The Cigna Group (NYSE: CI) is a leading global health insurance company that offers a range of health, dental, vision, and behavioural health services to individuals and businesses. The company recently posted Wall Street beating first-quarter earnings report primarily driven by the expansion of the company’s medical customer base and the declining COVID costs. The excellent first-quarter performance was enough for the company to revise their revenue and customer growth for the 2023 fiscal year.

Cigna’s first-quarter results for the fiscal year 2023 (2023Q1) demonstrated strong financial performance that exceeded market expectations. The company’s adjusted earnings per share (EPS) of $5.41 from the total revenues of $46.5 billion, compared to the market’s expectation of EPS of $5.26 from revenue of $45.586 billion, highlighted its ability to drive growth and profitability in a competitive healthcare market. The company’s decision to raise its full-year 2023 guidance for adjusted EPS, revenue, and customer growth came as a positive sign for investors pushing the share price 7% higher during trading on Friday.

Technical

The daily chart below shows that the price action recently broke through the upper trendline of the descending channel following the announcement of the quarterly performance o Friday and is challenging the 23.60% Fibonacci retracement level. The appearance of the death cross, as the longer-term 200-day moving average (200-EMA) crossed over the shorter-term 50-day moving average (50-EMA) and descending channel, could suggest that the market is currently bearish towards the share.

Should the price action fail to break above the 23.60% Fibonacci retracement level, investors could look to a pullback towards the $240.44/share support level as a possible level of interest. The buyers would also be interested in the $225.13/share support should the current bearish sentiment continue to push the price lower.

However, should the price action sustain a move above the 23.60% Fibonacci retracement, the $273.62/share resistance level could provide a long opportunity with a reasonable 10.53% discount from the share’s fair value.

When using the discounted cash flow model, Cigna’s fair value is currently at $305.82/share. The current pre-market price of $262.60/share leaves an enticing 16.46% discount from the share’s fair value.

Fundamental

Cigna’s financial performance in the first quarter was driven by robust growth across its segments, including Health Services, Integrated Medical, and International markets. This growth was supported by the company’s focus on customer-centric strategies, digital transformation initiatives, and strong execution capabilities. Additionally, the company’s partnership with Oscar Health helped it expand its digital offerings and improve its customer experience, contributing to revenue growth. The company’s largest revenue segment, Evernorth Health Services, accounting for 77.84% of total revenue in 2023Q1, grew 8% year-on-year, while Cigna Healthcare grew 12%.

Total revenue grew 1.61% quarter-on-quarter and 5.38% year-on-year from $45.743 billion and $44.108 billion. The EPS of $5.41/share represents a 9.07% quarter-on-quarter rise. However, the bottom line experienced a year-on-year decline of 9.98% from the 2022Q1 figure of $6.01/share. The company’s quarterly performance was primarily boosted by an 8% year-on-year increase in Cigna’s customer base to 19.5 million. The 8% rise was mainly due to the increased fee-based clients as well as the individual and Medicare Advantage customers.

The broader global healthcare market is expected to grow at a CAGR of 5.4% from 2020 to 2027, driven by increasing healthcare expenditure, rising prevalence of chronic diseases, and technological advancements in healthcare services. Additionally, the COVID-19 pandemic has accelerated the adoption of telehealth services, which is expected to further boost the healthcare market’s growth. As a leading player in the healthcare industry, Cigna’s strengths and innovation drive enable the company to be well-positioned to benefit from this growth.

Cigna’s strengths include a strong financial position, a diversified business model, and a focus on innovation. The company has consistently delivered solid financial results, with revenue growing from $39.67 billion in 2016FY to $180.64 billion in the 2022FY and net income growing from $1.87 billion to $6.67 billion over the same period. Cigna’s financial strength is reflected in its credit ratings, which are among the highest in the healthcare industry. Cigna’s diversified business model is another strength, as it allows the company to serve a broad range of customers and markets and innovate and adapt through dynamic environments. This diversification provides Cigna with stability and helps mitigate risks associated with changes in any segment.

