Adobe Inc. (NASDAQ: ADBE) is riding the wave of the digital revolution with its innovative products and cutting-edge solutions in the digital media and marketing industry. As the industry goes full steam ahead, Adobe is leading the charge, leaving its competitors in the dust. With a strong financial performance and a product lineup that’s firing on all cylinders, Adobe is a shining star in the digital cosmos.

The software maker is making waves once again in the industry with its latest announcement, which the company hopes could propel its share beyond the 28% year-to-date appreciation. The company announced early Thursday, 8th of June 2022, that it has launched the Firefly AI tool to be integrated with the newly-improved Adobe Express, which the company decided to push into big business, providing its large business customers with the power of artificial intelligence for generating images. But that’s not all – Adobe is going the extra mile by offering financial cover and indemnification for copyright challenges that may arise from content created using Firefly.

Technical

The weekly chart shows that the company’s share has formed an ascending triangle trading pattern as the price action has formed a dynamic support level from below as it continues to try and push higher. With the share price already achieved a 28% YTD rise and the current share price of $435.73/share offering a potential of a 5.51% upside as the share price converges towards its’ discounted cash flow fair value of $459.72/share (green line), investors could maximise their opportunity from the share’s exposure by looking for a potential pullback towards lower levels.

Therefore, with the appearance of the death cross as the longer-term 200-EMA (orange line) cross over the shorter-term 50-EMA (blue line), the bears could be hoping to get an opportunity to dictate the share’s direction, with investors looking to the $385.96/share support level for a potential long at 16.04% discount from the share’s fair value. The $333.02/share support level could offer another opportunity for a long at a discount.

Fundamental

In the fast-paced digital media and marketing world, Adobe has become the golden goose, consistently delivering the goods. The company has a finger on the pulse of the industry, capturing market share and leaving its rivals green with envy. Like a digital chameleon, Adobe adapts to the ever-changing landscape, giving its customers a leg up in the highly competitive online space. With its suite of products, Adobe paints a vivid picture of success, helping businesses carve out their own digital empire. With the digital media and marketing industry experiencing significant growth in recent years, driven by the increasing demand for digital content creation, data analytics, and personalised customer experiences. Adobe’s suite of products, including Creative Cloud and Experience Cloud, positions the company well to capitalise on these trends.

Adobe has taken a major and intelligent approach to extending its generative AI capabilities to corporate customers through the introduction of the company’s Firefly tool. With the rising number of lawsuits related to image data used in AI services, Adobe is offering financial cover and indemnification for copyright challenges that may arise from content created using Firefly. By including compensation, Adobe aims to instil confidence in its large business customers and provide them with a legally safe solution for generating images. The integration of Firefly into Adobe Express, a tool designed to assist non-designer business users, allows companies to create content within their brand guidelines by customising the service with their own logos and products. This move showcases Adobe’s commitment to supporting its customers and stands as a testament to its dedication to pushing the boundaries of generative AI in a responsible manner.

Additionally, Adobe’s introduction of AI-based features to its digital marketing tools, such as natural language-based report generation, is a significant step towards democratising data access and empowering users across the enterprise. Through these initiatives, Adobe continues to demonstrate its leadership in the digital media and marketing industry by providing innovative and intelligent solutions to its corporate clientele.

The company’s financial performance is as sharp as a tack, with record-breaking revenue and earnings growth. The company’s balance sheet is as solid as a rock, providing a sturdy foundation for future growth. Adobe has demonstrated strong financial performance, with record revenue and earnings growth. The company achieved $4.655 billion in revenue in the previous quarter, representing 13% year-over-year growth. Adobe’s profit margins are a thing of beauty as they dance to the rhythm of rising revenue and declining expenses. The company reported an earning per share beat of 3.26% after posting a quarterly EPS of $3.80/share against the market’s expectation of $3.68/share, while the gross profit experienced a 9.21% year-on-year increase. With a strong cash flow, Adobe can fuel its innovation engine and continue to dominate the digital market.

