Morgan Stanley (NYSE: MS) is poised to release its second-quarter earnings report, and investors are eagerly awaiting the results. With a track record of strong performance, strategic acquisitions, and solid financials, Morgan Stanley presents an enticing investment opportunity in the financial sector.

In the most recent quarter, Morgan Stanley’s revenue increased by 5.22% year-on-year, and its earnings per share increased by 9.5%. The company’s strong performance was driven by growth in its institutional securities and wealth management segments.

Looking ahead, Morgan Stanley is expected to continue to grow its earnings. The company has announced plans to increase its dividend by 9.7%, and it is also planning to repurchase $20 billion worth of its shares. These actions are a sign of the company’s confidence in its future prospects ahead of its second-quarter performance report.

Technical

The daily chart shows that the financial services behemoth’s share has been under firm bearish pressure following the breakout of a rising wedge, as confirmed by the appearance of the death cross as the longer-term 200-SMA (orange line) crossed above the shorter-term 50-SMA (blue line). The formation of the descending triangle trading pattern could also act to confirm the current bearish momentum.

Therefore, should a break out below materialize, a long opportunity could exist at the $79.47/share support level lower as bears continue to push the price higher. Barring a huge sell-off, the $74.84/share support could offer a buy-the-dip trading opportunity in the near term. However, strong quarterly performance and outlook could help the price action break above the triangle, leaving the $79.47/share resistance level to offer a long opportunity for a potential 8.57% upside as the share converges towards its’ estimated discounted cash flow fair value of $97.26/share (green line).

The current share price of $83.79/share, which offers a potential upside of 16.08% as the share converges towards its fair value, could be enticingly priced for a prudent investor ahead of the bank’s second-quarter performance report on Friday.

Fundamentals:

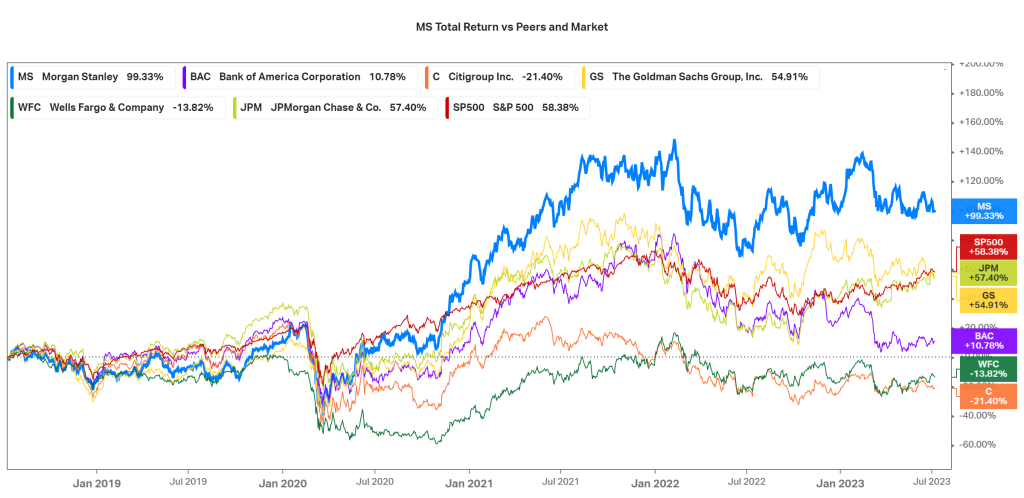

Share Performance: Morgan Stanley Outperforms Peers And Market Over Past Five Years.

The picture below shows that Morgan Stanley has outperformed its peers and the broader market over the past five years, with a total share return of 99.33%. This is significantly higher than the S&P 500 Index’s total share return of 58.38% and the average of its peers of 51.40%. Investors will be looking for Morgan Stanley to continue its strong performance when it reports its second-quarter earnings on Friday. The investment banking division is expected to be a key driver of earnings as dealmaking activity remains strong. The wealth management division is also expected to perform well as asset levels continue to grow.

However, there are some headwinds that could weigh on earnings, such as rising interest rates and increased competition. Overall, Morgan Stanley is well-positioned to continue with a strong track record of share performance should the market beat market expectations on Friday.

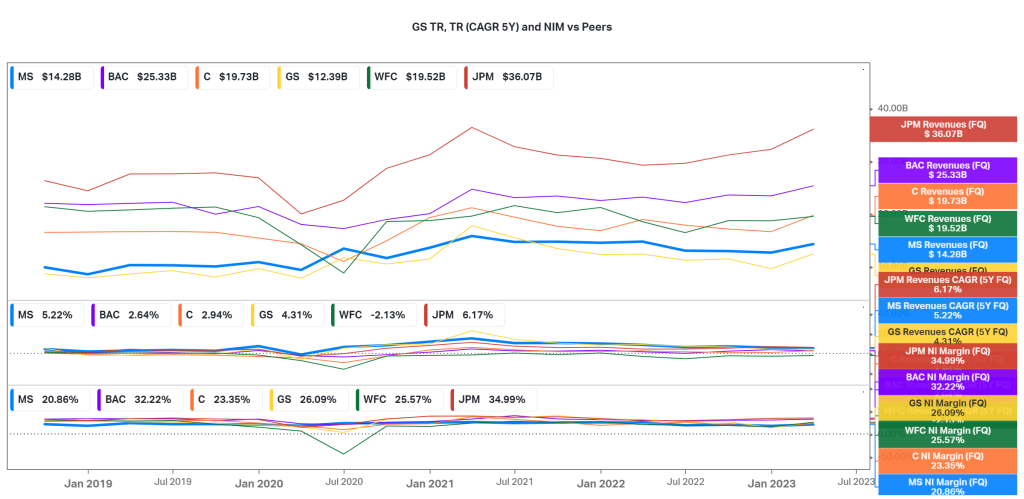

Financial Performance: Morgan Stanley Shines As A Financial Powerhouse.

