The higher interest rates that raised concerns in the US and European banking industries following the failure of the US Silicon Valley Bank and Switzerland’s Credit Suisse seem to have helped the more established banks higher with Citigroup Inc. (NYSE: C), also known as Citi, recently reporting outstanding first-quarter earnings and revenue figures.

The depositors’ flight to safety from the small- to medium-sized banks seem to have helped the big players enhance their margins while improving their loan portfolios with the high loan demand. The recent positive results helped the bank’s share price rally 4.78% post-announcement, and it is currently trading at 9.57% higher for the year.

Technical

The daily chart shows an appearance of a golden cross as the short-term moving average, the 50-EMA moved above the longer-term moving average, and the 200-EMA could indicate the presence of bullish sentiment towards the share. The bulls could hope the bullish sentiment prevalent could push the price action towards the resistance level at $52.21/share, a level of significance for the bulls. A sustained break above the initial resistance level would bring the $54.38/share resistance level into play.

However, should the bears take control, the 50-EMA and the 200-EMA could act as immediate support to the price action. A fall below the EMAs would bring the $43.79/share support level into play.

The share price is currently trading at a 13.05% discount from the share’s fair value of $55.71/share using the discounted cash flow model, which leaves considerable room for potential upside.

Fundamental

Citigroup reported their 12th consecutive earnings and revenue beat on Friday. The bank’s quarterly revenue of $21.447 billion, which beat the analysts’ $20.015 billion estimate, helped the bank earn quarterly earnings per share (EPS) of $2.19 per share (/share), which was 32.87% higher than the analysts’ forecast of $1.648/share. The bank also reported a net income increase of 7% year-on-year to $4.6 billion. The outstanding quarterly performance was primarily driven by improvement in the bank’s US Personal Banking, Services and Fixed Income segment, which offset the slump in the Equity Markets, Investment Banking and Wealth Management segments of the business.

The increased demand for the bank’s services helped Citi deliver an outstanding return on tangible capital RoTCE of nearly 11% on $21.4 billion of revenues and 12% year-on-year revenue growth as the bank’s CEO Jane Fraser’s strategy of prioritizing high-returning capital-light businesses continue to refine the bank’s performance. The bank’s recent performance has been primarily driven by Fraser’s decision to divest the group’s non-core global operations that were lacking the scale needed to constantly generate solid results and focus the freed-up capital on higher returns and margin operations such as Treasury and Trade Solutions and Wealth Management.

Fraser has also emphasized the need to modernize its technological infrastructure while transforming the business by fixing the bank’s operations and compliance. The company’s cost of credit was relatively high at around $2 billion, which was primarily driven by the normalization of credit losses and other provisions, which amounted to around $700 million. Thus the fact that the business was able to outperform expectations even in the face of building credit losses could speak volumes to the strength of the bank’s business model, which includes countercyclical businesses that can provide stability when other businesses struggle.

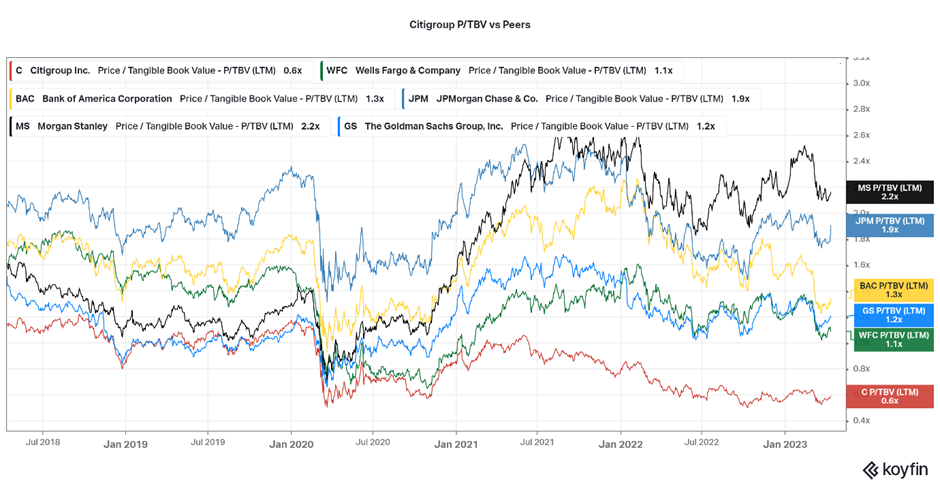

The chart below does show that Citigroup currently has the lowest price to tangible book value (P/TBV) compared to its major competitors. The P/TBV ratio can be used to measure the company’s market value relative to its tangible assets, with investors considering a company with a ratio of less than 1.0x a good investment. Thus, Citigroup’s 0.6x P/TBV for the period from May 2018, the lowest compared to its peers, could suggest that the bank is currently undervalued compared to its peers.

Summary

The fundamentals suggest that Citigroup is a share that has constantly outperformed expectations year-on-year but whose share continues to be undervalued compared to its peers. Therefore, a long opportunity could exist at the $52.21/share price level as the share attracts buyers, and a buy-the-dip opportunity could exist at $43.79/share if the bears continue to push the price lower.

Sources: TradingView, KoyFin, Zacks, Seeking Alpha.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.