The elevated concerns of a potential US recession following disappointing economic data in the US sent the US equity lower, with the effect trickling down to the Asian markets on Thursday morning trading session. The reported decline of the ISM Non-Manufacturing PMI fell from 55.1 to 51.2, which was 3.3 lower than the forecasted 54.5, refuelled recessionary fears sending equity markets lower, including the Hang Seng Index Futures (HKEX: HIS) which was trading at 0.28% lower during the morning session.

The bulls found support in the better-than-expected Chinese economic indicators, which helped limit the downside during the Asian trading session. The Caixin Services PMI for March marginally rose to 57.8 from 55.0, which was higher than the forecasted decline to 54.8. The positive data pushed the main components of the index, Alibaba and Tencent, 1.62% and 0.36%, respectively, higher during the morning trading session.

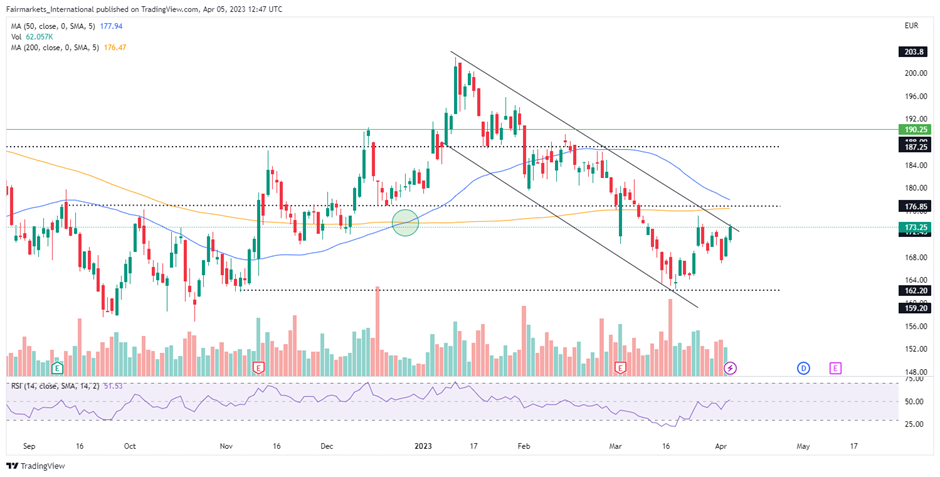

Technical

The 4H chart shows that bears are currently driving the index futures lower following the failure of the bulls to sustainably break above the resistance level of 20670. The 50-day moving average will be the initial hurdle the bears would need to overcome to continue their run. Therefore if the 50-day moving fails to hold, the bears could fancy a run at the 20080 and 19905 support levels, respectively.

However, if the 50-day moving average holds, the bulls could look to retest the 20670 resistance level if the index futures could break above the initial barrier, which could be posed by the 23.60% Fibonacci level. A break through the resistance level, supported by significant volume, could help the bulls rally as they look to push the price above the 20828 resistance level.

Summary

The Asian markets have shown that it is not entirely protected from the events in the US, and with the crucial Nonfarm Payroll (NFP) data being released tomorrow, there is an elevated possibility that the index futures could trade within a range in anticipation of the release.

Sources: TradingView, Reuters,

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.