In a world where e-commerce giants reign supreme, JD.com (NASDAQ: JD) stands tall as a prominent player in the Chinese retail industry. With a rich tapestry of technical and fundamental aspects, the company presents a compelling case for both caution and opportunity. The company has recently expanded into new markets and developed new businesses, such as cloud computing and logistics. JD.com is also investing heavily in artificial intelligence and other technologies, which could help it to maintain its competitive advantage in the years to come.

Despite its strong performance, JD.com’s stock is currently trading at a discount to its peers. This could be due to a number of factors, including the current economic slowdown in China and the ongoing trade war between the United States and China. However, should the company be successful in manoeuvring the current headwinds, JD.com could offer an enticing long-term investment opportunity with significant upside potential.

Technical

The retail behemoth’s price action has formed a descending channel trading pattern as the bears’ continued dominance, which has seen the share price decline more than 37% year-to-date. The appearance of the death cross as the longer-term 200-EMA (orange line) cross over the shorter-term 50-EMA (blue line) could confirm the presence of bearish sentiment towards the share price. Therefore, the $31.57/share support level could offer an opportunity for exposure towards the company should the bears continue to push the price lower. A break below the initial support level would bring the $27.72/share support level into play, the next level of interest for a potential long opportunity.

The bulls’ attempt to push the price higher could be a bumpier endeavour, with several barriers, including the channel’s resistance, the 50-EMA and the 23.60% Fibonacci retracement level likely to test the bulls’ charge. However, should the bulls successfully manoeuvre through the obstacles, the resistance level at $45.16/share could offer an opportunity for a long, with a potential for a 21.69% upside as the share converges towards its fair value at $57.67/share, found using the discounted cash flow model.

Fundamental

JD.com has been growing rapidly in recent years. In 2022, the company’s revenue increased by 19.4% to $151.7 billion. Net income also grew by 17.5% to $3.1 billion. JD.com’s strong financial performance has been driven by the growth of its e-commerce business and its expansion into new markets. The company’s e-commerce business has been growing rapidly due to the increasing popularity of online shopping in China. In 2022, the company’s e-commerce revenue increased by 21.2% to $147.6 billion. The company’s expansion into new markets has also been a key driver of growth. In 2022, JD.com expanded into Southeast Asia and India.

JD.com’s business model is based on its strong supply chain capabilities. The company has a vast network of warehouses and fulfilment centers that allow it to deliver products to consumers quickly and efficiently. The company also has a strong logistics network that enables it to transport goods to its warehouses and fulfilment centers quickly and cost-effectively. JD.com’s supply chain capabilities and focus on customer service have helped the company to differentiate itself from its competitors. Alibaba, for example, relies on a third-party logistics network to deliver products to consumers. This can lead to delays in delivery and can also increase the cost of shipping. The company offers a variety of customer service features, such as live chat, phone support, and a 7-day return policy. These features have helped JD.com to build a loyal customer base.

The Chinese internet sector, including e-commerce companies like JD.com, has demonstrated impressive growth and profitability. The combined profits of major internet and related services companies increased by 62.1% year-on-year, reaching CN¥ 38.4 billion. Additionally, the combined business revenue experienced a positive trend, with a 3.3% increase to CN¥ 408.3 billion.

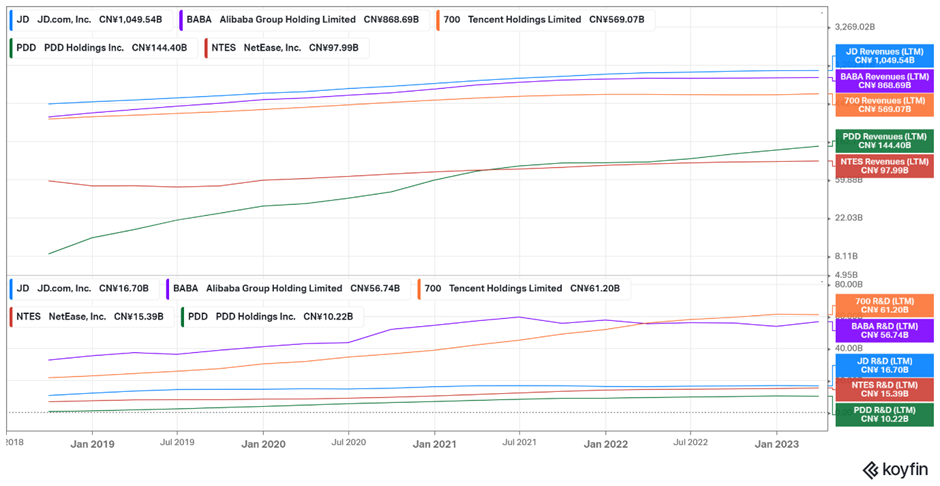

These figures suggest a favourable business environment and increasing consumer demand within the Chinese Internet sector. However, it is crucial to monitor the declining research and development (R&D) spending by these companies. While the pace of decline has moderated, a reduction in R&D investment could impact the company and sector’s long-term innovation and competitiveness.

