In the ever-evolving digital landscape, where virtual connections transcend boundaries and redefine human interactions, Meta Platform Inc. (NASDAQ: META) emerges as the visionary force poised to reshape the very fabric of our online existence. Meta, formerly known as Facebook, continued its impressive performance following the release of a top-line and bottom-line first quarter of the 2023 fiscal year performance (2023Q1). Meta’s share rallied 13.93% post-earnings report after the company reported earnings per share (EPS) of $2.20/share on the revenue of $28.64 billion versus the street’s EPS forecast of $2.021/share on revenue of $27.669 billion.

However, following the impressive quarter, the communication services giant is grabbing the headlines for different reasons. The company recently announced that it had filed for a five-part offering of $8.5 billion worth of senior notes to help fund capital expenditure, share repurchase of the company’s common stock, and to improve M&A activity. The announcement boosted the shares even higher and will open 1.19% higher on Tuesday’s US trading session.

Technical

The daily price chart of Meta Platform Inc. (NASDAQ: META) shows that the bulls have enjoyed considerable dominance over the bears since the rejection of the $88.54/share price level on the 3rd of November 2022. The share is currently trading at over 102% of the share’s turn-of-the-year price of $122.82/share. With the appearance of the golden cross, where the 50-day moving average (50-EMA) crossed above the 200-day moving average (200-EMA), the bulls could be confident in prolonging the dominance.

For the bull case, a long-term investment opportunity could exist if the price action pushes above the $248.02/share resistance level, which could act as an initial resistance level for the bulls. If the price sustainably breaks above the level of interest at $248.02/share, the possibility exists that the price could reach the $255.36/share resistance level, a share level towards the share’s fair value at $268.34/share(green line).

However, for the bear case, the price action could retract and decline towards the $235.86/share support level. A fall through the $235.86/share support level would send a bearish signal and could signal a gap-filling process. The bears could see the share price fall towards the $222.66/share support.

Using the discounted cash flow model, Meta’s fair value is $268.34/share, which offers an upside of 10.7% from the share’s current pre-market price of $242.41/share.

Fundamentals

Meta’s recent quarterly top-line figure of $28.645 billion represents a 2.64% year-on-year growth from the 2022Q1 revenue of $27.908 billion and a 10.94% quarter-on-quarter decline from the $32.165 billion achieved in 2022Q4. Top-line was primarily driven by a 10% and 3.5% year-on-year growth in the Rest of the World and the United States revenue, respectively, while Europe’s revenue slumped 2.2% year-on-year. Meta’s most significant revenue segment, Family Apps, which represented approximately 98.8% of the total revenue, grew 4% year-on-year to offset the 51.22% year-on-year decline in Reality Labs revenue.

One of the critical advantages Meta enjoys is its vast user base, with billions of active users across its platforms, including Facebook, Instagram, WhatsApp, and Messenger. The American multinational technology behemoth recently reported that their family daily active people (DAP) grew by 5% year-over-year for March 2023 to just above 3.02 billion on average, while the family monthly active people (MAP) also grew 5% year-on-year for March 2023 to 3.81 billion. Facebook’s daily active users (DAUs) and monthly active users (MAUs) for March 2023 grew by 4% and 2% year-on-year, respectively. This expansive reach provides Meta with a strong foundation as it ventures into the Metaverse. By leveraging its existing network, Meta can seamlessly integrate its Metaverse offerings into the daily lives of users, ensuring a smooth transition and widespread adoption.

Furthermore, Meta’s acquisition of innovative companies like Oculus and the developing of the Oculus Quest 2 VR headset has solidified its position as a frontrunner in the VR space. The Metaverse offers Meta the opportunity to unlock the full potential of these investments, enabling immersive experiences and enhancing user engagement. The company’s data analytics and artificial intelligence expertise further bolster its ability to create personalized and tailored experiences within the Metaverse.

