In the ever-evolving realm of retail software, Oracle Corporation (NYSE: ORCL) stands tall as the market leader, capturing a significant share in license, maintenance, and subscription revenues. With a powerful line-up of competitors, including tech giants like Adobe, Microsoft, and Salesforce, Oracle has proven its mettle and is ready to electrify the market with its advanced capabilities and cloud-driven approach.

As the storm of competitive upgrades and replacements brews, Oracle’s latest release, Oracle Retail version 16, is set to unleash a tempest of more than 33 retail services for cloud deployment, ensuring convenience and flexibility for retailers and customers alike. With notable partnerships, a soaring stock performance, and a forecast that promises double-digit growth, Oracle is on a mission to dominate the investment landscape and electrify portfolios with potential profits. The markets should be ready to harness the power of the cloud and ride the Oracle wave to new heights.

Technical

The daily chart shows that the Software-as-a-Service (SaaS) giant’s share has formed an ascending channel as it continues its upward trajectory that has seen the share rise over 9.8% month-to-date and an impressive 27.33% year-to-date. The share has firmly established a major resistance (solid green line) at an all-time high of $106.23/share and a major support level (solid red line) at $60.78/share. The share’s current price of $104.08/share offers a discount of 6.50% from the share’s fair value of $111.31/share, calculated using the discounted cash flow model.

The appearance of the golden cross as the shorter-term 50-day moving average cross over the longer-term 200-day moving average could suggest the persistence of bullish momentum towards the share price. However, to maximise the potential upside from the share, investors could keep a keen eye on the 97.30/share support level, a level of interest for bulls, as the price retraces from the all-time high. The 23.60% Fibonacci retracement level could offer some protection against further downside. However, the fall of the 23.60% Fibonacci retracement level would leave the $93.27/share as a potential level of opportunity for a long at a potential for 16.21% upside as the share converges to its fair value.

Fundamentals

Oracle holds a significant market share in license, maintenance, and subscription revenues, with Adobe as its closest competitor. However, Oracle’s focus on broadening its cloud service offerings has contributed to its growing presence in the retail software market. Notable partnerships with industry giants such as Bed Bath & Beyond, Office Depot, and Prada reflect Oracle’s ability to secure key clientele and leverage its expertise in cloud-based solutions.

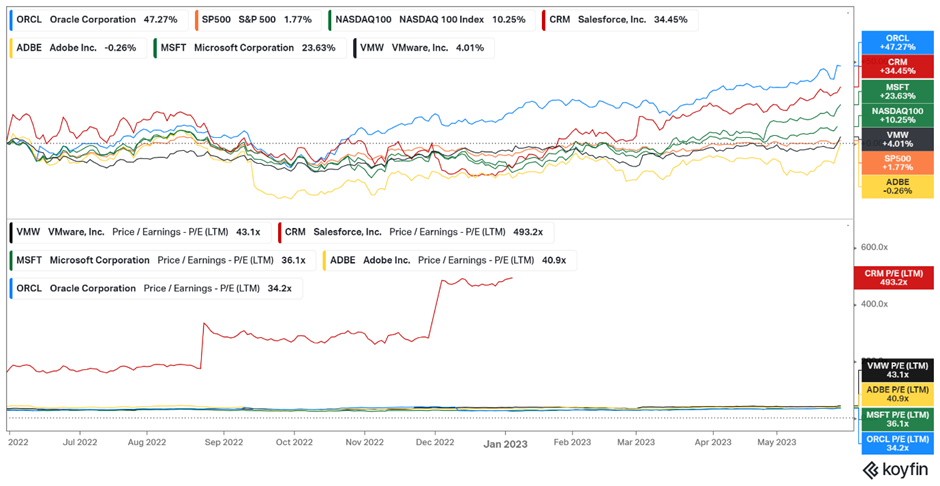

Oracle’s shares have shown impressive year-to-date growth, outperforming its peers, the Nasdaq 100 Index, and the US market, proxied by the S&P500 Index. The picture below shows that the company’s share (blue line) total return of 47.27% for the last year has not only outperformed Salesforce’s 34.45% (it is worth noting that Salesforce is having an incredible year with a total return of 62.49% YTD), Microsoft’s 28.03%, VMware’s 10.54% and Adobe’s 3.20% but has also outperformed the Nasdaq 100 Index’s 16.70% and the S&P 500 Index’s 5.70% for the same period. The company’s share return becomes even more impressive if you scrutinise the company’s P/E ratio of 34.2x, which is the lowest compared to its peers, which could suggest that the company’s share is relatively undervalued against its peers, especially Salesforce, which has a P/E ratio of 493.2x.

The company’s cloud business has been a major driver, with strong uptake of Oracle Cloud Infrastructure services and Autonomous Database offerings. The solid adoption of cloud-based applications, including NetSuite ERP, Fusion ERP, and Fusion HCM, further supports revenue growth. Additionally, partnerships with Accenture and Microsoft have opened avenues for Oracle to acquire new customers and expand its market reach. As businesses increasingly migrate their operations to the cloud, Oracle has embraced this paradigm shift. With its Oracle Cloud Infrastructure (OCI), the company offers a comprehensive suite of cloud services catering to diverse enterprise needs. This expansion into the cloud has opened up new revenue streams for Oracle, generating a “sky-high” growth potential. Investors could be confident in Oracle’s bright future, with profits “clouding” the horizon.

Oracle’s outlook for the fourth quarter of fiscal year 2023 is positive, with expectations of total cloud growth above 30% in constant currency. The company anticipates double-digit growth in operating profit and projects non-GAAP EPS growth between 3% and 5%, ranging from $1.59 to $1.63. The market consensus estimates reflect a steady year-over-year increase in earnings per share (EPS) and revenues, indicating a promising trajectory for Oracle.

Oracle’s release of Oracle Retail version 16, comprising over 33 retail services enabled for cloud deployment, highlights the company’s commitment to catering to evolving customer needs. The emphasis on establishing businesses that will allow convenient shopping experiences anytime and anywhere aligns with the retail industry’s ongoing transformation. Furthermore, Oracle’s approval from FedRAMP for an expanded list of Oracle Cloud Infrastructure services solidifies its position as a trusted provider for the defence, civilian, and intelligence community.

While Oracle’s cloud momentum is commendable, it faces challenges in terms of increased spending on product enhancements to stay competitive in the cloud domain. This may limit margin expansion in the short term. Additionally, the company’s on-premise cloud delivery for large enterprises and governments offers flexibility but requires diligent adaptation to evolving market demands. However, Oracle’s strategic partnerships and its always-free tier, which encourages potential customers to experience its services, provide a competitive edge.

Summary:

Based on the analysis, Oracle Corporation shows strong potential for growth and sustained performance. The company’s expanding cloud offerings, solid partnerships, and established market presence position it favourably in the technology sector. The anticipated growth in cloud-based applications and the increasing adoption of Oracle Cloud Infrastructure services offer a positive outlook for revenue expansion.

Investors could consider Oracle Corporation as a long-term investment opportunity. The company’s track record of innovation, notable partnerships, and focus on cloud-based solutions make it an attractive option within the technology industry. The current share price offering a discount of 6.50% from the share’s fair value could entice an investor looking for long-term exposure to the share. However, an investor should look for price retracement to lower support levels to maximise the value from the share’s exposure.

Sources: Trading, KoyFin

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.