The world’s leading online travel company that provides a variety of services, such as hotel and accommodation bookings, car rentals, and airline tickets, Booking Holdings Inc. (NASDAQ: BKNG), waited until after the bell to announce a Wall Street-beating first quarter of the 2023 fiscal year (2023Q1) earnings report.

The company reported quarterly earnings and revenue beat; however, the quarterly EBITDA of $586 million fell short of the street’s consensus of $626.9 million, sending the share more than 1% lower. The EBITDA miss in a quarter where the company reached an all-time high in both room nights and gross bookings sent investors checking out of the company’s share as the market worried about the company’s performance for the rest of the fiscal year in the very cyclical industry.

Technical

The daily chart shows that the share price of the global leader in the leisure industry has been threading higher since the rejection of the support level at $1619.95/share in early October last year. Booking Holdings Inc.’s share has grown an impressive 30.97% in 2023 as the company continue to soar as the industry continues to rebound from the COVID pandemic and the volatile macroeconomic conditions that had severely impacted the industry.

The appearance of the golden cross and the ascending channel could suggest that the market is bullish towards Booking Holdings Inc.’s share, and should the current market sentiment persist, the bulls could look to retest the all-time high at $2731.75/share. However, should the bears push the price lower, the 23.60% Fibonacci retracement level could be a significant barrier to a move below. The $2395.46/share and $2231.20/share support levels could offer opportunities for a long should the price action sustain a break below the 23.60% Fibonacci retracement level.

The pre-market share price of $2627.00/share is currently at a 9.10% discount from the share’s fair value came to $2889.92/share when using the discounted cash flow model. The 9.10% discount offers a substantial potential for the upside at the current share price.

Fundamentals

The company has a solid track record of revenue and earnings growth and continued the trend on Thursday, 4th of May 2023, after reporting earnings per share (EPS) of $11.60/share on revenue of $3.788 billion, slightly beating the street’s expectation of an EPS of $10.547/share on revenue of $3.743 billion for a quarter that has seasonably delivered smaller revenue than other quarters. The revenue was approximately in line with expectations, while adjusted EBITDA was slightly below expectations due to additional marketing expenses. The initial reaction to the EBITDA miss was to send the share price of the global leisure company lower. However, the share has firmly rebounded as investors scrutinized the performance compared to prior quarters, which showed that EBITDA grew an impressive 89% year-on-year, revenue grew 40%, and the net income of $266 million was a significant improvement from the loss of $700 million achieved in the prior year.

The company’s excellent quarterly performance was primarily driven by the strong booking figures, which could be suggestive of the strengthening of the travel and leisure industry rebound post-COVID. The company’s room night and gross bookings achieved a year-on-year growth rate of 38% and 44%, reaching all-time quarterly highs of $274 million and $39.4 billion, respectively. The growth rates were even stronger at 52% on a constant currency basis. The growth in room nights and gross bookings outperformed previous expectations, driven by continued strength in leisure travel bookings and an expanded booking window, with Asia’s booking demand up by 100% year-on-year and Europe and the rest of the world both up more than 30%. The international mix of total room nights was about 53%, the highest quarterly mix since 2019.

Booking Holdings Inc.’s robust bookings were primarily driven by the merchant business’s 81% and the agency business’s 19.7% year-on-year rise, with the agency business achieving double-digit gains across all the business’s verticals. The company also saw an increase in mobile apps, and a higher mix of direct channel bookings, while airline ticket booking grew about 73% year-over-year. The company’s marketing expenses increased by 32%. Although the take rate was lower than expected due to the timing effect, underlying accommodation take rates continued to be in line with 2019 levels. The company has not seen changes in the mix of hotel star ratings being booked or changes in the length of stay, indicating that consumers are trading down. The cancellation rates in 223Q1 were below 2022Q1 and 2019Q1, and the company expects high cancellable bookings for travel in the summer period.

