Technical Outlook: Are institutional investors accumulating long positions?

GBPUSD has been trading sideways for the past few days. Currently, prices have repeatedly been rejected at the significant zone of 1.2675-1.2620, as indicated on the chart. Additionally, after a strong downward movement, prices tend to enter an accumulation phase before resuming an upward trend. The sideways movement of GBPUSD seems reminiscent of such an accumulation phase.

Fundamental Outlook: UK August flash services PMI 48.7 vs 51.0 expected

The UK is grappling with disappointing PMI figures for August. The services sector is observed to be entering contraction territory, further contributing to the ongoing manufacturing sector recession across the region. The UK economy’s brief period of growth, lasting only six months, has now come to an end as the composite reading drops to its lowest point in 31 months.

Given the low PMI, a potential interest rate hike in September appears likely. The August PMI data will fuel speculation that interest rates could soon peak.

What’s Happening Behind the Scenes? Let’s Examine Some Insightful Data:

To become a professional trader, relying solely on technical and fundamental data is insufficient for making informed trading decisions. Real market data that operates behind the scenes is also crucial.

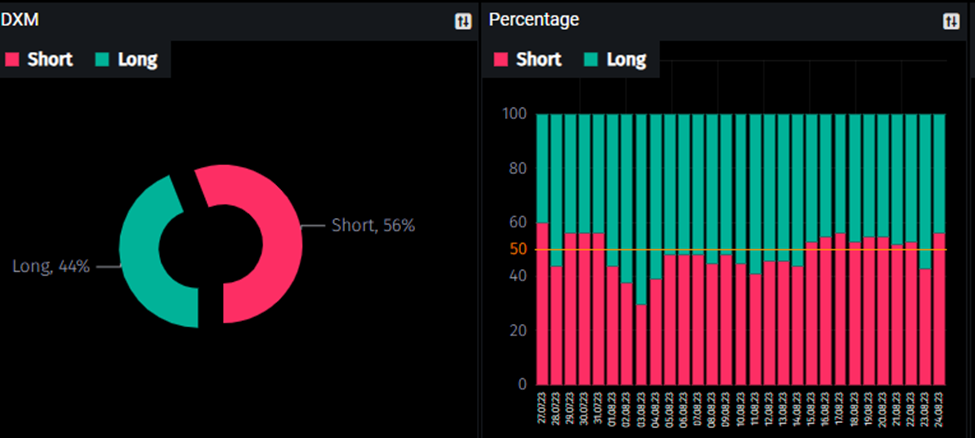

DXM: Contradictory Signal from Retail Traders

The DXM, or “Dump Money Index,” is a valuable tool for traders aiming to gauge retail participants’ sentiment. It measures the percentage of retail traders holding long or short positions in a specific market.

As seen, a significant number of retail traders are currently holding short positions (56%). This contrarian signal implies that taking reverse trades might provide advantages.

It’s worth noting that 95% of retail traders lose money over extended periods. This data indicates that retail traders often misjudge market directions. Therefore, contrarian traders who oppose retail traders’ positions may have a higher chance of success. Of course, success isn’t guaranteed with contrarian trading. Nonetheless, it’s a strategy that can enhance your winning prospects.

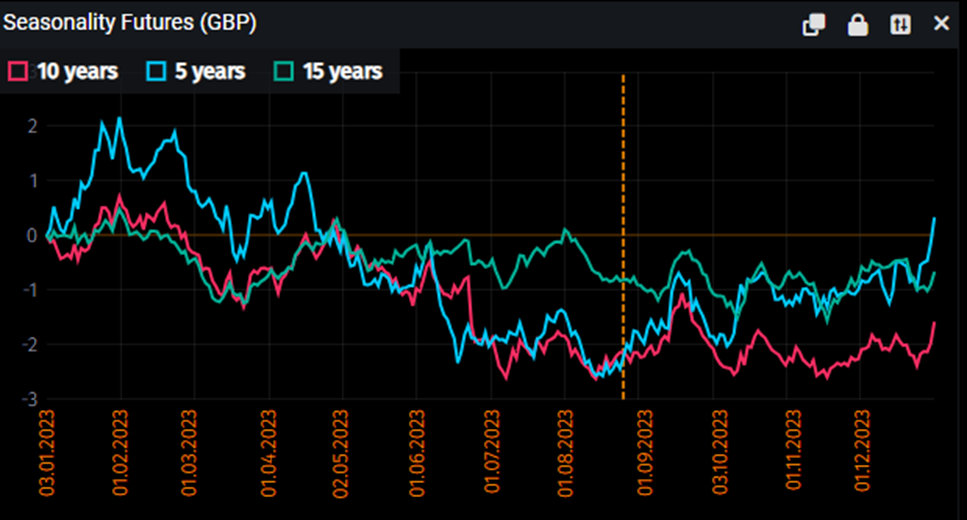

Seasonality in GBP Futures: Is the Pound Always Bullish in Summer?

Seasonality analysis predicts future price movements based on historical data. For GBP, seasonal analysis suggests the pair is likely to maintain a bull market until mid-September 2023.

However, please note that seasonality doesn’t consider new developments or economic changes; it’s a pattern that can evolve and isn’t infallible.

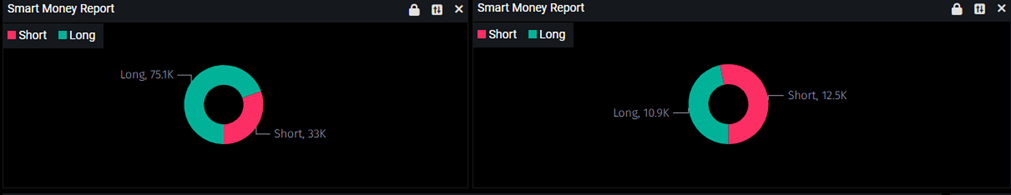

COT Data: Hedge funds & Leverage funds Favor Pound?

The Commitment of Traders (COT) report, issued weekly by the Commodity Futures Trading Commission (CFTC), provides insight into positions of large traders like hedge funds and investment banks.

As shown in the chart, hedge funds are currently accumulating a significant amount of GBP, approximately 75.1k positions. This data suggests their bullish outlook on the Pound, providing insights for our decision-making.

Investment Banks’ View: Are They Mostly Bullish on the Pound?

Undoubtedly, understanding banks’ actions is crucial for retail traders, given their significant role in the FX market. Looking at the chart, we can see that most investment banks, including Citi, BMO, and ANZ, share a clear bullish outlook on the Pound. As retail traders, aligning our targets with theirs might be a prudent choice.

Summary: All Signs Point to a Long GBP/USD Position

• Technical Analysis: GBP in an accumulation phase.

• Fundamental Analysis: Weak PMI could prompt BoE to raise interest rates for economic stimulation.

• DXM: Majority of retail traders are short on the Pound.

• Seasonality Analysis: Seasonal pattern suggests GBP could remain bullish until mid-September.

• COT: Significant GBP accumulation by major players.

• Investment Banks: The majority of investment banks hold a bullish view on the Pound with clear targets.

Author: Jacky.T

Sources: PMT

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.