavorable. The pair has been on a losing streak for the past week, underscoring its historically weak performance in August. A complete reversal of the downward momentum is still lacking, and further efforts from buyers will be needed to instigate a turnaround. Key levels to monitor include the May low at 0.6458.

However, considering the persistently unfavorable fundamental context, the path of least resistance for the AUD seems to be downwards, particularly if bond yields maintain their upward trajectory. This implies that the current rebound could be short-lived. Morgan Stanley’s latest research paper has the same bearish views on the AUD, and targets the currency to trade at 0.6200 by the end of this quarter.

DXM: A Powerful Tool for Retail Trader Analysis

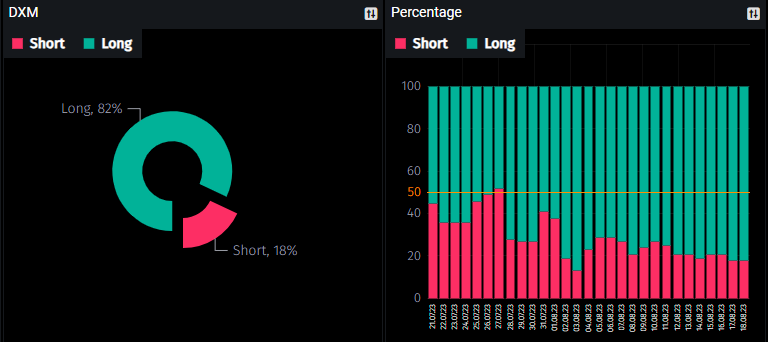

The DXM, or “Dump Money Index,” is a valuable tool for traders who want to understand the sentiment of retail participants. The DXM measures the percentage of retail traders who are holding long positions in a particular market.

The chart below shows the DXM for the AUDUSD pair. As you can see, many retail traders are currently holding long positions (82%). This is a contrarian signal, as it suggests take a reverse trade with them might get some advantages from them.

It is worth noting that 95% of retail traders lose money over extended trading periods. This data suggests that retail traders are often wrong about the direction of the market. Therefore, contrarian traders who take the opposite side of the market as retail traders may have a higher probability of success.

Of course, there is no guarantee of success with contrarian trading. However, it is a strategy that can be used to increase your chances of winning.

Unlocking Trading Insights with COT (Commitment of Traders) Report

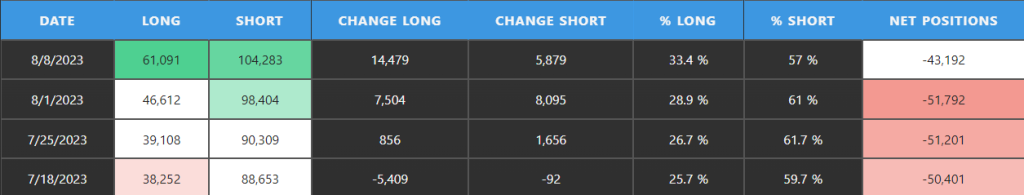

The Commitment of Traders (COT) report is a weekly report that provides information on the positions of large traders, such as hedge funds and investment banks. The report is released by the Commodity Futures Trading Commission (CFTC).

The latest Commitment of Traders (COT) report shows that leveraged funds have been heavily increasing their short positions on the Australian dollar (AUD). The report, released by the Commodity Futures Trading Commission (CFTC), shows that short positions increased to 104,263 contracts from 88,653 contracts in the previous week.

In the case of the AUD, the COT report suggests that the market is bearish. This could mean that the AUD could continue to fall in value. However, it is important to remember that the COT report is just one factor to consider when making trading decisions. Other factors, such as technical analysis and fundamental analysis, should also be considered.

Conclusion: AUD to Remain Under Pressure as China’s Economy Slows

The Australian dollar (AUD) is likely to remain under pressure in the near term as China’s economy slows. The AUD is closely correlated with the Chinese yuan, and the recent weakness in the yuan has weighed on the AUD.

The Chinese economy is facing several headwinds, including a slowdown in exports, a property crisis, and rising debt levels. These factors are likely to keep the yuan under pressure, which will in turn weigh on the AUD.

Author: Jacky.T

Sources: TradingView, PMT, CFTC

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.