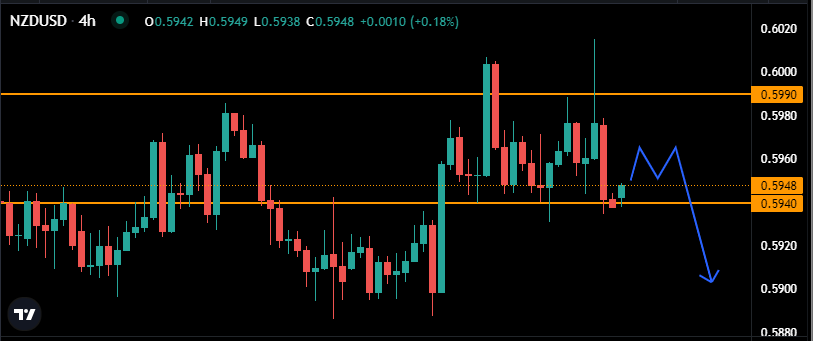

Technical Analysis: Still Within the Distribution Zone

In recent trading sessions, NZDUSD has remained range-bound between 0.5990 and 0.5940. This lack of movement can be attributed to the market’s anticipation of the NFP release. During the NFP event, we did witness some volatility, causing prices to dip but fail to breach the lower range. However, we maintain our outlook for further downside movement based on technical factors, including the presence of a distribution zone as indicated on the chart and a strong downtrend visible on the daily chart.

Fundamental Analysis: China’s Weak Growth and RBNZ’s Dovish Stance

New Zealand’s close economic ties with China make it susceptible to any slowdown or unfavorable policies in the Chinese economy. Recent data highlights uncertainties in China’s property sector and softer economic indicators, which have contributed to NZDUSD’s downward trajectory. Another factor to consider is New Zealand’s potential recession, attributed to aggressive RBNZ tightening measures and external influences.

Insights Behind the Scenes: Unveiling Crucial Data for Traders:

Becoming a proficient trader requires more than just relying on technical and fundamental data; insight into real market dynamics is vital.

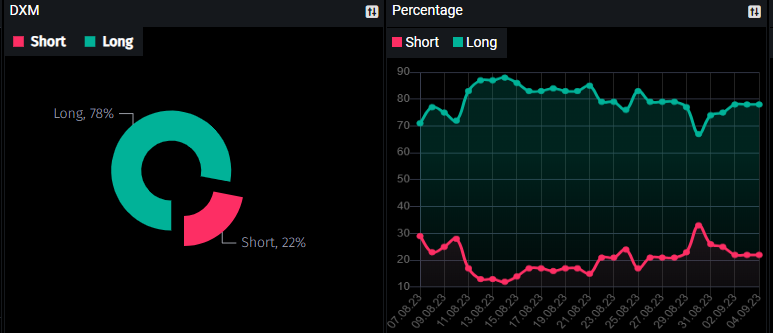

DXM: Decoding Retail Traders’ Sentiment

The DXM, or “Dump Money Index,” serves as a valuable tool for assessing retail traders’ sentiment. It quantifies the percentage of retail traders holding long or short positions in a given market. Presently, a substantial number of retail traders hold long positions (78%). This contrarian signal suggests potential advantages in taking reverse trades. Notably, statistics show that 95% of retail traders sustain losses over extended periods, implying their often erroneous market predictions. Contrarian traders who oppose retail sentiment may stand a higher chance of success, although success is never guaranteed.

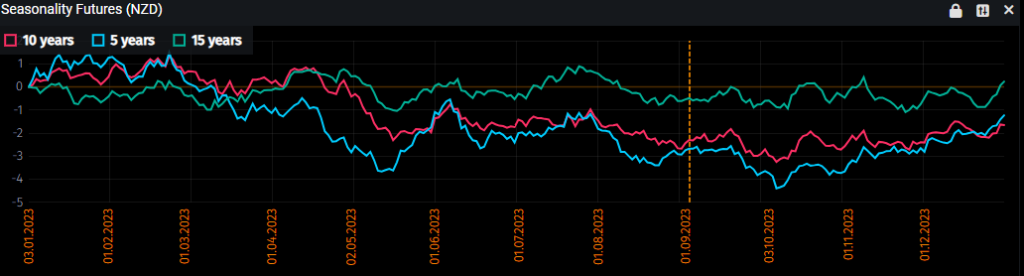

Seasonality in NZD Futures: Bearish Outlook Until October 2023

Seasonality analysis, rooted in historical data, forecasts future price movements. For NZD, this analysis indicates a likely continuation of bearish market conditions until October 2023. However, it’s crucial to recognize that seasonality overlooks new developments and economic changes, making it a pattern that can evolve and isn’t foolproof.

Summary: All the signals point to Long NZD/USD Position

• Technical Analysis: NZDUSD is in a distribution phase.

• Fundamental Analysis: RBNZ hold a dovish view and uncertainty of China growth

• DXM: The majority of retail traders hold long positions on the NZD.

• Seasonality Analysis: Seasonal pattern suggests continued NZD bearishness until October 2023.

Author: Jacky.T

Sources: PMT

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.