Technical Analysis: 145.00 Support Holds Firm

In the previous Asian session, USD/JPY saw a significant decline of 0.9%, equivalent to over 130 pips, settling at around 146.40 levels. This drop was triggered by a noticeable downward gap in the pair after BOJ Governor Ueda’s remarks regarding a potential “stealth exit” from the current ultra-easy monetary policy over the weekend. However, it’s important to note that as long as the 145.00 support level remains intact, there is still potential for further upside in USD/JPY.

Fundamental Analysis: Focus on Broader Context

The Japanese Yen continues to strengthen as BoJ Governor Ueda discussed the possibility of gradually moving away from the current highly accommodative monetary policy measures. He mentioned that the BoJ may assess wage growth by the end of 2023, which could lead to a reduction in monetary stimulus and the end of negative interest rates. However, maintaining a level of skepticism is crucial. Goldman Sachs shares a similar view, suggesting that the B0J has room to allow 10-year JGB yields to rise gradually. Allowing this yield to increase is seen as an effective alternative to currency intervention to counter yen weakness. In summary, the broader context of a bearish JPY and the 150 level in USD/JPY remain valid unless there are changes in the new adjustment of the 10-year JGB.

Insights Behind the Scenes: Unveiling Crucial Data for Traders:

Becoming a proficient trader requires more than just relying on technical and fundamental data; insight into real market dynamics is vital.

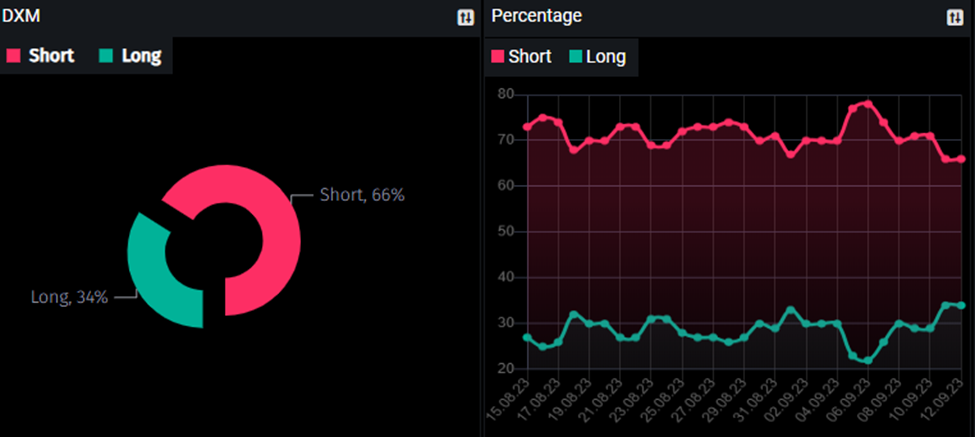

DXM: Decoding Retail Traders’ Sentiment

The DXM, or “Dump Money Index,” is a valuable tool for gauging retail traders’ sentiment. It quantifies the percentage of retail traders holding long or short positions in each market. Currently, a substantial 66% of retail traders hold short positions, indicating a contrarian signal that may offer potential advantages for those considering reverse trades. It’s noteworthy that statistics show that 95% of retail traders sustain losses over extended periods, underscoring the value of contrarian strategies.

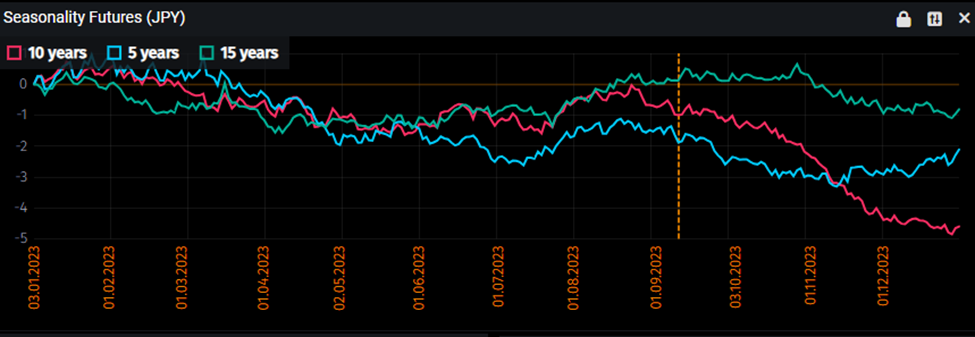

Seasonality in USD and JPY Futures: Summer Trends

Seasonality analysis predicts future price movements based on historical data. For USD, seasonal analysis suggests that the pair is likely to maintain a bull market until the end of December.

For JPY, seasonal analysis suggests the pair is likely to maintain a bear market until the end of 2023.

However, please note that seasonality doesn’t consider new developments or economic changes; it’s a pattern that can evolve and isn’t infallible.

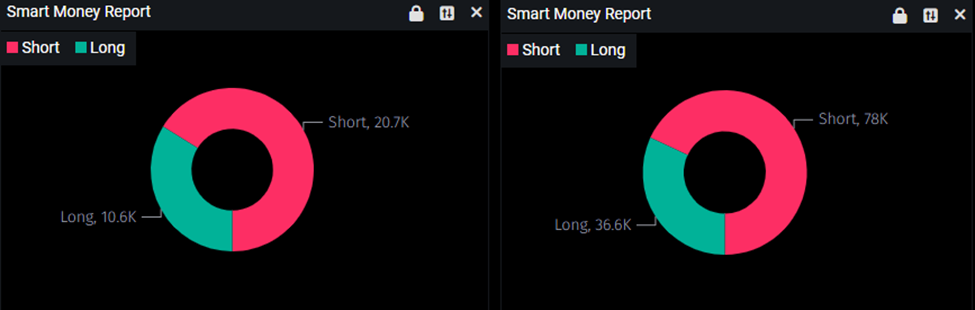

COT Data: Hedge Funds & Leverage Funds Positioning

The Commitment of Traders (COT) report, issued weekly by the Commodity Futures Trading Commission (CFTC), provides insights into positions held by large traders, such as hedge funds and investment banks.

Currently, hedge funds hold approximately 20.7k short positions in USD, while JPY has around 78k short positions. This data suggests that hedge funds are selling on both USD and JPY. But keep in mind that, it’s crucial to consider the broader context to determine which currency is stronger based on current fundamentals.

Summary: All Signs Point to a Long USD/JPY Position

- Technical Analysis: USD/JPY is still above the 145.00 level.

- Fundamental Analysis: A strong US economic outlook and the BOJ’s current ultra-easy monetary policy continue to weaken the Yen.

- DXM: Most retail traders hold short positions on the USD/JPY.

- Seasonality Analysis: Seasonal patterns suggest continued USD bullishness and JPY bearishness until end of the 2023 respectively.

- COT Data: COT data indicates that big players favor the USD over the Yen.

Trade Recommendation: Long USD/JPY Position

Entry: current market price, or any prices as long as it is within the accumulation zone

Take-Profit: 150.00

Stop-Loss: 144.826

Risk-to-Rewards: 1:2

Important noted:

- If the price drops back to the 145 level, it is recommended to take another long position at that level.

- In this case, it is recommended to divide your 1% risk into 2 positions, approximately 0.50 lot for each position. Alternatively, you can risk 1% with only one position.

Author: Jacky.T

Sources: PMT

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.