Technical Analysis: Trading Range and Accumulation Zone

Looking at the 4-hour chart for CHF/JPY, it’s evident that the currency pair has been trading within a significant range, bounded by 166.466 and 164.622 since August 11. This sideways movement suggests a period of accumulation. Presently, CHF/JPY finds itself at the lower end of this accumulation zone, signaling a potential rebound from this level.

Fundamental Analysis: SNB Rate Hike Anticipation vs. BoJ Policy Stance

The Swiss National Bank (SNB) has witnessed a decline in its FX reserves, which have fallen below CHF 700 billion, partly due to valuation effects. Additionally, the SNB’s strategy of selling foreign currency has been supporting the Swiss Franc over the medium term, acting as a check on inflation. The market is currently pricing in a 40% probability of an SNB rate hike. However, this estimate may be on the high side, and any dips in the CHF could offer opportunities for repositioning.

In contrast, the Japanese Yen experienced a temporary uptick last week due to verbal intervention by the Ministry of Finance (MoF). However, the Bank of Japan (BoJ) has decided to maintain its easy monetary policy until the end of 2023 and will only consider FX intervention if USD/JPY approaches 150. Morgan Stanley suggests that meaningful intervention by the BoJ may occur when USD/JPY approaches 155, as Japan’s limited foreign exchange reserves and the high costs of previous interventions (approximately $62 billion in 2022) act as deterrents until the exchange rate nears 155.

Insights Behind the Scenes: Unveiling Crucial Data for Traders:

Becoming a proficient trader requires more than just relying on technical and fundamental data; insight into real market dynamics is vital.

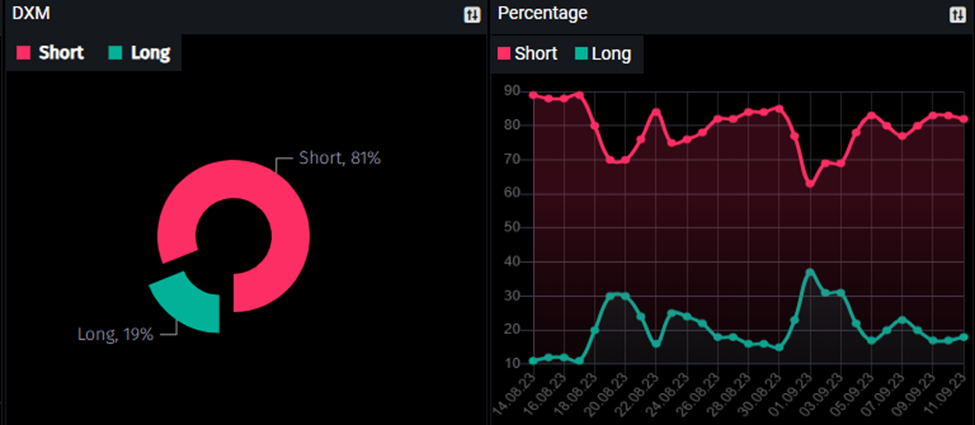

DXM: Decoding Retail Traders’ Sentiment

The DXM, or “Dump Money Index,” is a valuable tool for gauging retail traders’ sentiment. It quantifies the percentage of retail traders holding long or short positions in each market. Currently, a substantial 81% of retail traders hold short positions, indicating a contrarian signal that may offer potential advantages for those considering reverse trades.

It’s noteworthy that statistics show that 95% of retail traders sustain losses over extended periods, underscoring the value of contrarian strategies.

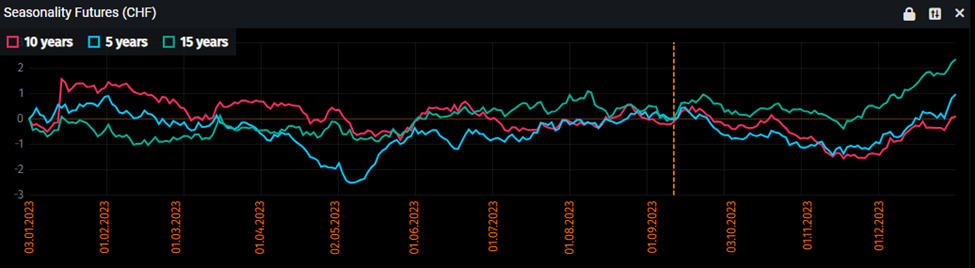

Seasonality in CHF and JPY Futures: Summer Trends

Seasonality analysis predicts future price movements based on historical data. For CHF, seasonal analysis suggests the pair is likely to maintain a bull market until end of September 2023.

For JPY, seasonal analysis suggests the pair is likely to maintain a bear market until end of the 2023.

However, please note that seasonality doesn’t consider new developments or economic changes; it’s a pattern that can evolve and isn’t infallible.

COT Data: Hedge Funds & Leverage Funds Favor Pound Over Aussie

The Commitment of Traders (COT) report, issued weekly by the Commodity Futures Trading Commission (CFTC), provides insights into positions held by large traders, such as hedge funds and investment banks.

Currently, hedge funds hold approximately 10.4k long positions in CHF, while JPY has around 78k short positions. This data suggests that hedge funds are favour on CHF than JPY, as they have huge amounts of short positions on JPY.

Summary: All Signs Point to a Long CHF/JPY Position

- Technical Analysis: CHF/JPY is in an accumulation phase.

- Fundamental Analysis: Strong economic outlook for Switzerland and weak outlook from BoJ

- DXM: Most retail traders hold short positions on the CHF/JPY.

- Seasonality Analysis: Seasonal patterns suggest continued CHF bullishness and JPY bearishness until end of September 2023 and end of the 2023 respectively.

- COT Data: COT data indicates that big players favor the Swiss Franc over the Yen.

Trade Recommendation: Long CHF/JPY Position

Entry: current market price, or any price as long as it is within the accumulation zone

Take-Profit: 169.250

Stop-Loss: 162.329

Risk-to-Rewards: 1:2

Important noted:

- If the price breaks above the top of the accumulation zone, consider another buy limit.

- In this case, it is recommended to divide your 1% risk into 2 positions, roughly 0.50 lot for each position. Alternatively, you can risk 1% with only one position.

Author: Jacky.T

Sources: PMT

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.