Markets:

- NZD leads, EUR lags

- Gold up $3 to $1896

- WTI crude oil down 48 cents to $79.63

- US 10-year yields down 1.4 bps to 4.32%

- S&P 500 down 12 points, or 0.3%, to 4387

The US dollar initially gained strength during the early North American trading session due to the typical trigger of higher bond yields. This uptrend in the dollar persisted for a while; however, later on, yields retreated from their highs and declined to session lows. Despite this development, the dollar managed to maintain its position as the euro exhibited notable weakness, dropping to 1.0844, representing a decrease of half a cent. This marked an 80-pip reversal following its earlier gains earlier in the day.

The British pound also displayed weakness, concluding the day near its lowest levels and reversing its prior advances.

Investors remained closely observant of China’s situation, with discussions about ‘national team’ purchases in equities contributing to a late-day upsurge in the Shanghai market. This prompted a surge of optimism in commodity currencies, with the Australian dollar (AUD) and New Zealand dollar (NZD) taking the lead. Positive sentiment was further fueled by a robust opening in US equities, although this momentum waned later as technology stocks relinquished their gains, including Nvidia (NVDA). Nevertheless, both the NZD and AUD managed to hold onto their gains, while the Canadian dollar (CAD) concluded the session unchanged.

As for USD/JPY, it exhibited reluctance to test the 146.00 level once again and spent most of the US session trading below that threshold. It seems that a push from Federal Reserve Chair Powell or a sustained rise in yields will be needed to sustain the upward momentum.

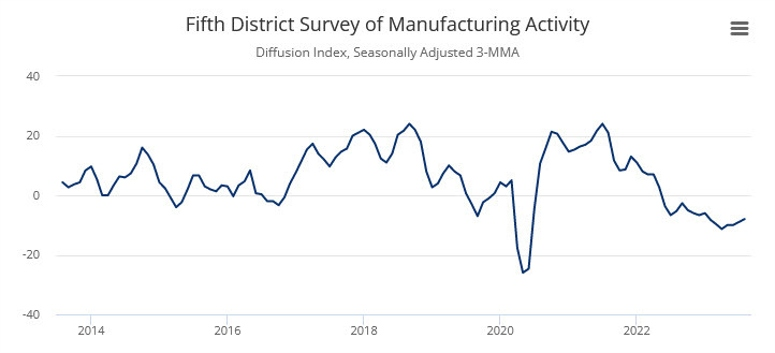

US August Richmond Fed composite index -7 vs -9 prior

- Prior month -9

- Shipments index -5 versus -6 in July

- Services index +4 versus -2 in July

- employment -3 versus +5 in July

- wages +22 versus +19 in July

- prices paid 3.17 versus 4.07 in July

- prices received 3.11 versus 4.01 in July

- New orders -11 vs -20 prior

- Expectations of new orders +22 vs +9 prior

The manufacturing sector in the United States is still facing challenges, although there is a slight enhancement in new orders, suggesting the possibility of a more positive outlook for 2024.

US existing home sales for July 4.07M vs 4.15M estimate

- Prior month 4.16M

- Existing home sales for July 4.07M vs 4.15M estimate.

- Sales are down -16.6% from a year ago.

- Inventory of homes 3.3 months versus 3.1 months last month

- Supply of homes 1.11 billion at the end of July for an increase of 3.7% from the previous month.

- Northeast -5.9% MoM and down -23.8% from a year ago. Median price was $467,500 up 5.5% from a year ago.

- Midwest -3.0% MoM and -20% from the previous year. The median price in the Midwest was 3 or $4600 up 3.9% from a year ago.

- South -2.6% MoM and down -14.3% from a year ago. The median price in the South was $366,200 up 1.7% from a year ago.

- West +2.7% MoM and down -12.5% from a year ago. The median price was $610,500 unchanged from July 2022

Other details.

- Median sales price $406,700 versus $410.2 K last month. Prices rose in the Northeast, Midwest, and South and were unchanged in the West.

- Median sales price is up 1.9% from a year ago.

- 1st time buyers were responsible for 30% of the sales in July up from 27% in June and 29% in July

- All cash sales accounted for 26% of transactions in July. It was 24% in July 2022. Individual investors or second-home buyers who make up many cash sales purchased 16% of homes in July down from 18% in June but up from 14% one year ago.

- Distressed sales – foreclosures and short sales – represented 1% of sales in July unchanged from the prior month and previous year.

Mortgage rates are experiencing an upward trend. Recent reports indicate that the 30-year mortgage rate is approaching around 7.4%, reaching its highest level since 2002. The combination of elevated prices and increased rates is expected to slow down the housing market. Just a short while ago, the 30-year mortgage rate stood at 7.09%. The lowest point for this year was at 6.08% in late January 2023. Comparatively, around a year ago, the rate was approximately 5.13%.

Fed’s Barkin says he won’t pre-judge the outcome of the Sept FOMC meeting

- Consumer spending and economic strength make it possible US economy could re-accelerate before inflation cools

- If inflation remains high and demand gives ‘no signal’ it is likely to drop, that would require tighter mon pol

- Recent moves in bond yields not a sign of ‘inappropriate’ market tightening, likely a response to strong economic data

Barkin also appears uncertain about the bond situation. Nonetheless, these remarks lean towards a more hawkish stance, leading to the S&P 500 dropping to its lowest point during the day.

Fed’s Barkin: If the US has a recession, it would likely be less-severe one

This is the sole headline from his remarks at the moment. I’ll be attentive for additional information.

I concur that it might be less intense, partly due to the fact that the Fed possesses 500 basis points of potential tools to counteract it.

More:

- Try not to focus too much on short-term market moves

- Fed needs to achieve 2% target to ensure its credibility

- Accounting for implications of work-from-home still has a ways to go

- Credit card debt is basically on-trend from from before the pandemic

- Balance sheet normalization is a ‘background’ policy at this point

Goldman Sachs: The dual forces driving the dollar’s rise

Goldman Sachs identifies two prevailing storylines influencing the present market trends: US strength and China difficulties. In the context of foreign exchange, these two narratives converge to enhance the USD’s potency.

1. US Resilience:

- Positive Economic Momentum: The US has showcased robust economic performance even amidst global challenges.

- GDP Revision: Goldman’s economists have adjusted their Q3 GDP tracking upwards by 1.1 percentage points in just the past week, reflecting a brighter outlook for US growth.

2. China Challenges:

- Economic Hurdles: While specifics aren’t detailed in the given excerpt, China is likely facing a combination of domestic and external pressures that might be causing economic uncertainties.

Implications for the Dollar:

- Unified Outcome: Despite the contrasting natures of these themes (positive for the US and challenging for China), in the FX market, they both align to boost the USD’s strength.

Looking Ahead: Goldman Sachs doesn’t foresee an immediate shift away from this pattern of USD gaining strength, particularly due to their optimistic outlook on US economic performance. The ongoing robustness of the US economy, combined with difficulties faced by China, supports the argument for a continued USD dominance.

Conclusion: Investors and market players should strategize their positions in light of these intertwined themes, recognizing that the consequences extend beyond the realm of currency markets.

Author: Jacky.T

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.