The Gold Spot Price (XAUUSD) followed through with declines from last week as it opened the new week on the back foot. The spot price shed 25 basis points in the early hours of the Monday trading session after two straight weeks of declines.

Last week, the U.S. Nonfarm payrolls surprised to the downside of expectations, coming in at 187K, although still very resilient as it grew month-on-month. The market resultantly shunned the Greenback, which fell to a one-week low against a basket of major currencies, while the yellow metal found its shine after a daily gain following three consecutive days of losses. This week, all eyes will be on the U.S. inflation reading as the market determines whether more rate hikes are oncoming.

Technical

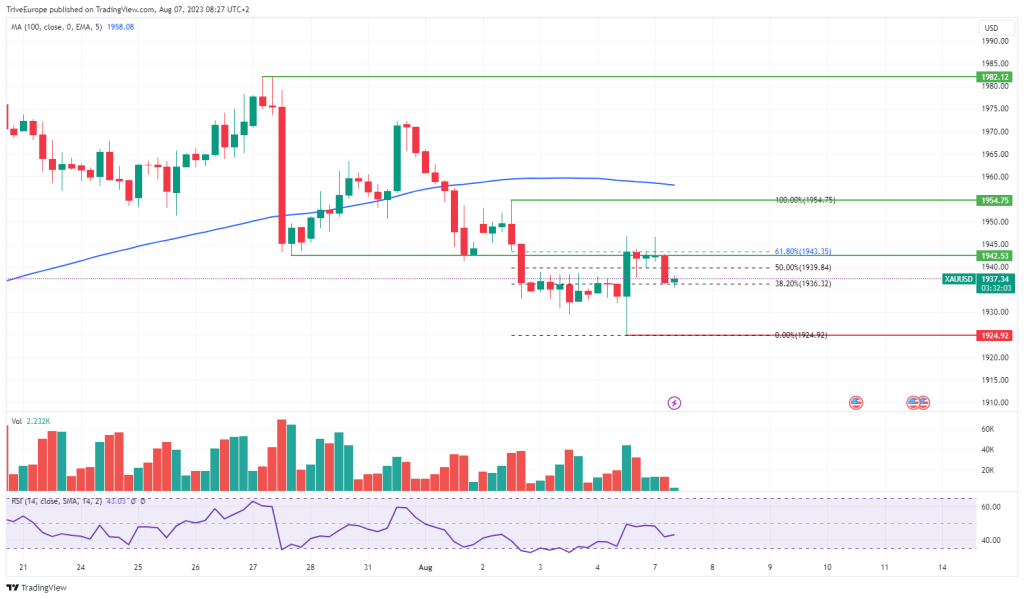

The Gold Spot price let go of some of its gains recorded on Friday last week as it opened lower to recommence the downtrend, represented by the spot price trading below its 100-day moving average. The rejection of the 1924.92 per ounce level formed a support level, while the sharp decline in the spot price from the 1954.75 per ounce level established resistance.

Last week Friday’s sharp gain on the weaker NFP reading sent the spot price as far as its Golden Ratio at 1943.35 per ounce before being met with excess supply over demand, which lowered the price. Given that downside momentum is currently unfolding, the 1924.92 per ounce level will likely serve as a point of interest to the downside. In contrast, if downside momentum falters, the 1943.35 per ounce level will potentially be a level of significance to the upside.

Summary

The key driver of sentiment for the week will probably be the U.S. Inflation reading which could give insight into whether the Federal Reserve will be encouraged to hike rates once again. Given that inflation is expected to grow slightly to 3.3% from 3% last month, the Gold Spot Price could falter on bets of a higher yielding Greenback, leaving the 1924.92 per ounce level probable.

Sources: Reuters, TradingView

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaims liability towards any user and other recipients of this report.