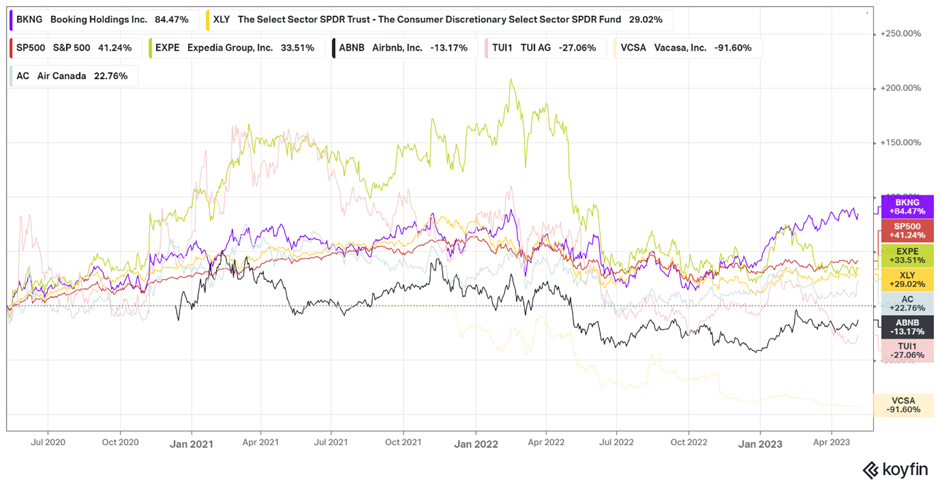

The chart below shows that the global leisure company’s share has provided better returns for its shareholders than its immediate peers and as well as the market proxied by the S&P500 Index (red line) over the recent three-year period. The online travel and related solutions company share’s total return of 84.47% was superior to Exepdia’s 33.51% (green line), Air Canada’s 22.76%(light blue line), Airbnb’s -13.17%(black line), TUI AG’s -27.06%(pink line) and Vacasa’s -91.60%(cream white line).

The leading online travel company’s excellent share performance in the last three years has not only outperformed its peers but has also outperformed the Consumer Discretionary Select Sector SPDR Fund’s (yellow line) total return of 29.02% and the S&P 500 Index’s (red line) total return of 41.24%. The main objective of the Consumer Discretionary Select Sector SPDR Fund is to achieve investment outcomes that, excluding expenses, closely match the price and yield performance of the Consumer Discretionary Select Sector Index (referred to as the “Index”).

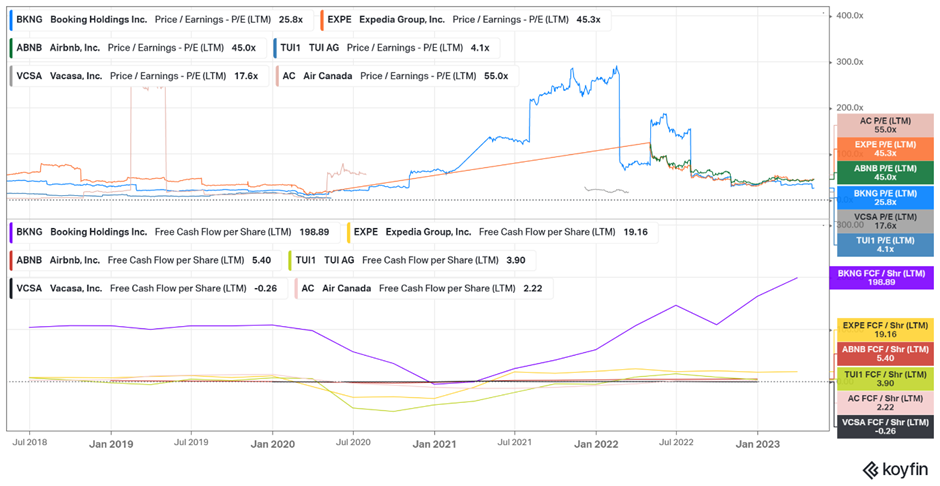

Booking Holdings’ P/E ratio of 25.8x, which is lower than the P/E ratio of most of its peers, indicates that investors may be valuing the company more conservatively than its competitors. Also, Booking Holdings’ FCF per Share of $198.89 is astronomically higher than the FCF per share of most of its peers, suggesting that Booking Holdings Inc. generates significantly more free cash flow per share than its peers in the online travel industry. The picture and the figures show that when comparing Booking Holdings Inc. to its peers, the company appears to be more conservatively valued on a P/E basis. Additionally, the company’s excellent FCF per share could indicate that the company may be generating more cash flow from its operations than its competitors in the online travel industry, which the company could use to fund its continued growth.

Summary

Booking Holdings is a well-established player in the online travel industry with a solid track record of revenue and earnings growth. However, investors should be aware of the risks associated with the travel industry, as well as the competitive nature of the market. The market is encouraged by the strength of the industry demand as economies shift towards the pre-pandemic levels, and Booking Holdings is well-positioned to benefit from the growth in the travel industry over the long term, making it a potentially attractive investment for those seeking exposure to this sector.

Sources: Booking Holding, Reuters, Motley Fool, Seeking Alpha, Koyfin, Trading View.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.