From a daily perspective, EURUSD has broken below the significant level of 1.1000. This suggests the potential for a continuation of the downward movement, especially considering that the European Central Bank (ECB) is expected to adopt a more passive approach in September. The euro has lost a substantial portion of its bullish conviction, particularly when compared to the faltering economy that pales in comparison to that of the United States.

From a technical standpoint, we observe the prices continuing to push down towards 1.0800. Additionally, according to a research paper from ANZ and Bank of America, they also hold a bearish view on EURUSD. Their forecast for EURUSD in three months’ time is around 1.0500.

DXM: A Powerful Tool for Retail Trader Analysis

The DXM, or “Dump Money Index,” is a valuable tool for traders who want to understand the sentiment of retail participants. The DXM measures the percentage of retail traders who are holding long positions in a particular market.

The chart below shows the DXM for the EURUSD pair. As you can see, many retail traders are currently holding long positions (65%). This is a contrarian signal, as it suggests take a reverse trade with them might get some advantages from them.

It is worth noting that 95% of retail traders lose money over extended trading periods. This data suggests that retail traders are often wrong about the direction of the market. Therefore, contrarian traders who take the opposite side of the market as retail traders may have a higher probability of success.

Of course, there is no guarantee of success with contrarian trading. However, it is a strategy that can be used to increase your chances of winning.

Unlocking Trading Insights with COT (Commitment of Traders) Report

The Commitment of Traders (COT) report is a weekly report that provides information on the positions of large traders, such as hedge funds and investment banks. The report is released by the Commodity Futures Trading Commission (CFTC).

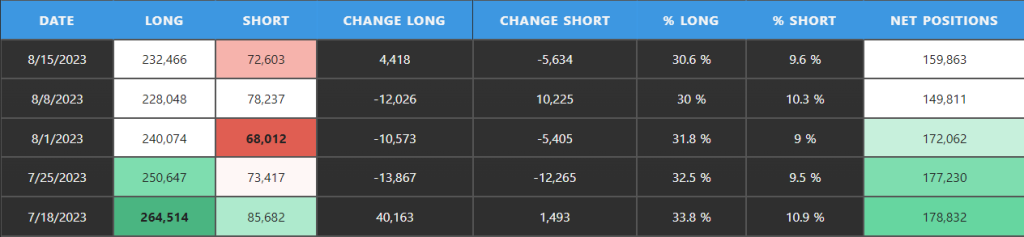

Based on the table provided, it is evident that there has been an overall decrease in their long positions and an increase in short positions on the EUR. Long positions have decreased from 264,514 to 232,466, while short positions have increased from 68,012 to 72,603. In the latest report, the net position (Long position – Short position) has decreased from 178,832 to 159,863. This indicates a strong bearish sentiment and a shift towards the short side for EUR.

Conclusion: EUR to Remain Under Pressure as Economy Slows

The euro has lost a substantial portion of its bullish conviction, particularly when compared to the faltering economy that pales in comparison to that of the United States.

Author: Jacky.T

Sources: TradingView, PMT, CFTC

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.