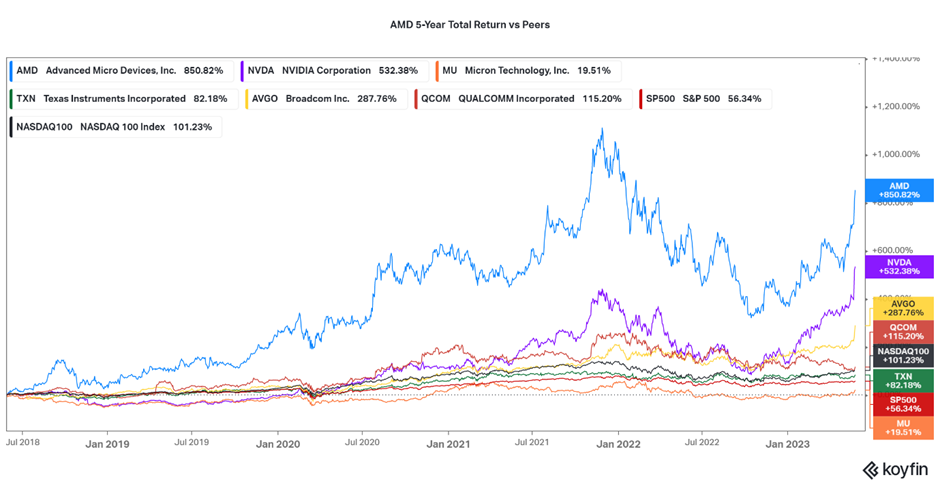

Advanced Micro Devices Inc. (NASDAQ: AMD) is riding the technology wave with its processors, and the market participants have responded in kind. With the share’s impressive gains of over 42% month-to-date, over 96% year-to-date, and a staggering 850% in the past five years, AMD is definitely flexing its processing power. The company’s push into artificial intelligence (AI) and its strategic positioning as an alternative to Nvidia’s dominance in the data center GPU market have captured the attention of investors.

While AMD may not have the same level of software ecosystem as record-breaking Nvidia, the company’s intellectual property, such as its x86 instruction set architecture license and chip design expertise, give it a competitive edge. Moreover, partnerships with tech giants like Amazon, Microsoft, Alphabet, and Oracle, coupled with its upcoming AI-focused products, make AMD a compelling player in the AI megatrend. As the semiconductor inductor continues to garner attention from the market, AMD could be a mighty chip to add to your investment portfolio as the industry leader continues to ride the AI and expand its market share.

Technical

The daily chart shows that the chipmaker behemoth’s share price has been confirmed within an ascending channel trading pattern as the bulls continue to ride the AI wave to a 15-month high. The ascending channel, a bullish technical formation, and the golden cross (green circle) appearance could suggest that the market is currently bullish towards the chipmaker’s share price. Therefore, the bulls could be hoping to continue to push the price to new yearly highs above, with the current pre-market price of $130.47/share, offering a discount of 11.22% from the share’s fair value of $146.96/share, possibly enticing enough for an investor looking for exposure to the AI wave.

However, with the share already surging well above most analysts’ average price targets, a prudent investor may want to wait for a steep pullback before adding to their positions. Timing the market is always challenging, but waiting for a pullback towards the support levels at $116.32/share and $102.61/share could help mitigate downside risks.

Fundamentals

AMD has garnered significant attention in the investment world due to its strong performance and potential growth opportunities in the AI (Artificial Intelligence) sector. As the AI megatrend continues to reshape various industries, AMD stands out as a key player in supplying the essential components that power AI systems. With a robust product portfolio, valuable partnerships, and an attractive valuation, AMD presents an enticing investment opportunity for those looking to capitalize on the AI revolution. While Nvidia has been a dominant force in AI, AMD has been strategically reorganizing its operations and developing innovative products to compete effectively. AMD’s forthcoming MI300 chip, a combination of CPU and GPU cores with fast memory, is poised to be an AI game-changer. Its high-performance design can significantly reduce the time required to train and operate AI models, making it an attractive option for companies looking to leverage AI capabilities, which could lead to strong demand for the chip. This positions AMD to capture a significant market share in the booming AI segment.

