Marco View:

The euro is under considerable downward pressure, a trend driven not only by US interest rates but also by diminished growth expectations within the Eurozone. Despite a slight dip in Euro’s Preliminary CPI from 5.2% to 4.3% last week, it does not signify a turning point for the Eurozone’s economy. This decline in CPI could be attributed to a significant drop in German price pressures, although inflation remains high in the Eurozone. The European Central Bank (ECB) can potentially utilize this recent data to bolster their narrative, especially after opting for a pause in their actions. In summary, inflation persists at elevated levels, accompanied by low consumer confidence and spending, a weakening Eurozone trade balance, reduced foreign investment in EUR assets, and a divergent economic outlook with the US. These factors collectively indicate a potential for further weakness in the Euro.

From the US perspective, the USD remains robust due to the Federal Reserve’s hawkish rhetoric and the strong economic growth in the country. Market sentiment is shifting, indicating a belief that the next easing cycle by the Fed, whenever it happens, will not be as extensive as those observed in previous decades. The anticipated low point for this cycle, estimated around three years from now, currently stands at 4.29%. This expectation of a less aggressive easing cycle has driven long-term US interest rates higher, with a target of 5.00% for the US 10-year Treasury yield. Additionally, challenges in China’s property sector have contributed to the attractiveness of the high-yielding US dollar. The USD is expected to maintain its upward trajectory, potentially reaching levels around 107.00/107.20.

FX View:

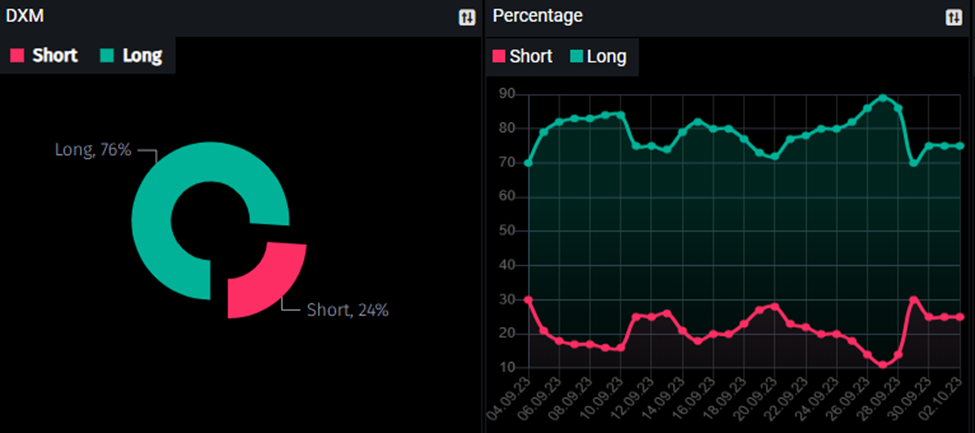

DXM Order stream data indicates that 76% of retail traders are currently holding long positions on EUR/USD, while only 24% are holding short positions. This data is insightful as it suggests an opportunity to trade against the majority, considering that 95% of retail traders tend to sustain losses over extended periods.

Seasonal patterns for EURUSD suggest that the downtrend in EURUSD will likely continue in the next 40 days, aligning with our short EURUSD strategy. However, it’s essential to remember that seasonality does not account for new economic developments and changes, but it can serve as a useful reference for decision-making.