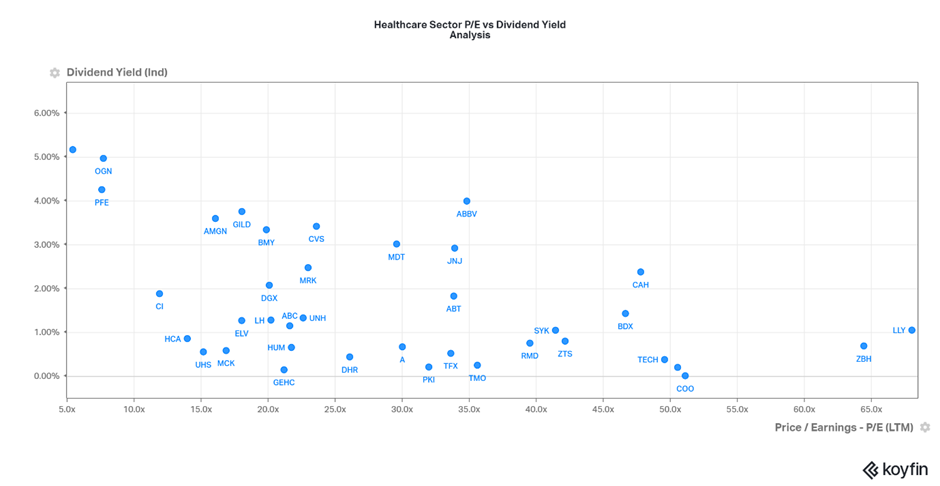

The picture below shows that Cigna is currently trading at a price-to-earnings (P/E) ratio of 10.8x, compared to the industry average of 15.2x, and has a company’s forward P/E ratio is 10.1x compared to its five-year average of 13.9x. Cigna’s dividend yield of 1.89%, which is higher than the industry average of 1.4%, is also attractive, providing investors with an income stream while they wait for the share to appreciate.

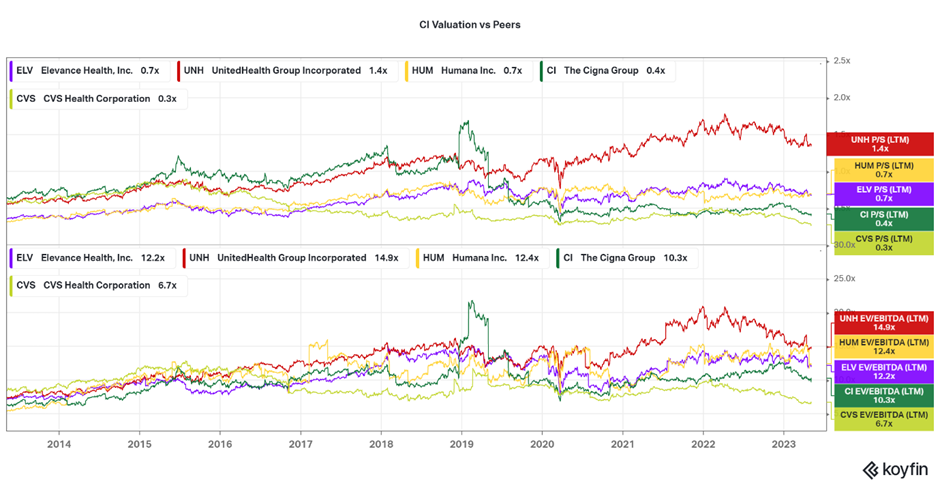

Looking at the picture below, the metrics suggest that Cigna might be undervalued compared to its peers. Cigna has a lower price-to-sales (P/S) and EV/EBITDA ratio than most of its peers. The company’s P/S ratio of 0.4x is below its five-year average of 0.6x. A lower P/S ratio suggests that the share is trading at a lower price relative to its sales, indicating that the market has undervalued the company. Based on its strong financial performance and growth prospects, Cigna is undervalued relative to its peers.

One of Cigna’s main challenges is the ongoing uncertainty surrounding healthcare policy in the United States. Changes to government policies and regulations can significantly impact the healthcare industry, and Cigna’s business is not immune to these risks. Another challenge for Cigna is the competitive landscape of the healthcare industry. The company faces increased competition from other large health insurers, such as UnitedHealth Group and Anthem, as well as smaller regional players. Competition could impact Cigna’s ability to grow its market share or maintain its pricing power.

Summary

Cigna is a well-established player in the healthcare industry that has proven to be a reliable investment choice for long-term investors. With a strong financial position, a diversified business model, and a compelling growth strategy focused on innovation and customer base expansion, Cigna is well-positioned to benefit from the growing demand for healthcare services in the United States and globally. Despite the challenging market conditions in the wake of the COVID-19 pandemic and the current macroeconomic conditions, Cigna has continued to demonstrate resilience and has the potential for growth in the coming years. As a result, Cigna appears to be undervalued relative to its peers and presents an attractive investment opportunity for long-term investors.

Therefore, a long opportunity could exist as the price action moves below $240.44/share towards $225.13/share. However, a trading opportunity could exist at $273.62/share should the bulls continue to push the price higher.

Sources: TradingView, KoyFin, Reuters, Seeking Alpha,

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.