The global semiconductor industry has emerged as a powerful catalyst, driving transformative advancements across various sectors, from artificial intelligence to autonomous vehicles. In the midst of this technological revolution, Applied Materials Inc. (NASDAQ: AMAT) stands tall as a pioneering force, harnessing the potential of materials engineering to propel the semiconductor market to unprecedented heights. The company share’s decline of 2.29% on Friday came like a bolt from the blue even after the company reported an exceptional top-line and bottom-lime market expectation beat as the market sentiment was weighed down by the US debt ceiling talks stalemate.

However, with their recently reported stellar financial results for the second quarter of the fiscal year of 2023 (2023Q2), Applied Materials has demonstrated its unwavering commitment to innovation and its ability to capture outsized growth opportunities. The company President and CEO, Gary Dickerson, is confident that the company is well-positioned to capitalise on the monumental market shift and deliver impressive returns to its shareholders as the surge in demand for semiconductors continues.

Technical

The daily chart shows that the company’s share has been trading within an ascending channel since November 2022, and the appearance of the golden cross could suggest that the bullish momentum could continue in the near term. Thus, the current pre-market price of $126.44/share at a discount of 9.83% from the share’s fair value of $140.22/share when using a discounted cash flow model could offer an enticing opportunity for substantial upside as the share converges towards its fair value.

However, the investor should keep a keen eye on the lower bound of the ascending channel should they look to maximise the potential upside from the exposure to the company. A breakout from below the channel could trigger a selloff towards the $109.50/share support level, a potential level of significance for a long. A sustained selloff beyond the $109.50/share price level would bring the $93.82/share into play as a potential next level of significance for a long.

Fundamentals

Looking at the semiconductor behemoth’s recent quarter performance could boost investor confidence in the company following an exceptional quarter where the company beat both the street top-line and bottom-line expectations by a significant 3.73% and 8.74%, respectively. The company reported quarterly sales of $6.63 billion against Wall Street’s expectation of $6.392 billion. The sales grew 6% year-on-year from the 2022Q2 figure of $6.254 billion. The revenue beat was primarily boosted by the company’s primary revenue driver, the Semiconductor segment’s remarkable 11.64% year-on-year rise to $4.977 billion from the 2022Q2’s $4.458 billion. The Semiconductor segment accounted for 75% of the total revenue for the quarter and, combined with the Applied Global Services segment’s revenue growth of 3.25% year-on-year, helped offset the disappointing 55.91% decline in the revenue growth of the Display and adjacent markets. Applied generated revenues of $1.428 billion, while the Display and adjacent markets chipped in with $168 million.

The company’s margins slightly contracted during the quarter after the company reported a 0.2 and 1.5 points decline in the gross and operating margins, respectively. Investors were spooked by the decline in margins, which was primarily driven by the decrease in operating across most of the company’s segments, with the 7.04% year-on-year increase in the Semiconductor segment’s operating income failing to offset the 74% and 2% declines experienced in the Display and adjacent markets and Applied Global Services segment’s operating income. However, the company’s diluted earnings per share (EPS) rose 6.9% year-on-year to $1.86/share from $1.74/share in 2022Q2 against the street’s expectation of $1.839/share. These results indicate strong operational performance and effective management of costs. Additionally, the company’s outlook for the third quarter is optimistic, with projected revenue of $6.15 billion compared to the consensus estimate of $6.06 billion. This consistent financial growth and positive outlook demonstrate Applied Materials’ ability to capture market opportunities and generate value for shareholders.

As a key player in the semiconductor industry, Applied Materials is well-positioned to benefit from the growing demand for chips. The increasing reliance on advanced technologies such as artificial intelligence, cloud computing, and 5G networks has fuelled the need for semiconductors across various sectors. Applied Materials offers a diverse range of products and services, including equipment, materials, and software solutions, catering to different segments of the semiconductor value chain. This broad market presence provides the company with stability and resilience, as it can adapt to changes in demand and technology. Applied Materials also maintains a competitive edge through its extensive research and development efforts, technological expertise, and strong relationships with major semiconductor manufacturers. The company consistently invests in innovation to enhance the performance and efficiency of its products, ensuring its customers have access to cutting-edge solutions. The company’s announcement of a seven-year $4 billion investment in a new semiconductor research centre in Silicon Valley left investors in high spirits about the company’s future growth and market consolidation prospects. Applied Materials’ commitment to sustainability and environmental responsibility also aligns with the increasing focus on green technologies in the semiconductor industry, further enhancing its competitive advantage.

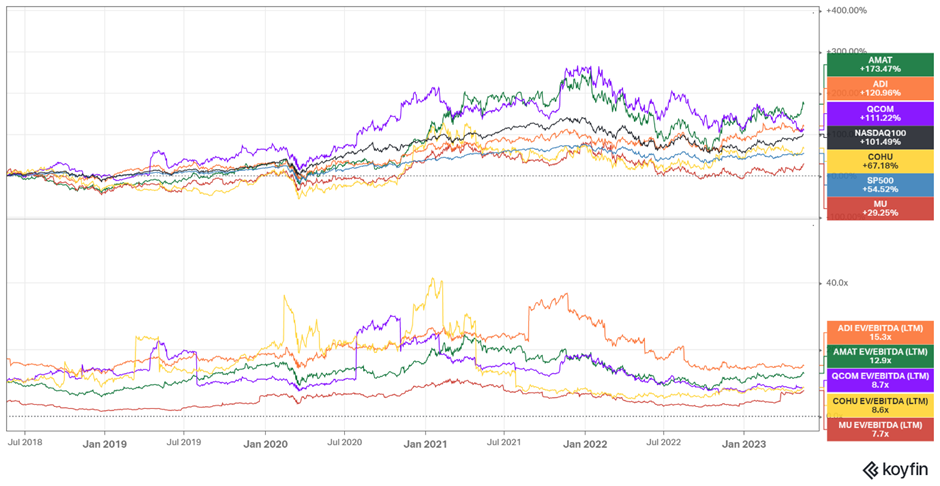

The picture below is a testament to the company’s strong performance in the past five years, which has seen the company’s share total return of 173.41% outpace most of its peers in the same period, with only Analog Devices Inc.’s 129.96% total return coming close the Applied Material’s share performance. The company’s share has also outperformed the S&P 500 Index (54.52%) and Nasdaq 100 Index (101.49%) by 118.95% and 71.98%, respectively.

Looking at Applied Materials’ EV/EBITDA of 12.9x, which is higher than its peers, suggests that investors are willing to pay more for each dollar of Applied Materials’ earnings than they are for the earnings of its peers due to the company’s long track record of profitability, strong competitive advantage and the market expects the company to grow faster than its peers in the future company’s due its ample growth opportunities and focus to research and development.

Summary

Applied Materials’ recent financial performance, market positioning, and growth prospects make it an attractive investment opportunity in the semiconductor industry. The company’s ability to exceed earnings, revenue estimates, diversified product offerings, and technological expertise demonstrate its strength in capturing market demand.

However, while Applied Materials has demonstrated solid financial performance and a competitive advantage in the semiconductor market, investors should be cautious against expecting significant upside potential from the current stock price. The stock has experienced a strong run this year, and further substantial gains might be limited. Therefore to maximise the value derived from the exposure to the share, it could pay for investors to wait for a potential pullback towards the lower significant levels for a potential long.

Sources: TradingView, Reuters, SeekingAlpha, Zack’s, Applied Materials.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.