PepsiCo (NASDAQ, PEP) is a powerhouse in the global food and beverage industry. With over a century of rich history, the company has established itself as a formidable player worldwide. At the heart of PepsiCo’s success lies its diverse portfolio of iconic brands, which enjoy strong brand loyalty, making the company a trusted choice for consumers across different demographics.

However, slowing inflation and a cancer-causing declaration by the WHO may have cast the company into the shadows, leaving investors on the edge of their seats in anticipation of the company’s financial earnings report expected tomorrow, which will establish if the company can cope with a volume-based revenue rather than on high prices and to establish whether the negative limelight has reduced consumption of the company’s products. Will earnings snap, crackle and pop, or will they leave investors with a bitter taste in their mouths?

Technical

The share price of PepsiCo edged lower, establishing major support at $179.38. However, the bulls were encouraged to drive the share price up, establishing major resistance at $196.58.

As the MACD indicator intersects below the signal line, the bears may be encouraged to pull back the price level towards the $179.38 major support if the $183.44 support at the 23.60% Fibonacci Retracement fails to hold. However, the bears have been unable to break through the $183.44 support twice, which may encourage the bulls to retest the $187.98 resistance at the 50% level, thereby marking a pivot point for an upward trend.

Fundamentals

PepsiCo is scheduled to announce its second fiscal quarter earnings tomorrow, and investors are eagerly awaiting the results. The company revised its quarter two revenue guidance upward following its first quarter results, raising expectations for revenue and EPS growth to 8% and 9%, respectively, up from previous guidance of 6% and 8%. These increased expectations are notable considering PepsiCo’s history of exceeding projections and considering Coca-Cola, the company’s largest competitor, left its guidance unchanged.

The food and drinks giant may succumb to demand pressure due to the WHO’s declaration of aspartame, a key ingredient in some of PepsiCo’s products, being possibly carcinogenic (cancer-causing), which may force PepsiCo to alter its products in the long run. However, the renewal of the sponsorship agreement between PepsiCo and UEFA Champions might negate the dip in demand experienced by the allegations.

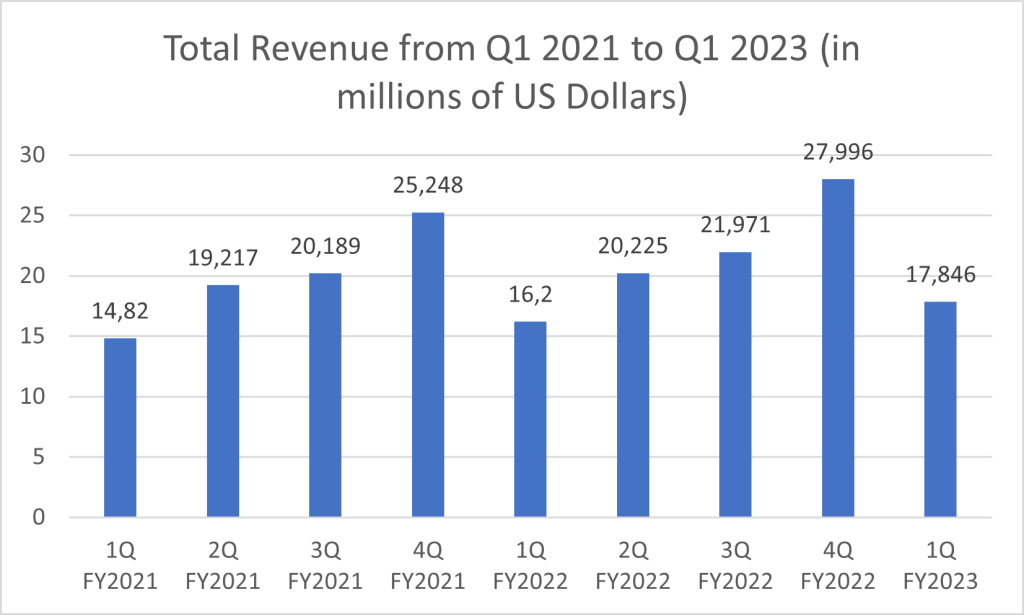

From the graph below, PepsiCo’s formidable revenue growth was driven primarily by pricing, as the company was operating in a high-cost environment driven by high inflation and high-interest rates. While many industries are forced to cut prices in an effort to boost demand in a slowing economy, the food and drinks industry remains a necessity in times of crisis. However, inflation seems to be slowing in the US, which may lead to a return to normal pricing levels, thereby shifting the focus to volume growth rather than pricing and possibly putting a damper on the company’s earnings for the rest of the financial year.

