China’s ban on iPhone

Tensions have risen between the world’s top two economies. The United States, during Biden’s administration, imposed chip technology sanctions on China due to trust concerns, and Huawei sales were banned in the US under Trump. On Wednesday Beijing ordered a ban on iPhone usage in government facilities, just a week before the iPhone 15 announcement, which appears deliberate, intensifying the tech war between the two giants.

What led to this?

Apple announced last year its intention to make the iPhone 14 in India due to concerns about China-US tensions. This shift may have indicated China’s dissatisfaction. Apple planned to move 25% of iPhone production to India by 2025, while Google left China 13 years ago because of censorship, and Samsung relocated production from China to Vietnam.

How are Apple and Its stock affected:

Apple shares $AAPL fell 6.8% to $177.56, after two days of losses, and slightly increased again to close the week on Friday at $178.18. Shares have lost around 10% from the record price of $196.45 earlier In July to shave around $200 billion from its market value to around $2.8 trillion.

This followed Beijing’s order for central government agency officials to not bring iPhones into the office or use them for work, preceding the anticipated stock boost from the upcoming iPhone 15 launch Tomorrow (Tuesday 12.09.2023). China plans to extend the ban to government-backed agencies and companies, potentially affecting around 500,000 iPhone sales, with the possibility of impacting millions more people. The extent and timeline of Chinese authorities’ enforcement remain unclear.

Evercore ISI analysts point out that China makes up 19% of Apple’s revenue and supported over five million jobs in China in 2019. This makes it challenging for the Chinese Communist Party to take significant action against Apple without affecting Chinese employment.

In recent years, China has begun to enact new laws and rules for companies as data security concerns increase. Last year, the USA decided to ban the import and sale of new communication equipment of 5 China-based technology companies, including Huawei, in the country due to security concerns.

What should investors be looking for?

The stock’s future depends on technical analysis and fundamentals. Bank of America warns of a potential 5–10-million-unit impact on iPhone shipments due to China’s ban, while Morgan Stanley believes it will affect Apple’s revenue by at most 4%, While Morgan Stanley: Apple’s 2-day stock sell-off on China expanding iPhone curbs is overdone.

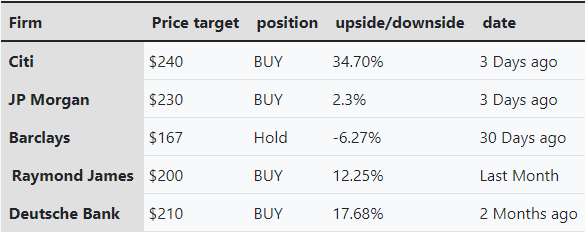

Citigroup’s analyst Atif Malik initiated coverage with a buy rating and a $240 target price, on August 4th, expecting a 30% increase after Apple’s $3 trillion market value milestone.

JP Morgan’s Samik Chatterjee lowered their price target on APPLE by 2.1% from $235 to $230 on Friday while their analysts maintained their strong buy rating on the stock.

Nasdaq Analyst Research has offered rating consensus and a summary of stock price targets for Apple (AAPL) over the last 3 months. The average price target stands at $206.86, with a high estimate of $240 and a low estimate of $167.

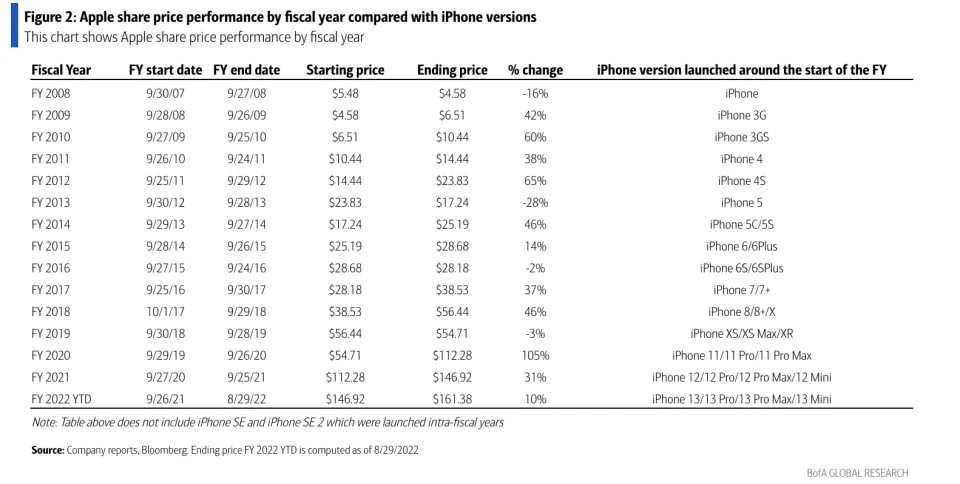

New iPhone releases have historically driven stock growth, including a triple-digit surge in fiscal year 2020.

Below we can check $APPL’s Price performance by fiscal year.

The market will closely monitor both potential escalations by China and most importantly the impending unveil of the iPhone 15, and Apple watch series 9, Tomorrow on Tuesday 12.09.2023 gauge the magnitude of China’s influence on Apple.

Sources used:

Barrons, Nasdaq, MarketWatch, Benzinga.

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.