The Nasdaq could be set for a weekly loss after US CPI failed to surprise to the downside and remained steady through July, dampening the tech sector rally. Tech’s next big hurdle might be to regain those losses through August if the macroeconomic picture does not improve as wall street had hoped.

The Nasdaq 100 Futures (CME: NQ) had seen much volatility return to the market as US CPI data came in as expected with no downside surprise. Headline inflation rose to 3.2% while the spotlight was firmly placed on Core CPI, which remains sticky. The US 30-year bond auction also did not help with softer demand for US Treasuries and higher yields driving the Dollar higher.

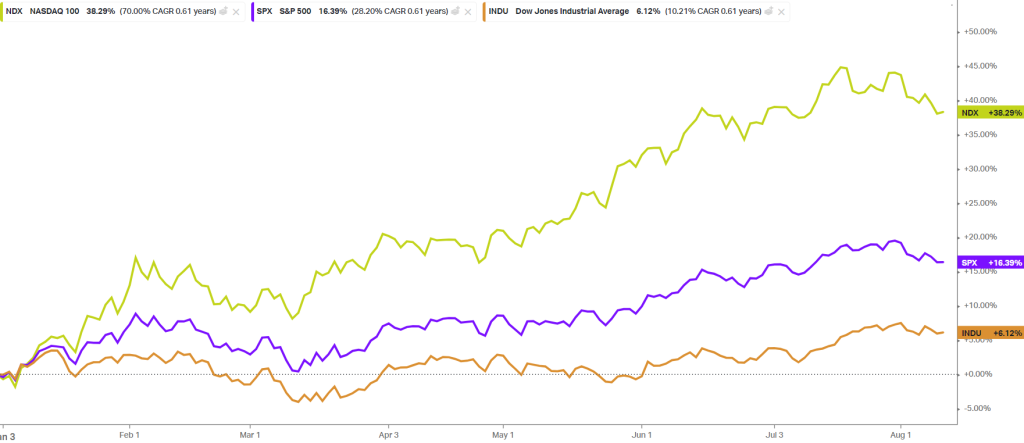

Despite the unfavourable macroeconomic environment, the tech-heavy Nasdaq has outperformed the other major US Indexes this year. The chart below shows the Nasdaq (green line) out in front with a 38% gain YTD, followed by the S&P 500 (purple line) with 16.39% and the Dow Jones 6.12%.

Technical

Looking at the Daily chart of the Nasdaq 100 Futures (CME: NQ), we can see a double-top technical pattern breaking lower from the neckline (NL). The first level of support is around the 15071 level, which should be watched closely as the 50-day SMA (blue line) is also above the price.

If the macroeconomic environment deteriorates, we could see the significant support level in focus at 14857 (green line), which coincides with the double-top breakdown projections.

Summary

The double-top technical pattern will be watched closely, along with increasing volume and the 50-day SMA as resistance to price. If the double-top technical pattern plays out, then the significant levels of support around 15071 and 14857 become focal points.

Sources: Reuters, Koyfin, TradingView

Piece Written by Barry Dumas, Head of Client Education

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaims liability towards any user and other recipients of this report.