Furthermore, the performance of Frito-Lay North America (FLNA) is crucial, as the division has shown promising growth and market share gains in recent quarters; hence it may be important to note if this division has sustained abnormal growth despite the flat volume.

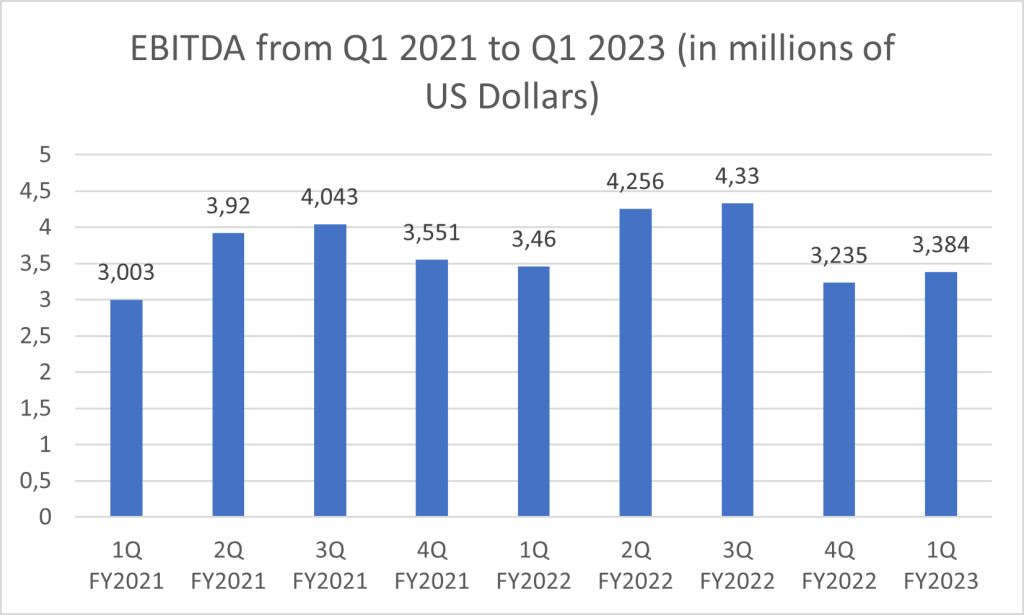

The graph above shows that the company’s revenue increased yearly, making the EBITDA exhibited in the chart below slightly worrisome. The company’s revenue trend should closely mimic the direction of the bottom line, but the company’s EBITDA reflects a decrease from the previous quarter to the current quarter, meaning that the company’s costs have increased quarter to quarter despite the increase in its prices, posing a possible problem in the future.