Over the past decade, Morgan Stanley has demonstrated impressive growth in both revenues and earnings per share (EPS). Despite a slight decline after reaching a peak in 2021, EPS increased by a remarkable 266%, reflecting the company’s ability to expand assets under management (AUM) while maintaining cost efficiency. Improved margins, higher sales, and share buybacks have contributed to this impressive EPS growth.

The picture below shows that Morgan Stanley shines as a financial powerhouse with robust financial performance. Its impressive track record of revenue growth, highlighted by a quarterly total revenue compound annual growth rate (CAGR) of 5.22%, sets it apart from competitors. With a net income margin of 20.86%, the company demonstrates solid profitability in the industry. As investors eagerly await the release of Morgan Stanley’s second-quarter earnings report, the company’s strong financial performance positions it as an enticing investment opportunity. Expectations are high for continued success and insights into its strategic direction and potential growth.

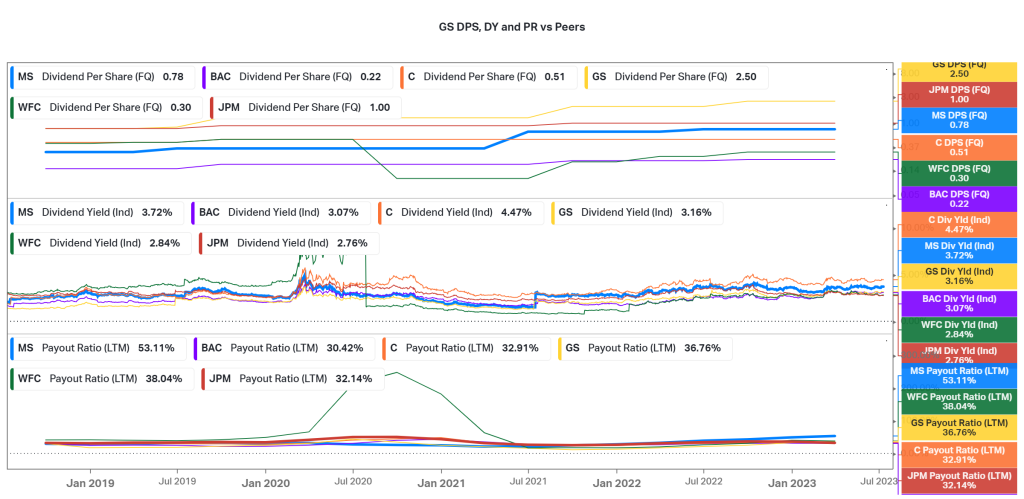

Dividend Growth and Stability: Morgan Stanley’s Dividend Hike Signals Confidence in Future Earnings.

Morgan Stanley recently announced an increase in its dividend following the successful stress tests of 2023. With a planned 9.7% dividend hike, the company aims to achieve a dividend yield closer to 4%. This attractive yield, coupled with Morgan Stanley’s status as a growing blue-chip entity, makes its dividend offering highly compelling. Furthermore, the company’s conservative approach to maintaining a payout ratio between 50%-60% ensures the sustainability of its dividend payments.

As seen in the picture below, Morgan Stanley shines in terms of dividend growth performance, setting itself apart from industry peers. With a dividend per share of $0.78 and an indicated dividend yield of 3.27%, the company offers steady income for investors. Comparatively, Bank of America and Wells Fargo lag behind, while Citi and Goldman Sachs compete closely. With a prudent payout ratio of 53.11%, Morgan Stanley ensures sustainable dividends. As the eagerly anticipated second-quarter earnings report approaches, investors can expect the company’s solid dividend growth to continue, providing an enticing opportunity for income-seeking investors.

Share Buybacks:

In addition to dividends, Morgan Stanley has prioritized share buybacks as a means of enhancing shareholder value. Over the past decade, the company has significantly reduced its outstanding shares by 15%, despite issuing shares for strategic acquisitions like E-Trade. With plans to repurchase an additional $20 billion worth of stock following the 2023 stress test, the company demonstrates its commitment to maximizing shareholder returns.

Outlook and Analyst Consensus:

According to Wall Street, analysts anticipate Morgan Stanley to sustain a strong growth trajectory in the medium term, with an estimated annual EPS growth rate of around 9.5%, to $1.239 per share on revenue of 13.141 billion for the second quarter. This positive outlook is supported by the company’s ability to expand its client base, manage assets effectively, and offer a diverse range of financial services.

Furthermore, the upcoming earnings report presents an opportunity for investors to gain deeper insights into Morgan Stanley’s performance and growth prospects.

Summary

Morgan Stanley presents an enticing investment opportunity ahead of its second-quarter earnings report. With a solid track record of financial performance, dividend growth, and share buybacks, the company has consistently delivered value to its shareholders.

As the financial sector remains under scrutiny, Morgan Stanley’s stability, regulation compliance, and strategic positioning make it an attractive investment choice. Investors should closely monitor the earnings report for a comprehensive understanding of Morgan Stanley’s future growth prospects and potential for generating robust returns.

Sources: TradingView, Trading Economics, KoyFin, Seeking Alpha, Morgan Stanley, CNBC, Market Screener.

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaims liability towards any user and other recipients of this report.