Technical Analysis: Favorable Zone for Long Positions

Looking at the 4-hour chart for EUR/AUD, we can observe a significant downward movement that occurred last Friday following the release of major news. However, during this trading week, prices appear to be recovering from the losses incurred last Friday and are moving back toward the accumulation zone. When examining the daily chart, it becomes evident that there was a false breakout to the downside, indicating a potential upward continuation.

Fundamental Analysis: RBA Confirmed to Pause of the rate yesterday

Yesterday marked the RBA’s interest rate and monetary policy decision, and it held the cash rate at 4.10%, aligning with market expectations. Notably, the RBA provided specific comments regarding their cash rate decision:

- Inflation has surpassed its peak but remains elevated compared to the target range of 2%-3%.

- The Australian economy is currently experiencing a period of below-trend growth.

- There exist significant uncertainties regarding the economic outlook.

- The possibility of further tightening of monetary policy is being considered.

In summary, the RBA’s statement conveys a somewhat hawkish stance, but it also acknowledges prevailing economic challenges and uncertainties, such as below-trend growth and elevated inflation. Additionally, the RBA expresses readiness to implement further tightening measures to achieve its inflation target.

Insights Behind the Scenes: Unveiling Crucial Data for Traders:

Becoming a proficient trader requires more than just relying on technical and fundamental data; insight into real market dynamics is vital.

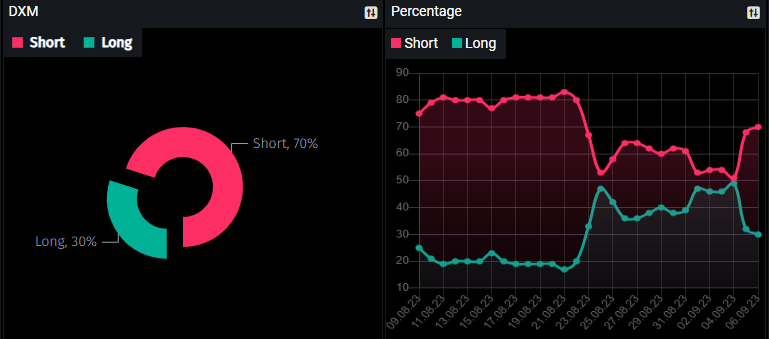

DXM: Decoding Retail Traders’ Sentiment

The DXM, or “Dump Money Index,” serves as a valuable tool for assessing retail traders’ sentiment. It quantifies the percentage of retail traders holding long or short positions in each market. Presently, a substantial number of retail traders hold short positions (70%).

This contrarian signal suggests potential advantages in taking reverse trades. Notably, statistics show that 95% of retail traders sustain losses over extended periods, implying their often-erroneous market predictions. Contrarian traders who oppose retail sentiment may stand a higher chance of success, although success is never guaranteed.

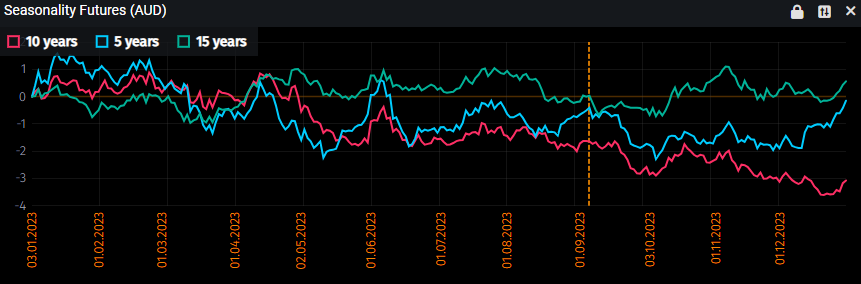

Seasonality in AUD Futures: Bearish Outlook Until October 2023

Seasonality analysis, rooted in historical data, forecasts future price movements. For AUD, this analysis indicates a likely continuation of bearish market conditions until October 2023. However, it’s crucial to recognize that seasonality overlooks new developments and economic changes, making it a pattern that can evolve and isn’t foolproof.

Summary: All the signals point to a Long EUR/AUD Position

• Technical Analysis: EURAUD is in an accumulation phase.

• Fundamental Analysis: RBA holds a hawkish stance but has a weak economy. A weak economy is not a good sign for a hawkish bank.

• DXM: The majority of retail traders hold long positions on the AUD.

• Seasonality Analysis: Seasonal pattern suggests continued AUD bearishness until October 2023.

Author: Jacky.T

Sources: PMT

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaim liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.