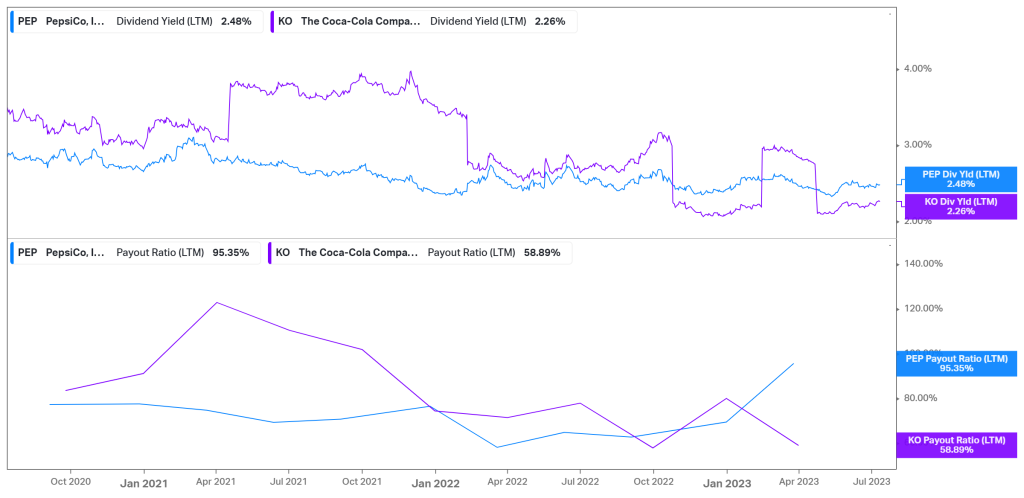

The company’s dividend yield is important to investors as the company has a dividend payout ratio of 95.35%, contrasting Coca-Cola’s 58.89% payout ratio. PEP also boasts a relatively constant dividend yield compared to KO, which sees a boost in its dividend yield followed by a sharp decline.

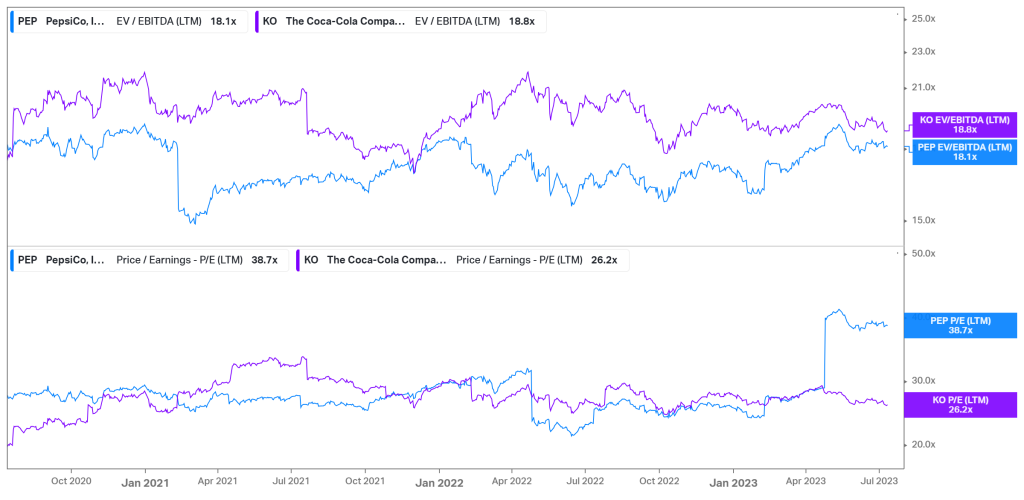

The below graph portrays that PepsiCo’s shares might be trading at a premium compared to its main competitor, Coca-Cola (KO). The stock has a P/E ratio of 38.7x, while KO trades with a P/E ratio of 26.2x. This premium might be justified considering PepsiCo’s impressive track record of dividends and strong growth rates. Over the past five years, the company has returned nearly 100% to investors in the form of dividends, outperforming both KO and the broader market. However, the EV/EBITDA ratio paints a different picture as PEP boasts a ratio of 18,1x compared to KO’s ratio of 18.8x, which seems slightly more reliable, as companies within the same industry should bear similar P/E ratios. From the fair value model, the share is trading at an 8.32% discount to the current share price of $183.94 per share.

Compared with the NASDAQ and the S&P, PEP experienced a total return of 48.69%, indicating that the company outperformed the global market by 19% and 25%, respectively.

Summary

Investors are waiting in anticipation for PepsiCo’s earnings release to establish whether the company can keep up with its formidable revenue growth in the next quarter despite slowing CPIs in the US and a possible drop in demand due to WHO’s declaration on aspartame. Formidable earnings may encourage the bulls to retest the $196.58 major resistance; however, macroeconomic pressures may see a pullback towards the $179.38 major support.

Sources: PepsiCo, TradingView, Koyfin, Comparably

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaims liability towards any user and other recipients of this report.