AMD has significantly forged valuable partnerships with tech giants such as Amazon, Microsoft, Alphabet, and Oracle, all of whom utilize AMD’s chips in their cloud computing operations. As businesses increasingly shift their processes to the cloud, the demand for AMD’s products is set to grow. Additionally, AMD’s custom processors for leading game consoles, including Microsoft’s Xbox Series X|S and Sony’s PlayStation 5, provide exposure to the thriving global gaming industry. Notably, Microsoft’s collaboration with AMD to develop AI processors strengthens both companies and creates a stronger competitor to Nvidia.

AMD has been on a remarkable upward trajectory, with its share price surging over the past year and even the past five years. However, looking at the picture below shows that AMD has been expectedly outperforming not only its peers in the last five years but its’ share return has also outpaced the Nasdaq 100 Index’s total return of 101.23% (black line) and the S&P 500 Index’s total return of 56.34% (red line) for the same period. This surge has been fuelled by several factors, including the positive impact of NVIDIA’s robust guidance on the AI market and AMD’s own strategic initiatives in the data center CPU and GPU segments. A further look at AMD’s share return trajectory compared to NVIDIA’s share trajectory makes AMD an irresistible proposition for investors looking for exposure to ride NVIDIA’s excellent share performance. The picture shows that AMD’s share performance has positively mirrored the $1 trillion company chip maker, putting AMD in a prime position for the potential for massive upside as NVIDIA continues to soar.

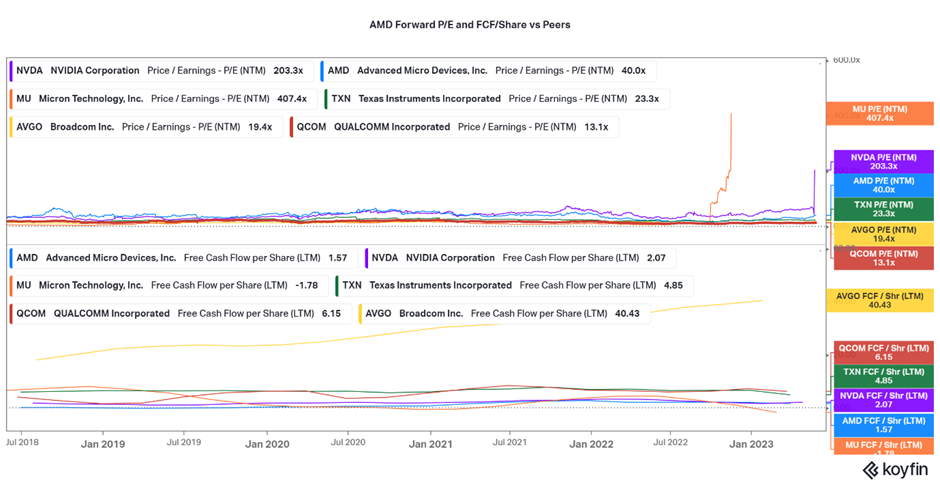

AMD’s stock is attractively priced compared to its peers, with the chip behemoth trading at around 40x its projected earnings for the 2024 fiscal year. The company’s forwards P/E is a tiny fraction of its major competitors, such as Micron Technology, Inc.’s forward P/E of 407.4x (orange line) and NVIDIA Corp.’s forward P/E of 203.3x (purple line). This valuation presents a compelling opportunity, considering AMD’s free cash flow per share (FCF/share) compared to its major peers for the previous fiscal year. The picture below shows that AMD offers potentially a more attractive and cost-effective investment option for investors looking for exposure in the semiconductor industry. As AMD continues to gain momentum in the AI sector and expands its market share, there is significant potential for further upside.

Summary

AMD appears well-positioned to benefit from the AI megatrend with its accelerated computing opportunities and valuable partnerships. The company’s focus on innovation, coupled with its competitive pricing compared to peers, makes it an intriguing investment option.

However, given the recent surge in the stock price and the potential for market volatility, investors should exercise caution, and market timing could be of utmost importance in the pursuit of maximizing value from the exposure. Nevertheless, lower $116.32/share and $102.61/share support levels could provide optimal levels for a potential long opportunity.

Sources: TradingView, KoyFin, Seeking Alpha, Financial Times, Advanced Micro Devices Inc.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.