Pfizer Inc. (NYSE: PFE), a global pharmaceutical behemoth, has been at the forefront of medical innovation for decades, and its’ shares soared after the company made headlines globally with its collaboration with BioNTech and the development of the highly effective COVID-19 vaccine. On Tuesday, Pfizer announced a stronger-than-expected first quarter of the 2023 financial year (2023Q1) performance to continue its outstanding quarterly performance, which has seen the company beat Wall Street’s earnings expectation for the ninth consecutive quarter.

However, the company’s share didn’t quite get the memo of the excellent quarterly performance, which saw the company beat both the street top-line and bottom-line expectations. The pharmaceutical giant’s share closed the Trading session on Tuesday 0.38% lower to reach a significant 23.77% decline from the share’s turn-of-the-year price of $51.01/share after the company decided against raising its guidance for 2023FY even after the excellent 2023Q1 performance.

Technical

The weekly chart shows that the pharma giant’s share price continues to succumb to the selling pressure, which has seen the share decline 23.77% from the share’s turn-of-the-year price. However, the appearance of the golden cross and the hammer candlestick could boost the bulls’ attempt to push the share price higher.

Therefore, a long opportunity could exist as the price action breaks above the $40.83/share resistance level at a discount of 14.96% from the share’s fair value of $48.01/share. The price action will need to overcome the 23.60% Fibonacci retracement level if the bulls look to launch a successful attack on the next level of interest at the $45.46/share resistance level. However, should the bears continue to push the price lower, a long opportunity could exist at the 22nd of December 2020 low of $36.60/share resistance level

Since Pfizer is a dividend-paying company, the company’s fair value is $48.01/share when using the discounted cash flow model. The fair value of $48.01/share offers an upside of an enticing 22.83% from the share’s current pre-market price of $39.16/share.

Fundamentals

The pharmaceutical giant reported quarterly earnings per share (EPS) of $1.23/share from a quarterly revenue of $18.282 billion, which delivered a 24.98% and 10.09% wall street’s EPS and revenue-beat, respectively. The street had expected an EPS of $0.984/share on revenue of $16.607 billion. The company’s quarterly performance was primarily boosted by the less-than-expected decline in the company’s COVID vaccine Comirnaty and the COVID antiviral Paxlovid revenue during the quarter.

However, what raised investor concerns was a decline of 29% and 30% year-on-year in revenue and the reported net income from the 2022Q1 to the most recent quarter. The revenue decline from $25.661 billion in 2022Q1 to $18.282 billion in 2023Q1 was primarily driven by the 51.7% year-on-year decline in Comirnaty and Paxlovid’s quarterly revenue, from $14.7 billion to $7.1 billion. Comirnaty’s unprecedented $10.3 billion decline in revenue year-on-year offset the Paxlovid revenue rise of about $2.85 billion for the quarterly as the antiviral continue to play a crucial role in aiding COVID treatment. The management’s remarks that it expects significantly lower sales contributions from its’ COVID products in the second quarter compared to the already significant decline in the first quarter spooked investors and intensified concerns about the company’s future outlook.

It is worth noting that the pharma giant’s non-COVID revenue grew 5% year-on-year, primarily driven by robust sales of anticoagulant Eliquis and the Prevnar family of Pneumococcal conjugate vaccines, which grew 5% and 2%, respectively, in 2023Q1. However, it seems that there is a negative for almost every positive for the globally renowned pharmaceutical company. Investors should be wary that Eliquis and Prevnar’s exclusivity patents will expire in 2026. The products generated a combined $6 billion for the 2022FY, and the expiration of the patent would significantly impact its sales. The decline in sales combined with the already declining COVID portfolio revenue would severely impact the company’s future outlook.

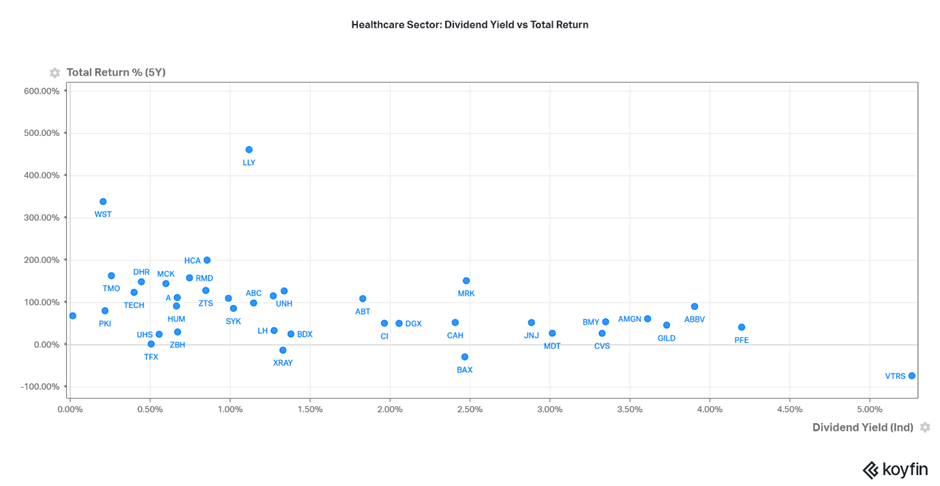

The picture below compares the share performance of the companies in the healthcare sector of the S&P 500. The picture shows that Pfizer’s share return for the past five years has been around par with the other peers in the industry. However, what sets the share price apart is the company’s very competitive dividend yield, currently at approximately 4.20%. The only share that offers a better dividend yield is that of Viatris Inc. which but with Viatris’ negative share return, Pfizer seems a better option among its peers.

Summary

Pfizer’s steadfast commitment to healthcare innovation and strategic partners positions the company for continued growth and returns for investors. While regulatory challenges and risks exist, Pfizer’s track record, financial performance, and commitment to shareholder value make it an enticing investment choice for those seeking exposure to the healthcare sector. Therefore, a long opportunity could exist as the price action moves above $45.83/share towards $45.46/share. However, a buy-the-dip opportunity could exist at $36.60/share if the bears push the share lower.

Sources: TradingView, KoyFin, Seeking Alpha, Reuters, MT Newswire.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.