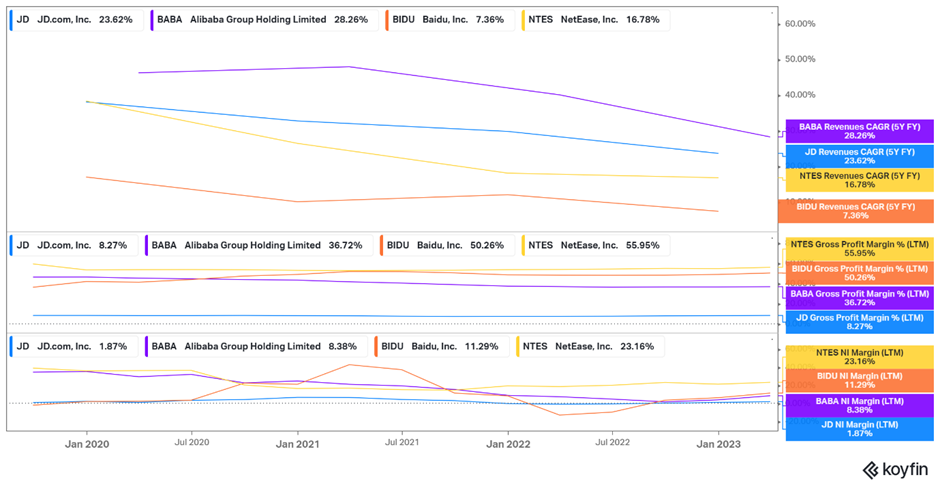

Looking at the company’s financial statements paint a very mixed picture, which could concern investors who are looking to invest in the company. Against its peers, the company generates the highest amount of revenue at CN¥1,049.54 billion and has grown its top line at a cumulative annual growth rate (CAGR) of a respectable 23.62% for the past five years, just shy of Alibaba’s revenue CAGR of 28.26% for the same period. However, what could gravely concern investors is the company’s gross profit margin (GPM) and the net income margin (NIM) of 8.27% and 1.87%, respectively, the lowest against its peers. The low GPM could indicate that the company lacks a comparative advantage against its peers, which could expose its performance and market share in the long term. Additionally, the company’s low NIM could be suggestive that the company is operationally inefficient, which could impact the company’s performance in the long term. Therefore, some investors could look for an improvement in the profit margin before being tempted for exposure to the company.

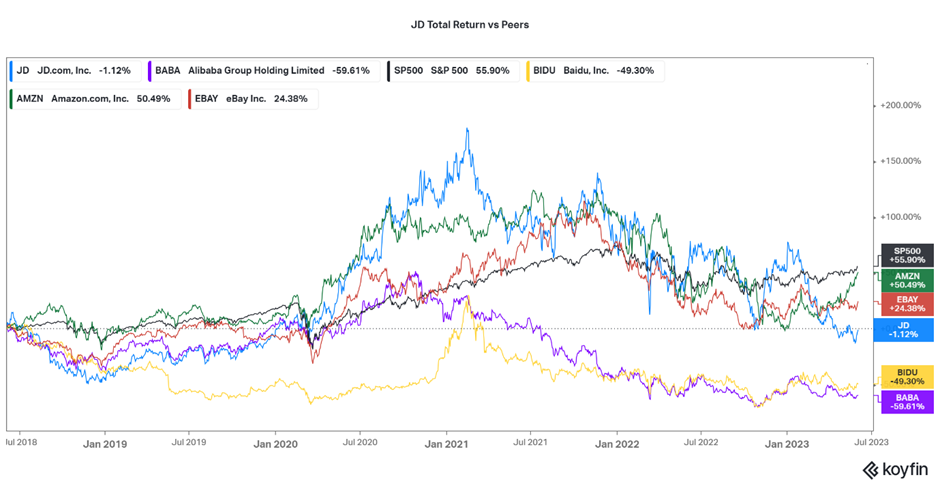

The picture below shows the extent of how much China’s retail industry has been affected by the different macroeconomic activities in the economy in the past five years, including COVID lockdowns and the unstable Sino-US tensions. The economy’s industry has underperformed, with JD.com, Alibaba and Baidu all returning negative total returns, with JD.com the better of the lot at -1.12%. The volatile macroeconomic conditions in China have helped the companies not only underperform their US counterparts, Amazon.com (total return of 50.49%) and eBay (total return of 24.38%) but also helped them underperform against the US stock market, proxied by the S&P 500 Index (black line) which has returned a 55.90% for the same period.

The Chinese company have been significantly impacted by the country’s Authorities’ fight against the COVID-19 pandemic, and with major publications suggesting that the world should brace for another COVID wave from the economy, maybe it could be beneficial for investors to continue monitoring the developments that could again impact the company’s performance. With the new COVID variant, the XBB variant, expected to peak at above 60 million cases a week, the return to the draconian “zero COVID” policy could firmly be on the cards, which would have a significant impact on the company’s short term performance, so investors should be wary.

It is worth noting that the company has undertaken proactive adjustments in response to the changing external environment and industry dynamics in the post-COVID era. The company has refocused on its core business, optimizing its product mix and sales channels to improve operating efficiency and quality. It has also scaled back on some new businesses to concentrate resources on ventures that can create long-term value. The company is improving the efficiency of its management and operations by streamlining its organizational structure, empowering frontline business teams, and providing growth opportunities for young talent. The company aims to build a robust ecosystem that attracts more third-party merchants, particularly high-quality SMEs, to its platform.

Summary

Based on the fundamental analysis, JD.com presents a mixed picture for potential investors. While the company has achieved significant revenue growth and operates in a sector with favourable growth prospects, its low-profit margins raise concerns about its comparative advantage and operational efficiency. Furthermore, macroeconomic conditions, including COVID-19 and geopolitical tensions, have impacted the company’s performance and may continue to do so. Thus, it would benefit investors to keep monitoring the developments within the region to reduce risk related to the exposure through the company.

Sources: TradingView, KoyFin, Seeking Alpha, CNBC, MT Newswire.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.