Marco View:

Today marks the calm before the storm in the FX market, with all eyes eagerly awaiting the FOMC Meeting scheduled for later today at 2:00 a.m. GMT+8. The general expectation is that the Federal Reserve will keep interest rates steady at 5.50%. However, what’s truly capturing the market’s attention is the Fed’s stance, which is expected to remain hawkish. Many in the market are interpreting this September meeting as a ‘Hawkish Skip.’ Rather than fixating on the interest rate itself, the market is closely monitoring the Fed’s projection for core inflation, which is expected to show a decline. Currently, core inflation hovers between 3.7% and 4.2%, but Morgan Stanley suggests that by December, it may fall below the lower end of this range. To align with the Fed’s projection, core inflation would need to increase at an annual rate of 4.5% in the final four months of this year, following a 2.6% increase over the previous four months. The August PCE report, scheduled for release on September 29, is expected to show a month-on-month increase of +0.2%, matching July.

Shifting the focus to Australia, yesterday featured the RBA meeting minutes and marked Philip Lowe’s final meeting as the Governor and Chairman of the RBA. This meeting centered on five critical aspects: international and domestic economic development, international and domestic financial markets, and the future direction of monetary policy. In summary, global economies are grappling with easing headline inflation while core inflation persists due to robust demand and labor costs. Advanced economies are experiencing subdued growth due to the pressures of cost-of-living and tight labor markets. China’s property market woes pose economic risks. In Australia, inflation remains high but is on a downward trajectory, while the housing market continues to surge. Monetary policy discussions are debating whether to raise rates to combat high inflation or maintain the status quo to assess previous tightening impacts. The latter is favored due to economic uncertainties, with policymakers closely monitoring data and global developments.

FX View:

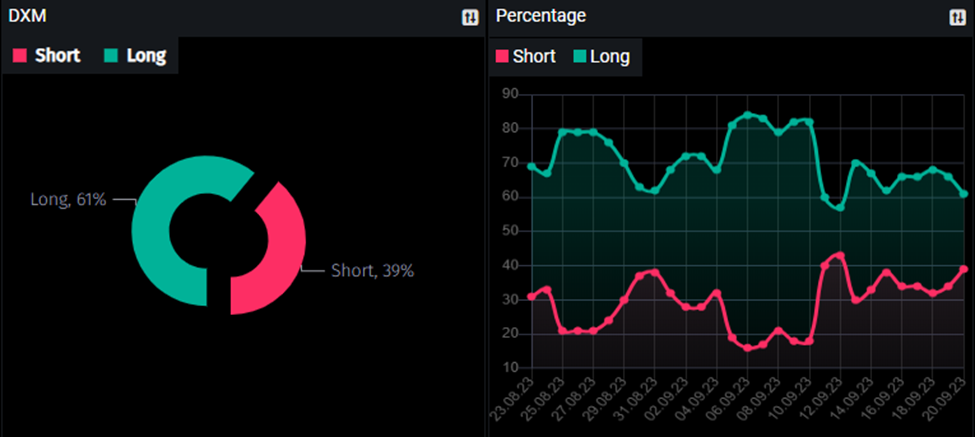

DXM Order stream data indicates that 61% of retail traders are currently holding long positions on AUD/USD, while only 39% are holding short positions. This data is insightful as it suggests an opportunity to trade against the majority, considering that 95% of retail traders tend to sustain losses over extended periods.

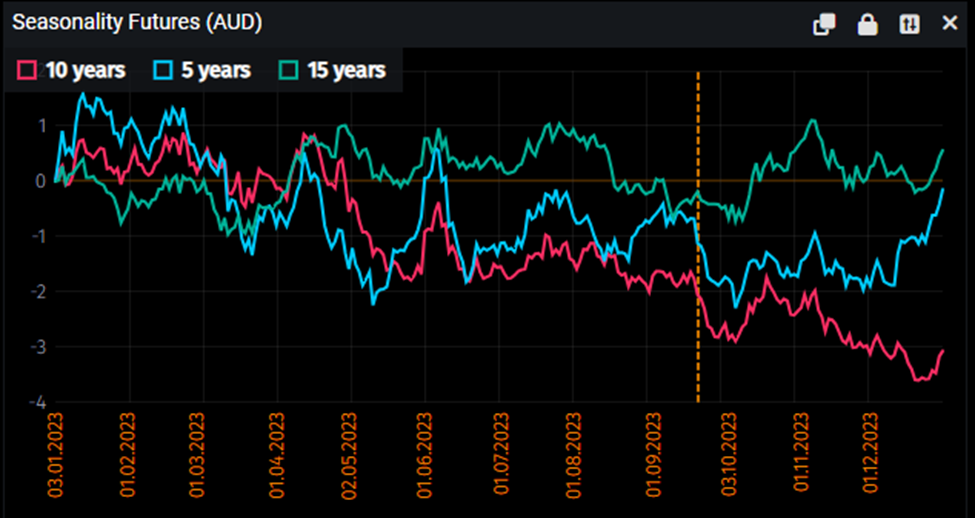

Seasonal patterns for AUD suggest that the downtrend in AUD will likely continue until the end of December, aligning with our short AUD strategy. However, it’s essential to remember that seasonality does not account for new economic developments and changes, but it can serve as a useful reference for decision-making.

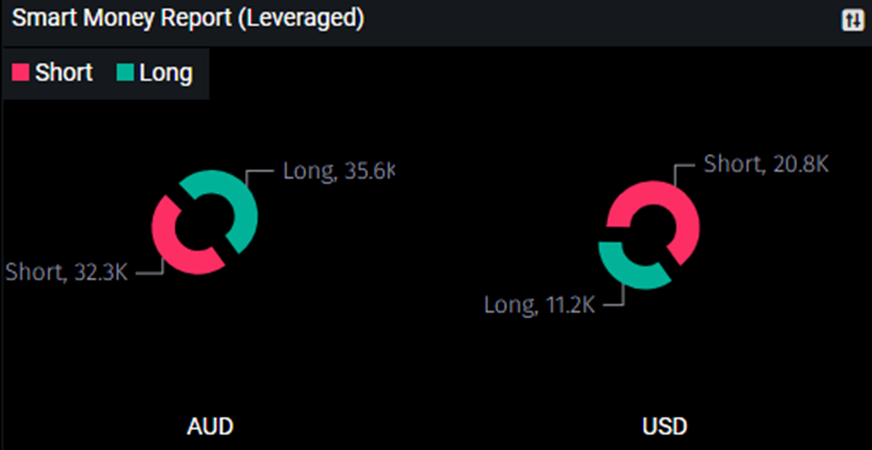

Considering the COT perspective, hedge funds appear to favor AUD over USD, with AUD being net long and USD net short. Nevertheless, it’s crucial to consider the broader context and current fundamentals to determine which currency is stronger.

Summary: All Signs Point to a Short AUD/USD Position

- Marco’s view: Hawkish stance from the US and uncertainty economy growth in Australia

- DXM: Most retail traders hold long positions on the AUD/USD.

- Seasonality Analysis: Seasonal patterns suggest continued AUD bearishness until end of the October 2023.

Trade Recommendation: Short AUD/USD Position

Entry: Market order

Take-Profit: 0.63200

Stop-Loss: 0.65200

Risk-to-Rewards: 1:2

Author: Jacky.T

Sources: PMT

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.