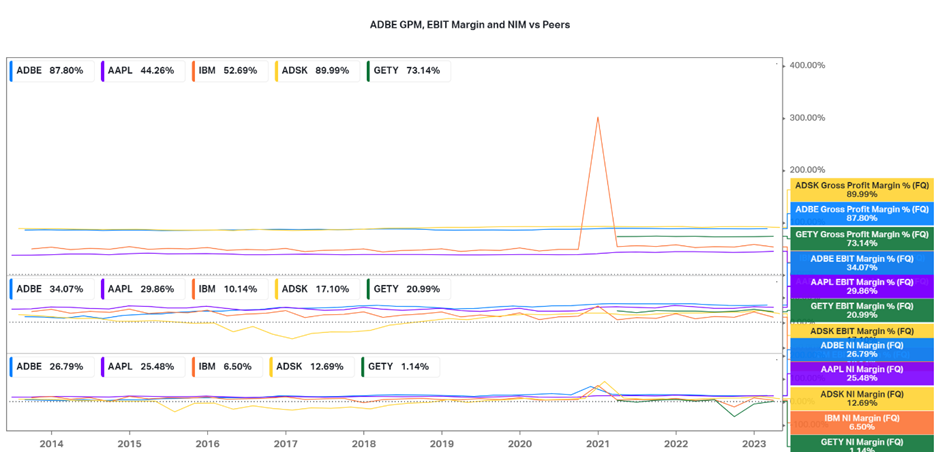

The ratio analysis picture below paints a picture of financial health that’s worth its weight in gold. Adobe’s profitability ratios shine like a beacon, demonstrating its ability to generate impressive returns well above its peers. The company has a very respectable 87.80% gross profit margin, but what could entice an investor looking for an excellent performing company would be the peers-beating 34.07% EBIT margin and 26.70% net income margin (NIM). The higher-than-peers EBIT margin and NIM speak volumes about the company’s ability to turn sales into cash flow, which the company could use to pursue growth prospects or even share buybacks.

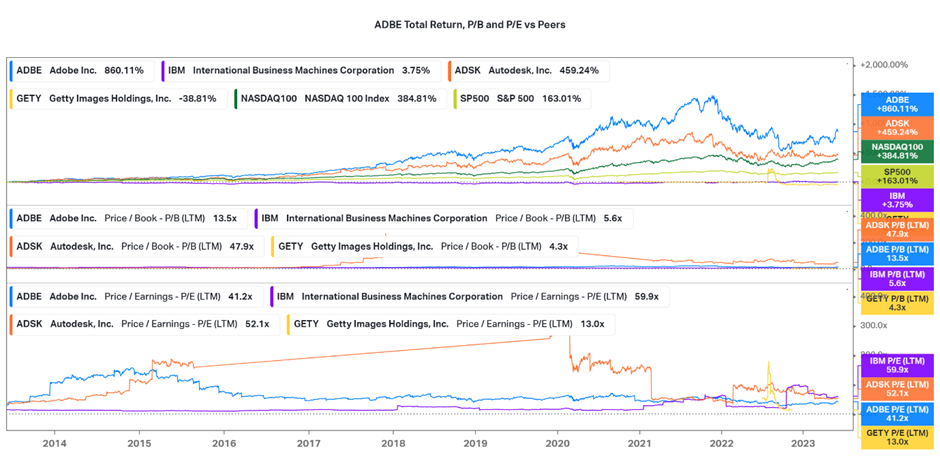

In comparison to industry peers, the picture below shows that Adobe is the cream of the crop. Its valuation multiples, such as the price-to-earnings (P/E) ratio and price-to-book (P/B) ratio, suggest that investors are willing to pay top dollar for a piece of the Adobe pie, with the total return of the past decade likely justifying the market appetite. The market recognises Adobe’s prowess and growth potential, propelling its stock to new heights.

Summary

Adobe Inc. is a compelling investment opportunity due to its strong financial performance, industry leadership, and innovative product offerings. The company’s ability to capitalise on the growing digital media and marketing industry positions it for continued success.

However, with the current share price offering a potential of a 5.51% upside as the share converges towards its fair value, investors could maximise the potential of their exposure by waiting for a pullback to lower levels.

Sources: TradingView, KoyFin, Reuters, Seeking Alpha, Investor Place, Adobe.com.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.