Gold Breaks Key Level – Potential for Downward Momentum

From a daily perspective, Gold has experienced a noteworthy breach beneath the crucial 1900 level, and trading below it in the past few days. The breach suggests potential for a continuation of the downward trend. This is particularly pertinent as the 10-year bond yield reaches a new pinnacle of 4.22% previously. With these elements in play, a carefully calibrated approach is advised.

Friday: Fed Chair Powell speaks at the Jackson Hole Symposium

In the upcoming speak at the Jackson Hole Symposium, analysts believe the symposium might not shed new light on monetary policy, considering recent policy comments, but it will offer insights into global central bankers’ views on mid-term economic challenges. The Fed’s stance has been leaning towards rate hikes if needed, backed by recent data. The FOMC’s recent notes highlight their concern with high inflation and potential risks, maintaining a cautious policy approach. Some officials warn against over-tightening, while recognizing the need for slower economic growth and a softer job market to balance the economy. Despite these challenges, predictions of a mild recession this year have been dismissed, showcasing the economy’s durability amidst stringent monetary policies.

Technical Analysis and Price Movements

From a technical standpoint, the current prices hover within the range of 1895 to 1885. A significant breach below the pivotal 1885 level would potentially signal a continuation towards 1880, followed by 1850.

DXM: A Powerful Tool for Retail Trader Analysis

The DXM, or “Dump Money Index,” is a valuable tool for traders who want to understand the sentiment of retail participants. The DXM measures the percentage of retail traders who are holding long positions in a particular market.

The chart below shows the DXM for the XAUUSD pair. As you can see, many retail traders are currently holding long positions (51.8%). This is a contrarian signal, as it suggests take a reverse trade with them might get some advantages from them.

It is worth noting that 95% of retail traders lose money over extended trading periods. This data suggests that retail traders are often wrong about the direction of the market. Therefore, contrarian traders who take the opposite side of the market as retail traders may have a higher probability of success.

Of course, there is no guarantee of success with contrarian trading. However, it is a strategy that can be used to increase your chances of winning.

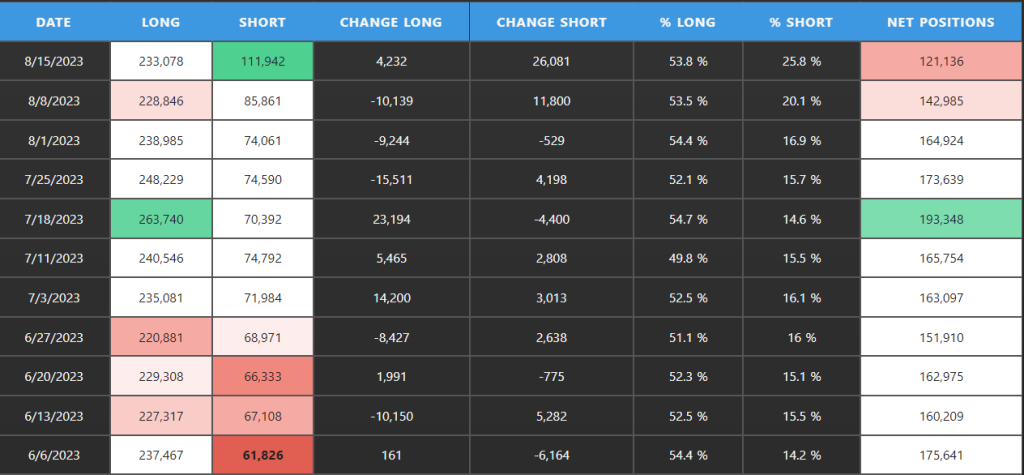

Unlocking Trading Insights with COT (Commitment of Traders) Report

The Commitment of Traders (COT) report is a weekly report that provides information on the positions of large traders, such as hedge funds and investment banks. The report is released by the Commodity Futures Trading Commission (CFTC).

Upon dissecting the provided data, a compelling narrative unfolds. Cumulative short positions have exhibited a persistent uptrend over the analyzed period. Notably, short positions surged from 61,826 to 111,942, whereas long positions dipped from 263,740 to 233,078. Consequently, the net position witnessed a decline from 193,348 to 121,136. While the aggregate long positions still surpass short ones, the recent surge in short positions underscores a pivot towards the short side in the current context.

Conclusion: Gold to Remain Under Pressure but eyes on Jackson Hole Symposium

Traders and investors should eye on the Friday’s event, even markets are expect not shed new light on monetary policy, but it will offer insights into global central bankers’ views on mid-term economic challenges as Fed’s stance has been leaning towards rate hikes if needed, backed by recent data.

Author: Jacky.T

Sources: TradingView, PMT, CFTC

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.