As the technology landscape continues to evolve, Qualcomm Incorporated (NASDAQ: QCOM) emerges as a frontrunner in the semiconductor industry, offering investors an enticing opportunity to capitalize on its potential. The semiconductor giant reported an excellent second quarter (2023Q2), beating Wall Street’s top-line and bottom-line expectations.

However, the recent dim outlook following the company’s excellent quarterly performance sent the company’s shares more than 7% lower after the bell. Qualcomm’s Chief Executive Officer, Cristiano Amon, warned that the company’s performance had been heavily impacted by the more-than-expected demand deterioration driven by the challenging macroeconomic environment and the overall downturn across the semiconductor industry.

Technical

The daily chart shows that the semiconductor giant’s share price currently has a dynamic resistance that acted as a significant ceiling to the bulls’ attempt to push the price higher. With the price action currently below the moving averages could send the presence of bearish sentiment towards the share.

Thus, the bulls will need to break above the dynamic resistance if they want to initiate a rally. A break above the dynamic resistance could push the price action above the $118.74/share resistance level, with the moving averages and the 23.60% Fibonacci retracement level acting as immediate resistances. A sustained break above the 23.60% Fibonacci retracement level in significant volume would bring the $127.75/share resistance into play.

However, should the current bearish sentiment persist, the $93.92/share support level could provide a buy-the-dip opportunity for investors looking for a value-buying opportunity.

Qualcomm’s fair value is currently at $144.39/share when using the discounted cash flow model. The current pre-market price of $104.46/share is at a discount of 38.22% from the share’s fair value, leaving an enticingly sizeable room for the upside.

Fundamentals

The leading semiconductor and telecommunications equipment company waited until after the bell to deliver its 2023Q2 performance. It was a reasonably eventful release after the company posted market-beating quarterly earnings per share (EPS) of $2.15/share from revenue of $9.268 billion. The street was expecting an EPS of $2.146/share from revenue of $9.09 billion. The bottom and top-line were primarily driven by the company’s chipset quarterly revenue of $7.9 billion, which was near the top of the company’s earlier quarterly forecast and the licensing business’ $1.3 billion, which was at the lower band of the company’s guidance.

However, the market was spooked by the significant 17% year-on-year decline in the chipmaker’s Qualcomm CDMA Technologies (“QCT”) overall revenue and the remarks by the CEO that the company expects the “larger-than-normal” decline in the company’s primary revenue driver to persist in the upcoming quarters. The remarks suggest that quarterly free cash flow, which declined from $2.7 billion to -$486 million year-on-year, could continue to deteriorate during the fiscal years, which was enough to send investors looking for safety away from the share.

The management’s outlook for the third quarter also negatively impacted the share performance after the company forecasted an EPS guidance of $1.70/share to $1.90/share from revenue of $8.1 billion to $8.9 billion, which fell well short of the street’s expectation of an EPS of $2.13/share from revenue of $9.12 billion.

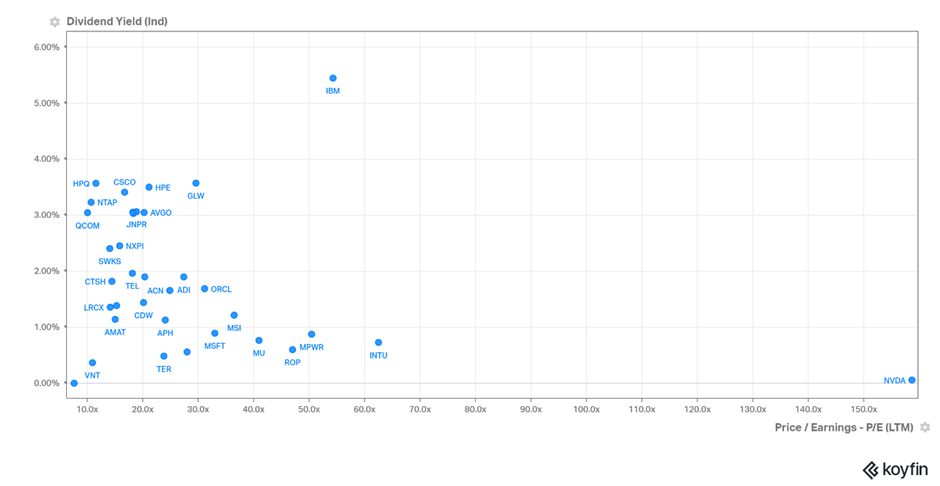

The picture below shows that the company’s share offers a very competitive dividend yield when compared to peers within the information technology sector of the S&P 500 Index. The company’s low P/E could suggest that the share could be enticing for investors looking for cheap shares that are high divided-paying.

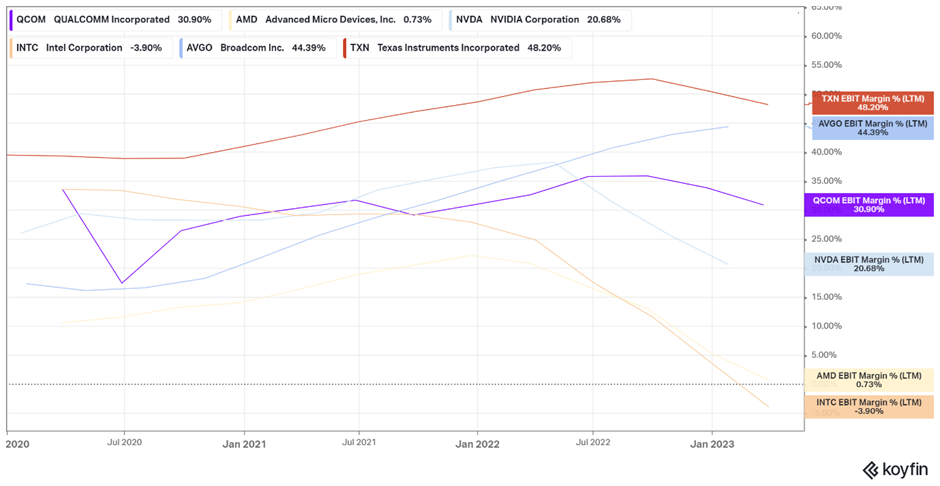

The picture below also shows that the company’s ability to turn revenue into profit is among the most competitive within the semiconductor industry. The company’s EBIT margin of 30.90% trumps the larger NVIDIA EBIT Margin of 20.68%, while Advanced Micro Devices Inc has a dismal EBIT Margin of 0.73%.

However, like every other company, there are some inherent risks associated with investing in Qualcomm. The company operates in a highly competitive industry, and there is a risk that it may lose market share to competitors. In addition, the current macroeconomic condition, heightened recessionary fears and concerns about the viability of the Chinese demand after the reopening could impact Qualcomm’s business, as China is a key market for the company. However, Qualcomm has been able to navigate these risks effectively so far, and its strong market position provides a safeguard against any potential headwinds.

Summary

Qualcomm represents an enticing investment opportunity, given its dominant position in the semiconductor industry and growing demand for 5G technology. However, the company’s outlook could be of concern to investors, but the diversified product portfolio, focus on licensing and intellectual property, and strategic initiatives could boost sentiment. Nevertheless, a long opportunity could exist as the price action moves above $118.74/share towards $127.75/share. However, a buy-the-dip opportunity could exist at $93.92/share if the bears push the share lower.

Sources: TradingView, KoyFin, Reuters, Seeking Alpha, Qualcomm.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.