The US Crude Oil Futures (NYMEX: CL) closed a second consecutive trading session in the red following the weak economic data release from the US, which stoked fears of a possible global recession and the subsequent lowered demand for the commodity. ISM reported that the Non-Manufacturing PMI for March fell from 55.1 to 51.2 versus the forecasted 54.5, which shows that the US services sector slowed more than expected as demand cooled. The lower-than-expected decline raised concerns in the market that the pace of slowing demand could push the economy towards a recession that would dim oil’s outlook.

Even so, oil futures are poised to finish a third consecutive trading week on the green after the surprise oil cut by OPEC+ sent the futures price sharply higher. The EIA also reported that US oil stocks dropped by more than 3.7 million, which was more than the widely expected 2.329 million decline. The US oil futures are currently trading at 5.51% higher for the week.

Technical

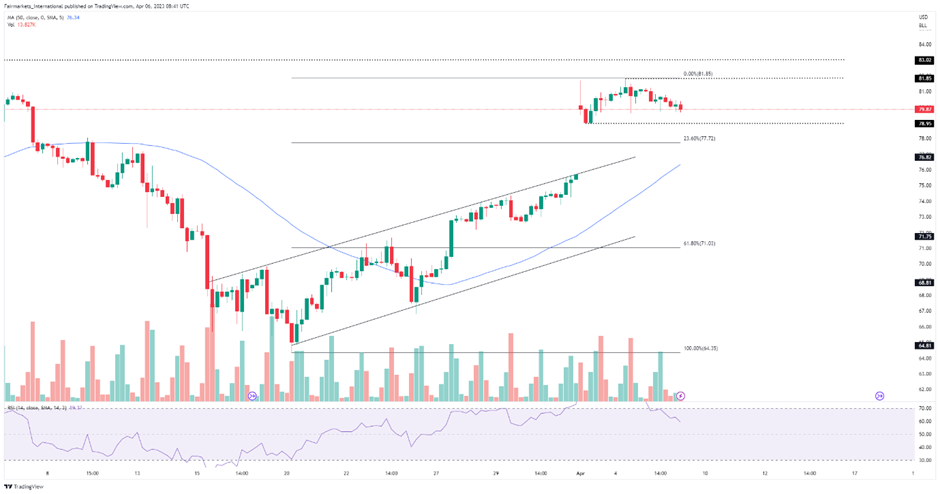

The 4H chart shows that the oil futures were trading within an ascending before the event-driven gap up following the OPEC+ announcement. The price action has retraced following the failure break above the three-month high. Therefore, following the bulls’ failure to break above the resistance level at $81.85 per barrel (/BLL), the bears could look to retest the support level at $78.95/BLL. The breakthrough below the initial support level would bring the 23.60% Fibonacci level into play as the bears look to pull the price action back within the channel.

However, a failure to sustainably break below the support level could give the bulls the impetus to retest the resistance level at $81.85/BLL, a level of interest for the bulls. A breakout above the initial resistance level would bring the resistance level at the 1st of December 2022 high of $83.02/BLL into play.

Summary

There is an elevated potential that the oil futures could trade within a range as both the bulls and the bears look to cover their position and ensure they are not overexposed ahead of the crucial Nonfarm Payroll (NFP) data release tomorrow.

Sources: TradingView, CNBC, Reuters.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.