Marco View:

The Australian Dollar (AUD) is depreciating due to several factors. Despite some economic resilience offsetting concerns about slower growth in China, pessimism in China persists, putting downward pressure on AUD/USD. Higher US yields compared to Australian assets lead investors to move funds to higher-yield currencies, further weakening the AUD. Additionally, large pension funds reducing their hedge ratio on foreign investments due to AUD-USD headwinds contribute to selling pressure on the Australian Dollar. According to the recent research paper by Natwest, Goldman Sachs, HSBC and MUFG, they all have a bearish stance on AUD. Moving forward, The strong US economy and expectations of a longer hawkish stance from the Fed are likely to support the continued strength of the US dollar.

FX View

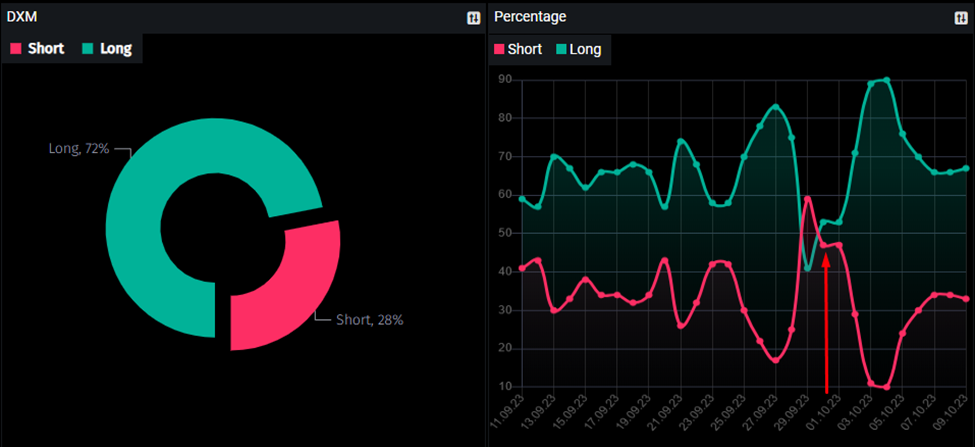

The DXM Order Stream data reveals that 72% of retail traders have long positions on AUD/USD, whereas only 28% have short positions. Moreover, a DXM occurred a negative flip during the 1st October, which means all the retail traders are change their direction to the long side, which is a wrong side of fundamentally. It provided to us an insight to place an order which is against them.

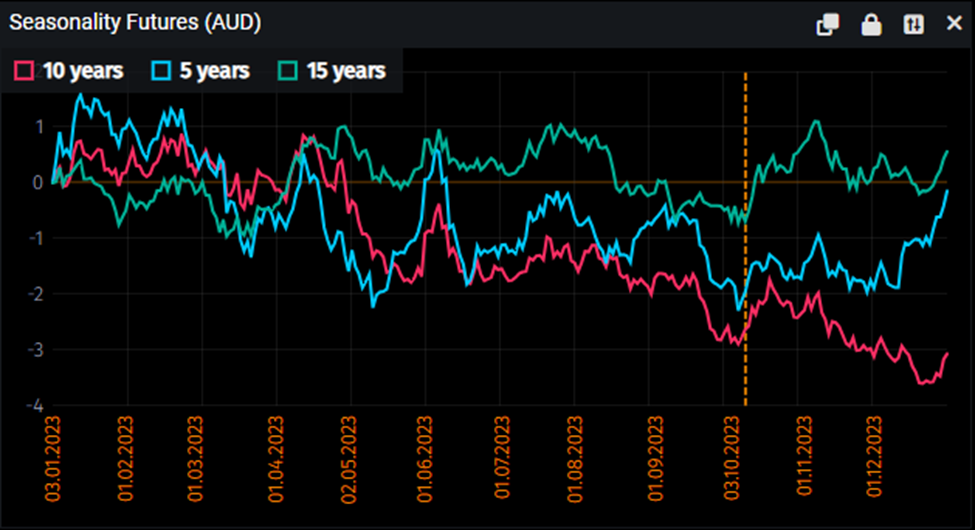

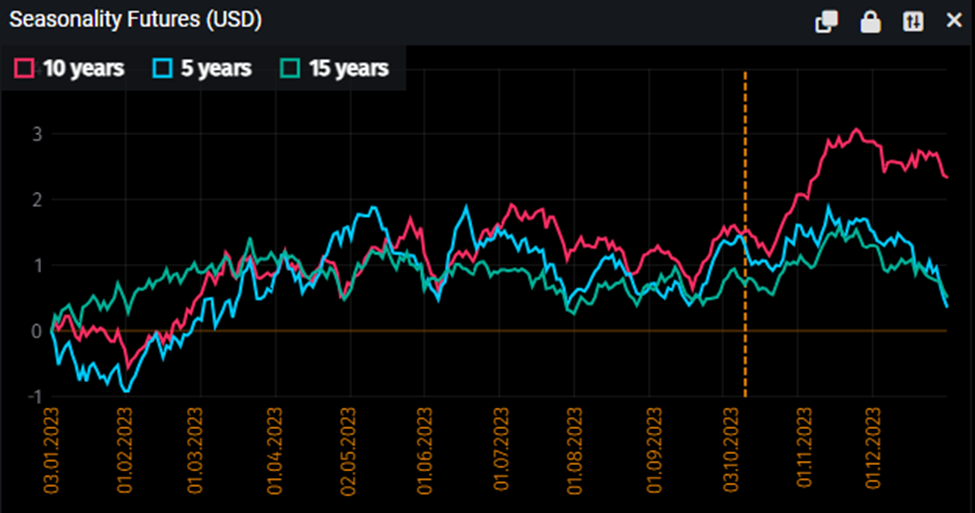

Seasonal patterns suggest that both AUD and USD will provide a contradictory signals to on our bearish idea. Particularly, AUD shows a bullish sign for next 4 weeks and USD shows a bearish sign for next 4 week. However, it’s essential to consider the broader context and current fundamentals to determine which currency is stronger. It’s important to remember that seasonality does not account for new economic developments and changes, but it can serve as a useful reference for decision-making.

Examining the Commitment of Traders (COT) data reveals intriguing insights into both AUD and USD. Both currencies have experienced a significant flip in their net percentages. Particularly, AUD showed a negative flip and USD showed a positive flip, transitioning from 1.3% to -6.7% for AUD and -23.3% to 7.2% for USD. This indicates a shift among hedge funds towards selling AUD and buying USD.

Trade Recommendation: Short AUD/USD Position

Entry: Market order

Take-Profit: 0.61240

Stop-Loss: 0.6509

Risk-to-Rewards: 1:2

Author Jacky.T

Sources: PMT

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.