Marco View:

Today, all eyes are on the Reserve Bank of Australia’s (RBA) interest rate decision at 11:30 a.m. (GMT+8). Market consensus suggests the RBA will maintain its OCR at 4.10%, foreseeing further tightening policies after a rise in August CPI. Major financial institutions such as Barclays, Citibank, Goldman Sachs, Credit Agricole, and UniCredit also predict a hold in today’s meeting. However, there’s potential for a 25bps hike in November. While the RBA maintains a hawkish stance, the Australian Dollar’s upside is limited due to elevated inflation in Australia and investor pessimism about China’s economic outlook. Despite China’s official PMI indicating expansion, uncertainty in the property sector and overall growth dampens investor confidence.

Canada’s recent CPI rise from 3.3% to 4% is attributed to the increase in energy prices, boosting the Canadian Dollar (CAD). The surge in oil prices has been instrumental, with forecasts from major investment banks like Barclays and Goldman Sachs suggesting further increases, possibly reaching $100/bbl by the end of 2023. This external factor bodes well for commodity currencies, especially the CAD, potentially leading the Bank of Canada to hike rates by 25bps in October 2023.

FX View:

The DXM Order Stream data reveals that 79% of retail traders have short positions on AUD/CAD, whereas only 21% have long positions. Despite this, our existing short bias on AUD/CAD contradicts this data. Therefore, it’s advisable to wait for a change in the DXM data before considering any new positions. Additionally, it’s prudent to wait until after the RBA meeting to avoid potential market volatility related to the event.

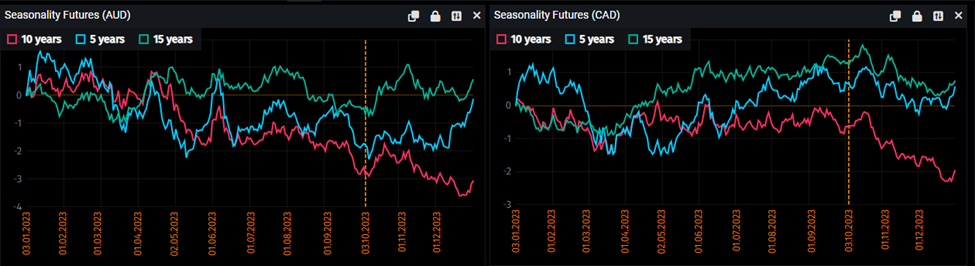

Seasonal patterns suggest that both AUD and CAD will maintain their bullish movement for the next 4 weeks. However, it’s essential to consider the broader context and current fundamentals to determine which currency is stronger. It’s important to remember that seasonality does not account for new economic developments and changes, but it can serve as a useful reference for decision-making.