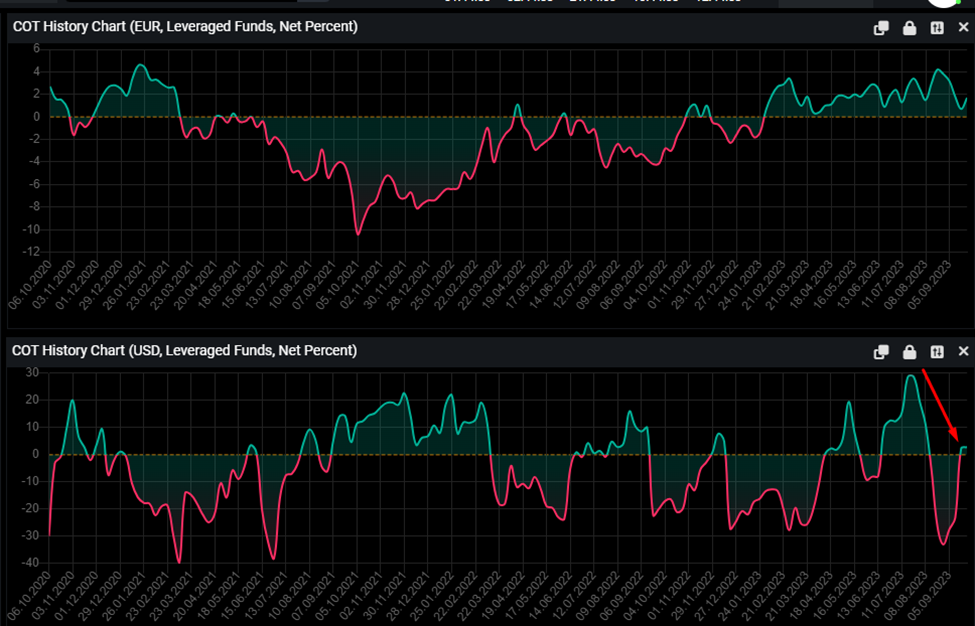

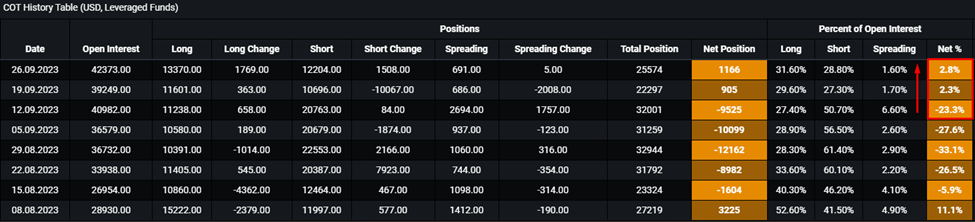

Examining the Commitment of Traders (COT) data offers intriguing insights into the USD. There has been a notable positive flip in its net percentage, transitioning from -23.3% to 2.8%. This indicates that hedge funds are beginning to shift their investments towards buying USD, suggesting a potential strengthening of the US dollar in the near future.

Summary: All Signs Point to a Short EUR/USD Position

- Marco’s view: The Eurozone’s economy continues to weakness and strong economy in the US.

- DXM: Most retail traders hold long positions on the EUR/USD.

- Seasonality Analysis: Seasonal patterns suggest continued EUR bearishness in the next 40 days.

- COT: Data shows that a positive flip on USD, suggests that hedge funds are strong buying USD.

Trade Recommendation: Short EUR/USD Position

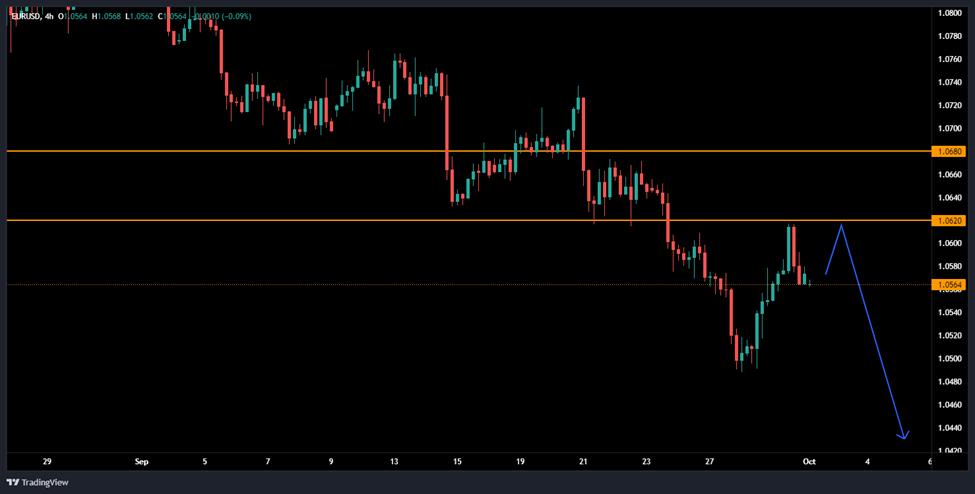

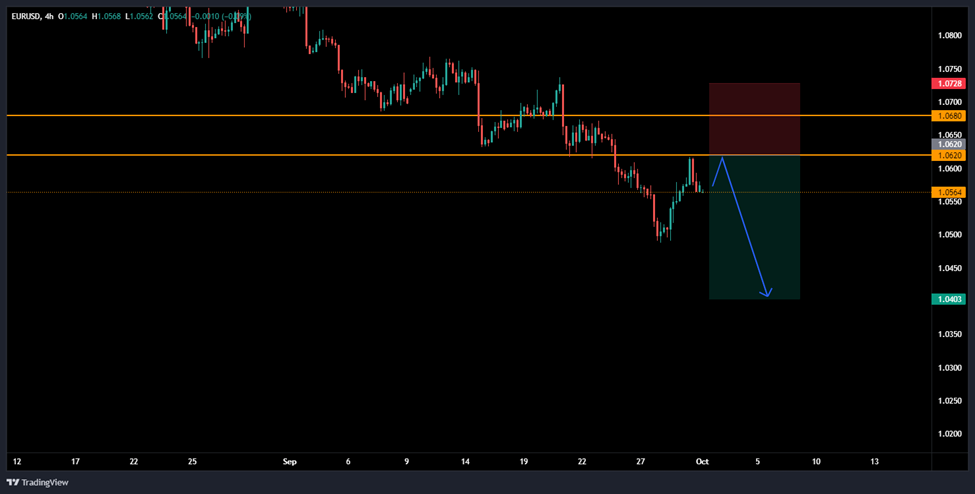

Entry: Sell limit at 1.0620

Take-Profit: 1.0400

Stop-Loss: 1.0728

Risk-to-Rewards: 1:2

Author: Jacky.T

Sources: PMT

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaim liability towards any user and other recipients of this report.