NZDUSD

In the realm of daily trading, the NZDUSD pair has decisively breached the significant 0.60000 level. This break signals a plausible extension of the prevailing downward trend. A keen observation of the market and the imminent interest rate decision from the Reserve Bank of New Zealand (RBNZ) at 10:00 a.m. GMT+8 today reveal an expected hold on the cash rate, currently set at 5.50%. As of now, no indications of a hawkish stance have been detected.

NZDUSD Technical Analysis: Testing Crucial Support

Taking a technical stance, the NZDUSD exchange rate persists in its downward trajectory, drawing closer to the notable support at 0.59000. The breach of the 0.60000 level has sparked concerns among traders, potentially paving the way for further bearish momentum. Chart patterns and indicators suggest a prevalent selling pressure, indicating a predilection for short positions among market participants.

Expert Outlook: JP Morgan and Goldman Sachs Bearish on NZDUSD

Prominent financial entities, JP Morgan and Goldman Sachs, have conveyed a bearish sentiment towards the NZDUSD in their recent research reports. JP Morgan’s analysis foresees a downward path for the NZDUSD, projecting a target near 0.57000 within the next three months. Similarly, Goldman Sachs anticipates a descent towards 0.55000 within the same timeframe. These expert projections underscore the cautious market sentiment surrounding the New Zealand Dollar against the US Dollar.

DXM: A Powerful Tool for Retail Trader Analysis

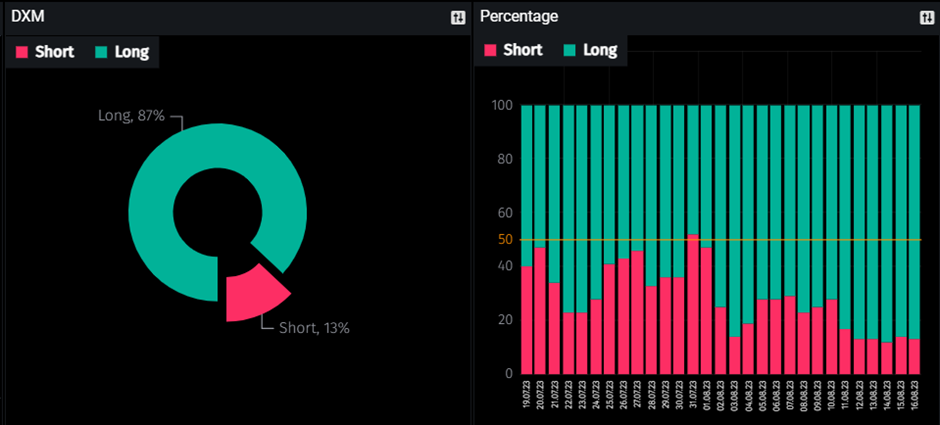

The DXM, or “Dump Money Index,” serves as a valuable instrument for traders seeking to understand the sentiments of retail participants. By assessing the chart provided below, it becomes evident that an overwhelming 87% of retail traders have chosen the long position for NZDUSD, with a meager 13% favoring the short position. It is worth acknowledging the well-known statistic that 95% of retail traders encounter losses over extended trading periods. This data introduces a significant and intriguing dimension, encouraging traders to consider contrarian trading strategies.

Unlocking Trading Insights with COT (Commitment of Traders) Report

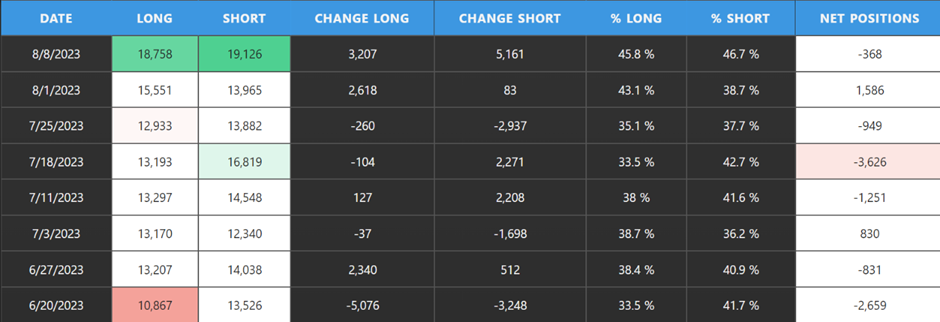

In the realm of trading, the COT, or Commitment of Traders report, stands as a pivotal tool. This report mandates professional and licensed traders to disclose their positions to the CFTC (Commodity Futures Trading Commission) on a weekly basis. Through careful analysis of these positions, a window is opened into their activities within the market. This invaluable information equips us with potential advantages that can be harnessed to inform our trading decisions.

Analyzing the provided table, it becomes evident that the cumulative short positions surpass the long positions. Ranging from 12,340 to 19,126, short positions have increased, leading to a subsequent transition in net positions from 1,586 to -368. This transformation signifies a shift from a positive to a negative net position, indicating a substantial bias towards the short side.

Conclusion: Monitoring the NZDUSD Trend Amid RBNZ Decision

As the NZDUSD pair faces continuous downward pressure, all eyes remain on the RBNZ’s impending interest rate decision and its potential impact on the currency’s performance. Traders and investors are advised to stay attuned to any updates from the RBNZ statement and to consider the bearish projections from industry experts like JP Morgan and Goldman Sachs. The breach of pivotal support levels accentuates the necessity for a vigilant approach in managing NZDUSD positions during this period of escalated volatility.

Author: Jacky.T

Sources: TradingView, PMT, CFTC

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaims liability towards any user and other recipients of this report.