The Charles Schwab Corporation (NYSE: SCHW) could be hoping that the recent stronger-than-expected first quarter (Q1) earnings report could cap the share’s rout and spear-head the recovery of the company’s share, which has declined approximately 36% from the turn-of-the-year price. The brokerage giant’s share has endured a difficult start to the year after falling more than 25% in the wake of SVB’s collapse. The collapse raised concerns about the stability of the global banking sector, which led to a huge panic selloff in global banking shares.

Charles Schwab reported their first-quarter earnings report after the bell on Monday, and the share price rose by 3.94% and will be opening the Tuesday trading session at $52.49/share. The bank reported analyst beating earnings per share (EPS) of $0.93/share but recorded a top-line miss as the company reported that the recent Federal Reserve’s interest rate hike has helped the company experience an 11% quarter-on-quarter decline in customer deposits affecting the bank’s revenue for the quarter.

Technical

The daily chart shows that the bank’s share has suffered sharp declines in the first quarter of 2023, and the bulls would expect that the recent positive earnings report could catalyse a share recovery. Therefore, should the bulls dominate the bears, an opportunity could exist as the price action breaks above the $59.20/share resistance level. A break above the initial resistance level would leave the $65.58/share resistance level as the next level of interest.

However, should the bears continue to push the price lower, then an opportunity for a long position could exist at the support level at $45.07/share. The share price is currently trading at a sizeable 29.85% discount from the share’s fair value of $67.78/share using the discounted cash flow model, which leaves considerable room for potential upside.

Fundamental

The bank reported quarterly EPS of $0.93/share, which beat the analysts’ estimate of $0.90/share by 3.38%. On the contrary, the company missed the top line after reporting quarterly revenue of $5.116 billion, which was 0.34% lower than the market’s expectations of $5.134 billion. Even though the revenue missed the estimate, investors could take positives in that the quarterly figure represented a 9.6% year-on-year growth and remained close to the all-time high figures. The revenue was primarily driven by the 27% year-on-year increase in interest rate income item. The company’s revenue miss was primarily driven by the decline in the customer deposit, even though the company’s interest rate income of $2.77 billion beat the analysts’ estimate of $2.74 billion.

The investors could be concerned that while the major US banks were reporting a surge in their customer deposits, the American multinational financial services company’s experienced a 30% year-on-year decline in their customer deposits. The bank reported quarterly deposits of $326 billion, an 11% quarter-on-quarter decline, after a mass exodus that saw the bank lose over $41 billion worth of deposits in three months. The bank fell victim to the Federal Reserve’s rate hikes which enticed customers to shift towards higher-yielding instruments, including money-market funds. The bank’s executives have also reassured investors that the deposit exodus slowed during the latter parts of the quarter as the market’s sentiment towards the Federal Reserve terminal rate shifted.

Nevertheless, the company’s financials show that the company’s net income rose by 14% year-on-year to $1.6 billion from $1.4 billion in the same quarter last year. The improvement comes in the quarter, where the company’s deposit fees and trading income was primarily affected by the higher interest rates and the volatile macroeconomic conditions. The bank attributed the improvement in its net income to the better management of its operations and cost-management measures. The asset management and administration fees for Q1 were $1.12 billion, up from $1.05 billion in Q4 of 2022, and the total expenses excluding interest, rose to $3.01 billion for Q1 from the $2.90 billion figure in Q4 of 2022.

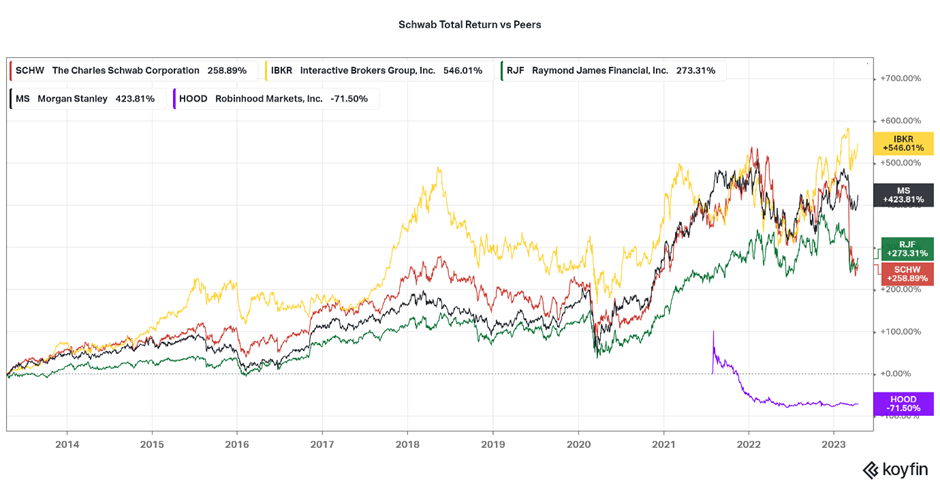

The chart below shows that the broker’s share has gained over 258% in the past ten years. The outstanding share performance underperformed some of the bank’s major peers, with Interactive Broker’s Group and Morgan Stanley achieving a total return of 546.01% and 423.81% for the same period.

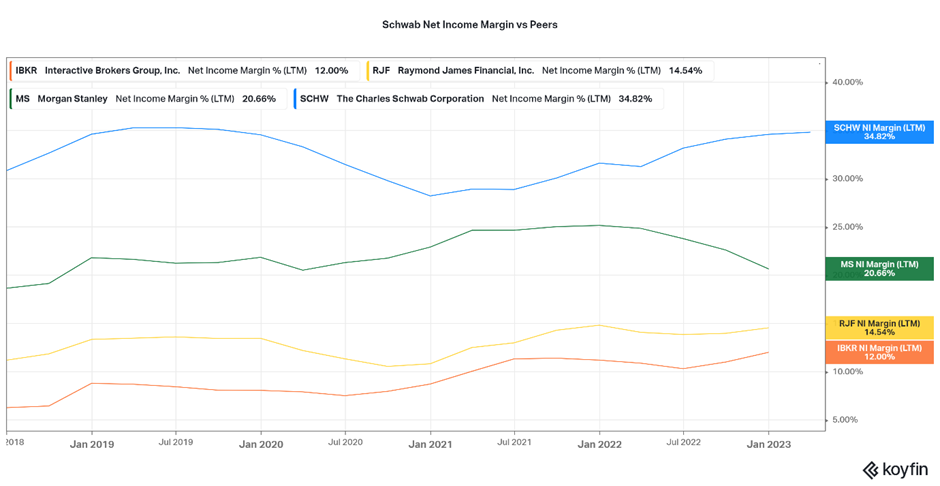

However, the share’s investors could find solace when looking at the bank’s net income margin, which shows that the company has achieved a net income margin of 34.82% for the five-year period from 2018, with the closest competitor being Morgan Stanley, with a net income margin of 20.66%.

Summary

The bank would be hoping that the worst is over and that the quality first quarter performance could revitalise the share’s recovery. Therefore, a long opportunity could exist at the $59.20/share price level as the share attracts buyers, and a buy-the-dip opportunity could exist at $45.07/share if the bears continue to push the price lower.

Sources: TradingView, KoyFin, Reuters, MT Newswire, Seeking Alpha,

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.