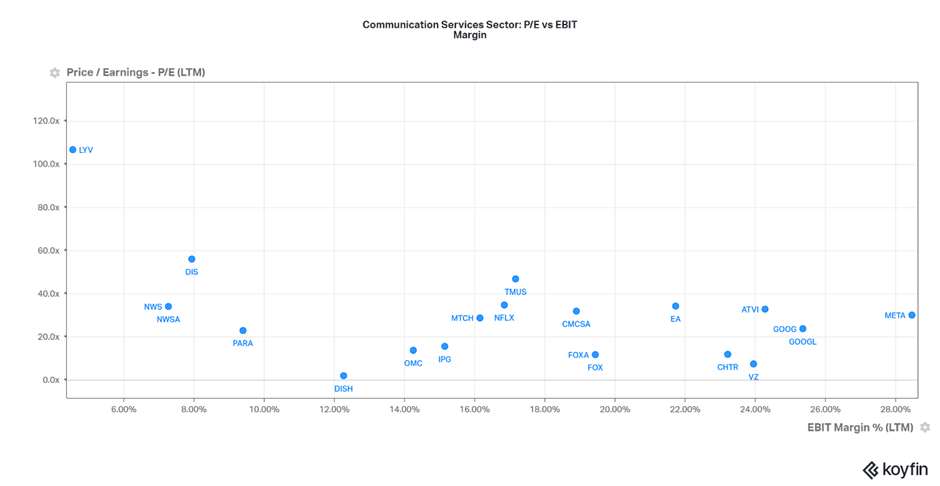

Comparing the communications services sector shares in the S&P 500 Index shows that Meta has the highest operating profit as a measure of its revenue (EBIT Margin) while its price to earning (P/E) is amongst the lowest in the sector. The picture suggests that the company’s share is undervalued compared to its peers when looking at its ability to turn revenue into profit.

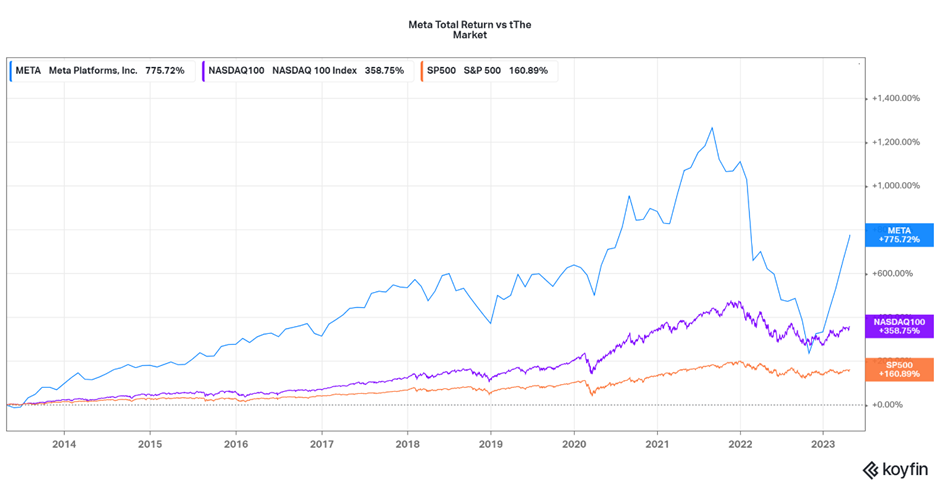

The picture below shows the share’s performance when comparing it to the market’s performance proxied by the S&P500 Index (orange line) and the market-capitalization-weighted index of all the stocks traded on the Nasdaq stock exchange, the Nasdaq 100 Index (purple line), in the last ten years. Meta’s share total return of 775.72% beats the Nasdaq 100 Index and S&P500 Index’s total return of 358.75% and 160.89%, respectively. This outstanding share performance suggests that Meta’s share is worth a second look for investors looking for long-term investments that can return exceptional results.

However, it is important to acknowledge the challenges Meta may face along the way. Privacy concerns and data security have been subjects of scrutiny in the past, and with the Metaverse, these concerns will likely intensify. Meta must prioritize transparency, accountability, and user consent to build trust and ensure the responsible use of data. Regulatory challenges may also arise as governments worldwide grapple with the implications of the Metaverse. Meta’s ability to navigate these obstacles will be crucial to its long-term success.

Summary

n conclusion, Meta Platform Inc.’s transformation into a Metaverse-centric company opens up a world of possibilities. With its solid user base, technological prowess, and visionary leadership, Meta is well-positioned to redefine the way we interact with the digital realm. However, investors must be mindful of the challenges and risks inherent in this transformative journey. Therefore, a long opportunity could exist as the price action moves above $248.02/share towards $255.36/share. However, should the bear push the share lower, a buy-the-dip opportunity could exist at $235.86/share.

Sources: TradingView, Seeking Alpha, Koyfin, Investopedia, Meta, Reuters.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.