Shell plc (LSE: SHEL) is one of the world’s leading integrated energy companies and has long been a significant player in the global energy landscape. With a history spanning over a century, the recent Wall Street beating quarterly performance outlined the company’s ability to adapt to changing market dynamics and embrace new opportunities.

Shell reported a stronger-than-expected first quarter (2023Q1) adjusted earnings of $9.6 billion and adjusted EBITDA of $21.4 billion, exceeding the previous quarters in the face of volatile macroeconomic conditions. The British oil giant followed up the excellent financial performance with an announcement of a $4 billion share buyback to reduce the issued share capital and the company’s outstanding shares by 250 million.

Technical

The daily chart shows the oil and gas behemoth’s share is currently trading in a wide ascending channel as the bulls continue to push the price higher. The bullish signals sent by the moving averages could boost the bulls’ attempt to continue taking ground away from the bears in the near term. Having broken through the 200-day moving average (200-EMA), the bulls could look to break above the 50-EMA in their attempt to push the price towards the £24.765/share resistance level, a level of interest for the bulls. Should the bulls sustain a break above £24.765/share, a long opportunity could exist as the price push towards the £26.115/share resistance level, a fraction of the share’s fair value of £28.275/share.

However, should the bears gain control of the price action, the 200-day EMA would act as immediate support. A break below would bring the £21.955/share support level into play.

Shell’s fair value is currently at £28.775/share when using the discounted cash flow model. The current market price of £23.895/share is at a discount of 20.42% from the share’s fair value, leaving attractively substantial room for the upside.

Fundamental

Despite the challenges posed by the unstable macroeconomic conditions and the volatility in oil prices, Shell has demonstrated resilience and adaptability. The company has implemented cost-cutting measures and optimized its portfolio, resulting in improved financial performance. Shell’s focus on cash generation, disciplined capital allocation, and debt reduction has enhanced its financial flexibility and ability to invest in future growth areas.

Shell’s financial performance has been impacted by various factors, including fluctuations in oil and gas prices, refining margins, and the COVID-19 pandemic. However, the company has taken steps to enhance its financial resilience. The company’s 2023Q1 adjusted earnings per share (EPS) grew 15.83% year-on-year to $1.39/share from $1.20/share in 2022Q1. Quarterly revenue also grew 3.28% year-on-year to $86.96 billion from the $84.2 billion achieved in 2022Q1. The management attributed the excellent performance to the company’s well-positioned resilient portfolio and improved operational delivery despite a relatively volatile environment. Chief Financial Officer, Sinead Gorman, reiterated that Shell will continue to focus on performance and strengthening of their portfolio to deliver value to their shareholders.

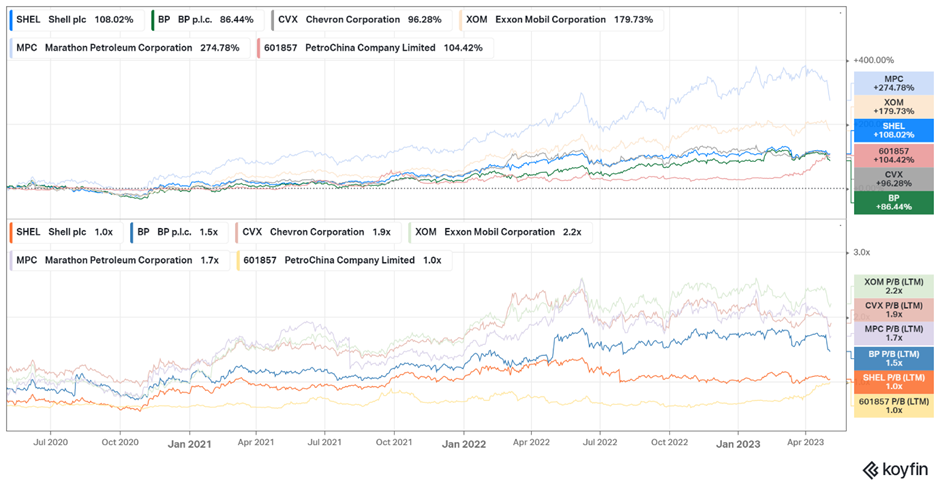

The first picture below compares the company’s share total return for the past three years. Shell’s share has returned a respectable 108.02% but lagged Exxon Mobil and Marathon Petroleum’s total return of 179.73% and 274.78%, respectively. However, the second picture shows the company’s price-to-book value of 1.0x, suggesting that the company’s share is relatively valued and cheaper compared to its peers. Thus, combining the factors could indicate that the share could be enticing for investors looking for exposure to the energy sector.

While Shell has made progress in diversifying its energy portfolio, transitioning towards cleaner energy sources poses challenges. The company’s dependence on oil and gas revenues remains significant, and the shift towards renewables may take time to yield substantial financial returns. Additionally, fluctuations in oil prices, geopolitical risks, and regulatory uncertainties can impact Shell’s profitability and project economics.

Shell is well-positioned to leverage several growth opportunities. The increasing global demand for liquefied natural gas presents a significant avenue for growth, especially in emerging markets. Furthermore, as electric vehicles gain popularity, Shell’s expanding electric vehicle charging infrastructure and investments in battery technology position it to benefit from the ongoing transportation sector transformation. The company’s strong presence in emerging economies, particularly in Asia, also offers growth potential.

Summary

Shell has demonstrated remarkable resilience in the face of various challenges. Despite market volatility, energy industry shifts, and risks associated with oil and gas dependency and regulatory uncertainties, Shell’s strategic initiatives and investments in renewables and emerging markets position it well for long-term success. Therefore, a long opportunity could exist as the price action moves above £24.765/share towards £26.115/share. However, a buy-the-dip opportunity could exist at £21.955/share if the bears push the share lower.

Sources: TradingView, KoyFin, Reuters, Seeking Alpha, Shell.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.