Innovation, sustainability and technological advancement in the automotive industry have made Tesla, Inc. (NASDAQ: TSLA) a household name in the industry since its humble beginnings in 2003. The company’s focus on electrical vehicles (EVs) and clean energy has helped the company amass a market capitalization of $572.19 billion and the honour of being the world’s largest automaker by market capitalization

With the company reporting its earnings and revenue results for the first quarter of the 2023 fiscal year (FY) next week, it could be worthwhile to relook at what has made the company what it is today and whether the company can outperform the record-breaking 2022 fiscal in the current macroeconomic landscape. With the analysts’ division on Tesla’s near-term prospects, the market would be very keen on the company’s first-quarter performance and expect the earnings and revenue to contract to $0.858/share and $23.76 billion, respectively.

Technical

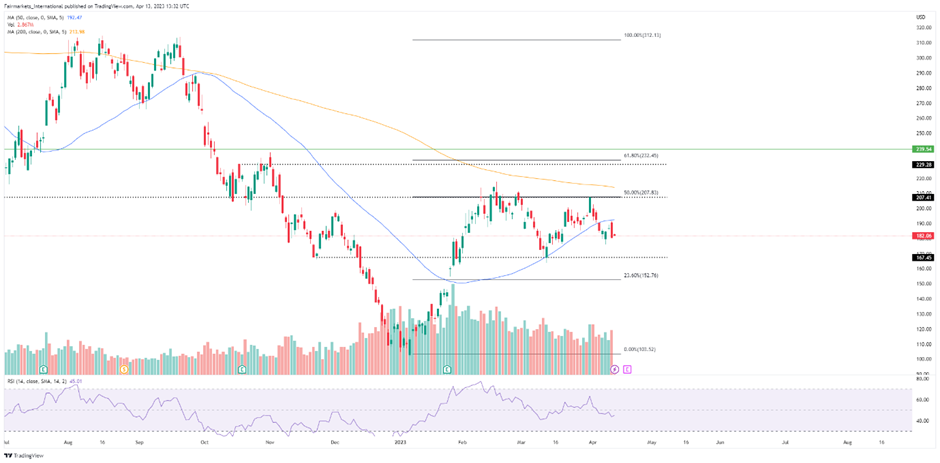

The daily chart shows that the price action is trading within a range created by the immediate support level at $167.45 per share (/share) and the resistance level at $207.41/share in anticipation of the next earnings report. The share would need another exceptional quarter to push the price towards the $207.41/share, a level of significance, with the next immediate hurdle being the 200-day moving average. A break out above the 200-day moving average would indicate the presence of buyers and would aid the bulls’ attempt to break above the resistance level of $229.28/share, a fraction of the share’s fair value.

However, earnings miss could lower the price with the $167.45/share price level offering the initial support. A break below the initial support would bring the 23.60% Fibonacci retracement level into play.

The discounted cash flow model returned $239.54/share as the company’s share fair value. The current share price of $182.06/share suggests that the share is currently trading at a discount of 31.57% from the share’s fair value, leaving ample room for upside.

Fundamentals

Tesla’s share closed 10.97% higher the day after the company reported its last revenue and earnings reports, although the report showed mixed results. The company reported a record-breaking quarterly revenue figure of $24.318 billion which missed the expected $24.669 billion by over $351 million. The earnings of $1.19 per share exceeded the analysts’ forecast of $1.129 per share. Even though the company missed the analysts’ quarterly revenue expectations, its fourth-quarter revenue, operating income and net income were the highest ever in its history.

The overall 2022 FY performance was excellent. The company registered a 51% year-on-year total revenue increase to $81.452 billion from $53.823 billion in 2021 FY and a staggering 378.58% increase from the 2018FY figure of $21.461 billion. The company’s operating profit margin has grown by 18.6% to 16.8% for the 2022FY from -1.8% in the 2018FY. The growth in operating margin has been primarily supported by the introduction of low-cost models, more efficient cost-reduction measures and the decline in the company’s average selling price, which has halved between the 2017FY and 2022FY, as the company look to cater to numerous socioeconomic segments in its pursuit to increase its footprint in the automotive industry.

Tesla has an impressive growth outlook, with its vehicle deliveries increasing by 31% in Q4 2022 compared to the previous year. The company’s production has also been on the rise, with its Shanghai Gigafactory increasing it production in the fourth half of 2022. Tesla is also expanding its product offerings, with the introduction of the Cybertruck and the Tesla Semi expected to boost the company’s revenue in the coming years. Furthermore, the company’s solar and battery energy storage businesses also offer significant growth prospects as the global demand for sustainable energy solutions grows.

While the company has enjoyed an exceptional financial performance recently, it is worth noting that it faces increased competition from well-established companies that have since entered the EV market. The company faces intense competition from established car manufacturers such as Toyota, General Motors, and Volkswagen, which are also investing heavily in electric vehicles and could erode some of the company’s market share in the industry and likely put pressure on profitability in the longer term.

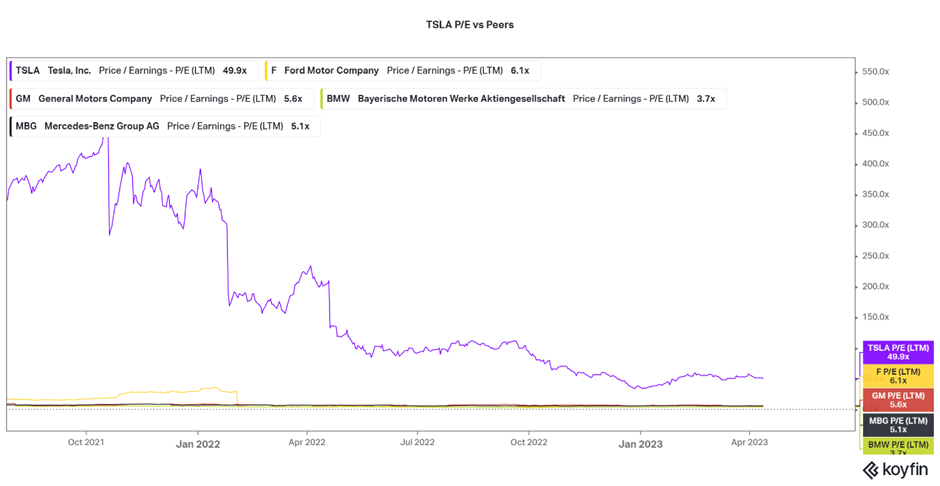

The company’s valuation has also been a point of concern for some analysts, as its price-to-earnings (P/E) ratio is substantially higher than that of its peers. The picture below shows that Tesla’s P/E ratio of 49.9 is approximately 8.2 times the P/E ratio of the closest competitor, Ford Motor Company, with a P/E ratio of 6.1. Additionally, investors could be wary of Tesla’s high valuation as this increases the risk of share price volatility, as any negative news can cause a significant drop in the share price.

Summary

Tesla’s fundamental analysis presents an attractive investment opportunity with solid revenue growth, a substantial asset base, and impressive growth prospects. However, the company’s earnings have been volatile, and its valuation is high compared to other manufacturers, which increases the risk of share price volatility. Therefore, depending on the next week’s earning report, a long opportunity could exist at the $207.41/share price level, with the $167.45/share price level offering a “buy-the-dip” opportunity.

Sources: TradingView, KoyFin, Reuters, CNBC, Investopedia, Tesla.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.