Salesforce, Inc. (NYSE: CRM), the cloud-based software giant, is gearing up to release its quarterly report on May 31, 2023, and investors are eagerly awaiting the results. The company has been on a remarkable rally this year, driven by investor enthusiasm for its cost-cutting initiatives. However, despite showing modest progress in improving operating profitability, Salesforce still has some work to do to meet the expectations of conservative investors.

As the stock continues to soar, it’s essential to evaluate the company’s performance and consider its potential for higher levels of profitability. So, buckle up and get ready for a cloud-powered journey through the world of Salesforce!

Technical

The daily chart shows that the software company’s share has formed a rising wedge as the bulls continue to push the share higher, which has seen the share rise to a significant 58.65% from the turn of the year’s share price of $135.19/share.

Should the bulls fail to break above the wedge, the market could be looking at the share’s reaction around the lower bounds of the wedge. A break below the wedge would bring the $199.82/share support level, with the 23.60% Fibonacci retracement level acting as a significant barrier to continued move lower. The failure of the 23.60% Fibonacci retracement level could trigger a sell-off towards the $190.65/share support level.

However, should the price action open next week above the weekly high currently at $212.82/share could boost the bulls’ charge higher with the $216.51/share resistance level offering a potential long opportunity at a 7.93% discount from the share’s fair value of $233.67/share, using discounted cash flow model.

Fundamentals

Salesforce has witnessed an impressive rally this year, with its stock surging 58.65% YTD, primarily driven by investor enthusiasm for cost controls and its commitment to improving profitability. The company’s strategy of reducing expenses through layoffs and optimising its real estate footprint has garnered attention. While the benefits of these measures will take time to materialise, the market has responded positively to Salesforce’s commitment to enhancing profitability. However, while Salesforce has shown modest progress in improving GAAP operating profitability, there is still room for growth.

To evaluate Salesforce’s future progress, it is crucial to analyse its most recent quarter as a baseline. In the most recent quarter, Salesforce reported a significant improvement in operating income, shifting from a loss of $176 million to a gain of $357 million. Although losses impacted GAAP earnings on strategic investments and income taxes, the company’s core business segments continue to grow, demonstrating the resilience of its customer base and the quality of its product offerings. Salesforce’s presence in the APAC and EMEA regions has shown promising expansion potential, compensating for a slightly moderating growth rate in the mature Americas market. By capitalising on these regions, Salesforce can maintain double-digit growth rates despite its already significant market presence. Moreover, the company recorded an operating income of $1,030 million for the full fiscal year, compared to $548 million in the preceding year. Although there was a GAAP loss in the most recent quarter due to losses on strategic investments and income taxes, investors typically disregard one-time items as they do not reflect the company’s operating performance.

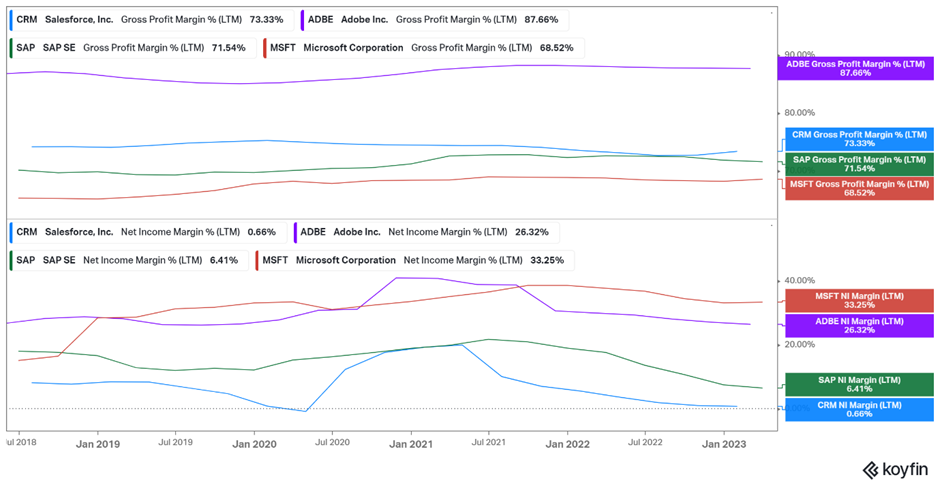

One area of concern for investors is Salesforce’s profitability, especially the net income margin, which appears modest considering its $206 billion market capitalisation and concerning compared to its peers. While the company reports non-GAAP earnings, some investors emphasise the significance of stock-based compensation (SBC) expenses as a legitimate cost. Employees receiving stock as part of their compensation package may demand alternative forms of remuneration if SBC is discontinued. The picture below shows that as much as Salesforce has maintained a gross profit margin (GPM) of 73.33%, the company’s net income margin (NIM) of 0.66% is not something to write home about. Therefore, Salesforce needs to demonstrate improved levels of profitability to justify its current valuation.

Salesforce has a compelling opportunity to differentiate itself in the marketplace by integrating AI-powered tools into its enterprise software offerings. The demand for AI productivity tools in the enterprise sector is growing rapidly, and Salesforce can leverage this trend to solidify its competitive position. Investors should closely monitor management’s commentary regarding this initiative as a potential indicator of the company’s ability to innovate and adapt to evolving market trends. Additionally, Salesforce’s ability to exceed its Q1 and full fiscal year guidance will be crucial in assessing its performance and growth trajectory.

From a valuation perspective, Salesforce’s price-to-earnings (PE) multiple of 493.2x is relatively high compared to its competitors. Compared to its peers like SAP SE (85.2x), Adobe (38.6x) and Microsoft (35.3x), Salesforce seems relatively overvalued on a P/E basis. However, the company’s price-to-free cash flow ratio is at a multiyear low, suggesting potential opportunities for cash flow-oriented investors willing to overlook SBC expenses. Nonetheless, until Salesforce demonstrates higher levels of GAAP profitability or accelerates its revenue growth, it may be considered overvalued by conservative investors.

Summary:

Salesforce presents an intriguing investment opportunity with its strong market position and growth potential in under-penetrated regions. As investors eagerly await Salesforce’s upcoming earnings report, it is crucial to brace for potential shifts in the market.

The company’s progress in cost controls and operational efficiency will be closely scrutinised, especially in terms of profitability. While Salesforce has shown modest improvements in its operating income, careful investors may prefer to wait for higher levels of net income margin before making any significant investment decisions. As the earnings release approaches, it is essential to closely monitor the company’s ability to meet or exceed guidance and evaluate the impact on its valuation.

Sources: TradingView, KoyFin, Seeking Alpha,