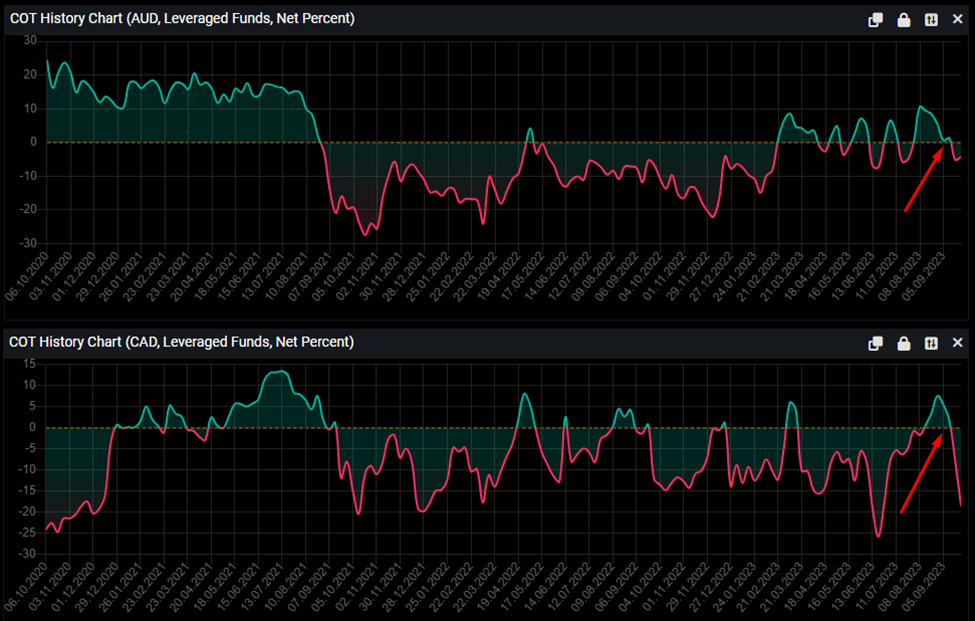

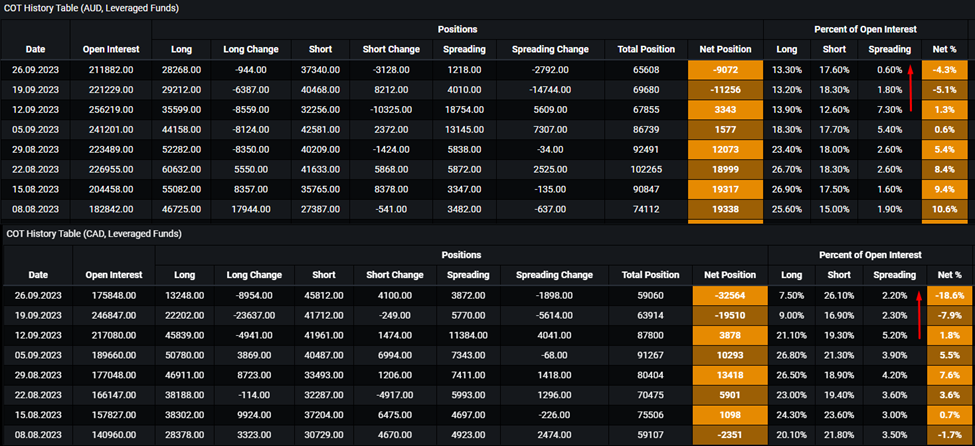

Examining the Commitment of Traders (COT) data reveals intriguing insights into both AUD and CAD. Both currencies have experienced a significant negative flip in their net percentages, transitioning from 1.3% to -4.3% for AUD and 1.8% to -18.6% for CAD. This indicates a shift among hedge funds towards selling both currencies.

Upon closer examination of the CAD data, it’s noteworthy that the CAD flipped from negative to positive on August 8, only to revert to negative in recent data. This suggests that hedge funds might be taking profits on their CAD positions while retaining some remaining long positions on the currency.

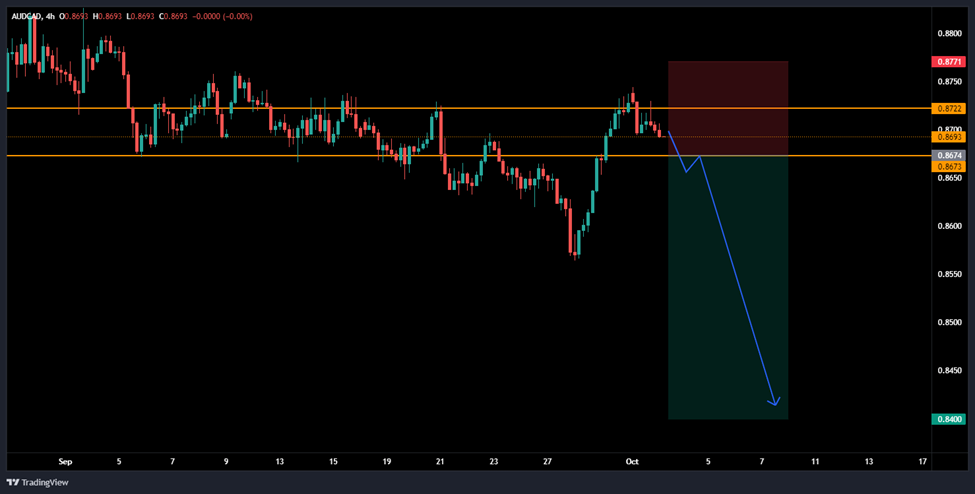

Trade Recommendation: Short AUD/CAD Position

Entry: Short after the RBA meeting

Take-Profit: 0.84000

Stop-Loss: 0.87700

Risk-to-Rewards: 1:2

Author: Jacky.T

Sources: PMT

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.