XAUUSD

From the daily chart, we delve into the movements of the XAUUSD pair, offering insights for astute traders looking to make informed decisions. The current landscape presents a significant opportunity for investors to position themselves strategically.

Gold Breaks Key Level – Potential for Downward Momentum

From a daily perspective, Gold has experienced a noteworthy breach beneath the crucial 1900 level. While it ultimately closed above this level by the end of the US Session, the breach suggests potential for a continuation of the downward trend. This is particularly pertinent as the 10-year bond yield reaches a new pinnacle of 4.22%. With these elements in play, a carefully calibrated approach is advised.

FOMC Meeting and Market Dynamics

In the upcoming FOMC Meeting, scheduled for today, market expectations revolve around the projected terminal rate, situated between 5.25% and 5.50%. This dynamic environment adds complexity to the trading landscape, warranting vigilance and strategic acumen. It’s noteworthy that the July meeting hinted at the possibility of further rate hikes, and the Federal Reserve’s assessment of the economy’s growth as “moderate” underscores the need for prudent decision-making.

Technical Analysis and Price Movements

From a technical standpoint, the current prices hover within the range of 1907 to 1900. A significant breach below the pivotal 1900 level would potentially signal a continuation towards 1880, followed by 1850. This data-driven analysis is a vital component for traders to refine their strategies and maximize their potential returns.

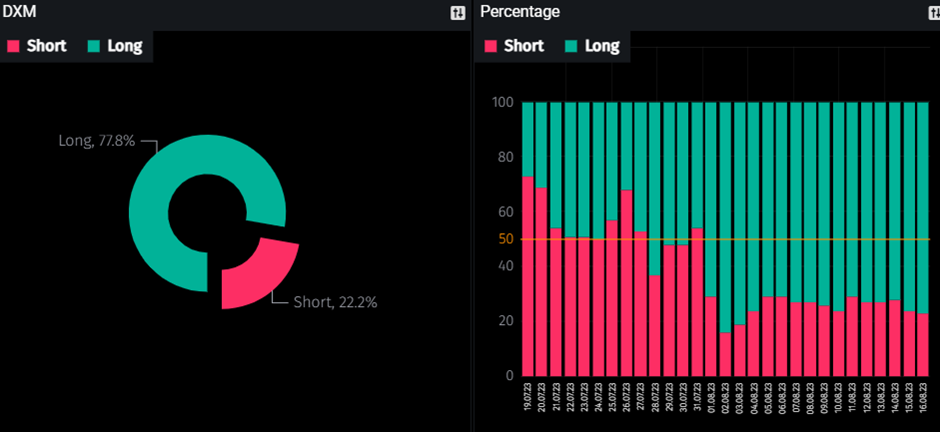

DXM: A Powerful Tool for Retail Trader Analysis

The DXM, or “Dump Money Index,” serves as a valuable instrument for traders seeking to understand the sentiments of retail participants. By assessing the chart provided below, it becomes evident that an overwhelming 77.8% of retail traders have chosen the long position for GOLD, with a meager 22.2% favouring the short position. It is worth acknowledging the well-known statistic that 95% of retail traders encounter losses over extended trading periods. This data introduces a significant and intriguing dimension, encouraging traders to consider contrarian trading strategies.

Unlocking Trading Insights with COT (Commitment of Traders) Report

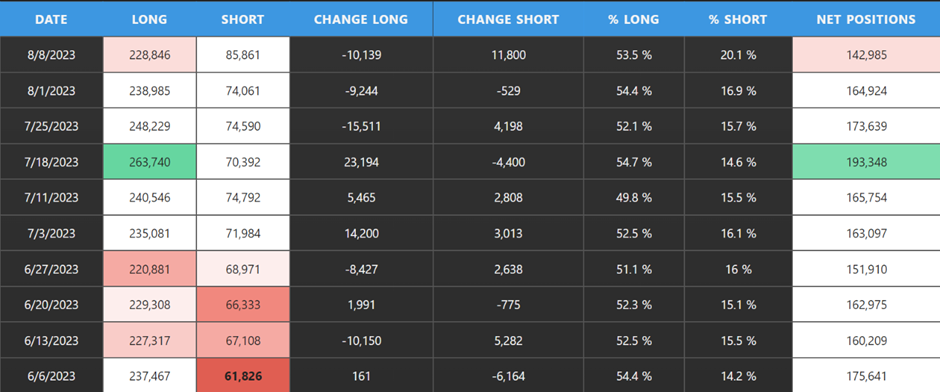

COT, or the Commitment of Traders report, is a crucial tool demanding weekly position submissions from seasoned traders to the CFTC (Commodity Futures Trading Commission). This report unveils a treasure trove of insights into their market activities, enabling us to harness this knowledge for strategic advantages in our trading choices.

Upon dissecting the provided data, a compelling narrative unfolds. Cumulative short positions have exhibited a persistent uptrend over the analyzed period. Notably, short positions surged from 61,826 to 85,861, whereas long positions dipped from 263,740 to 228,846. Consequently, the net position witnessed a decline from 193,348 to 142,985. While the aggregate long positions still surpass short ones, the recent surge in short positions underscores a pivot towards the short side in the current context.

Summary: Keep eyes on the FOMC Meeting tomorrow and the potential move higher on the 10-years yield. Both factors could drive the gold prices toward downside.

Author: Jacky.T

Sources: TradingView, PMT, CFTC

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaims liability towards any user and other recipients of this report.