The Down Jones Futures (CBOT: YM) closed a second consecutive trading session on the green on Thursday as investors shifted their focus towards the Federal Reserve’s favoured inflation report, the PCE Price Index. The futures are currently up 1.92% for the week, aided mainly by the lowered concerns of the US banking industry stress as investors look to the inflation report to push the equities markets higher.

Even though the equity markets have enjoyed a stellar week, the risk parity is still on shaky ground, and investors are still treading cautiously. With the inflation rate well above the 2% target, equity investors could find solace in the recent initial jobless claims, which came in at 198K compared to the forecasted 196K, which could lower the pressure on the Fed to hike the rate as investors look forward to the PCE data later today.

Technical

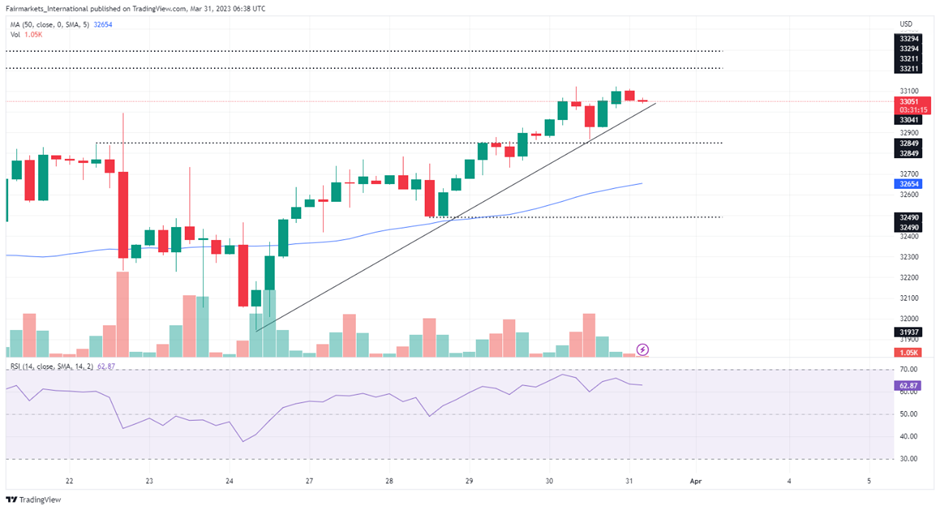

Looking at the 4H chart, the appearance of the upward trendline shows that index futures are currently trending up well above the 50-day moving average. If index futures respect the trendline, then a short-term trading opportunity could exist as the price action moves above the resistance level at the 27th of February 2023 high of 33211, a level of significance for the bulls. A breakthrough above the initial resistance level could bring the next level of interest at the 23rd of February 2023 high of 33294 into play.

A sustained breakthrough below the trendline could bring the support level of 32849, a level of significance for the bears, into play. A breakthrough below the 32849 price level could bring the 50-day moving average into play. A breakthrough below the 50-day moving average could confirm the presence of bearish sentiment, and the bears could push the price towards the support level at 32490.

Summary

With the investors firmly focusing on the inflation report later today, the direction of index futures would be primarily driven by investor reaction to the report. Nevertheless, with the recent jobless claims showing a higher-than-expected increase, the bulls could be confident of finding value at 33211 during the trading session.

Sources: TradingView, CNBC, Reuters.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.