In today’s interconnected world, where communication plays an integral role in every aspect of our lives, Vodafone Group (LSE: VOD) has constantly maintained its position as a key player in shaping the future of telecommunications. However, following a disappointing 2023 fiscal year performance, the giant engaged in self-reflection and announced new strategic plans to help the company recapture its competitive edge and former glories.

Margherita della Valle, the Chief Executive Officer of Vodafone Group, announced that the company would be cutting the workforce by 11 000 personnel in the next three years, both in the company’s headquarters and the local markets, sending the share tumbling to heights last experience in 2022 as investors looked to cut ties with the telecommunications giant that continues to tumble from grace.

Technical

The weekly chart shows that the company’s share is currently under bearish momentum, which has seen the share decline around 0.2% for the year to add to the 24.97% and 7.02% declines achieved in the 2022 and 2021 fiscal years, respectively. The share has shed over 80% of the share’s all-time high as increasing competition in the telecommunication industry continues to chip away at the British telecommunication behemoth’s market share.

Looking at the moving averages sends strong bearish signals, and should the momentum continue to push the price lower, an opportunity could exist at the support level at £0.7959/share, which would offer a potential for a 35.09% upside as the share price converges towards its fair value at £1.2262/share. However, should an investor look to limit their risk exposure, the investor could expect the bulls to push the price higher and respect the dynamic resistance that has formed and could look for opportunities as the price action retraces back towards the £1.0250/share significant level around the 23.60% Fibonacci retracement level.

Fundamentals

The British telecommunication company reported a disappointing 2023 fiscal year (2023FY) performance, and the gloomy outlook for the 2024FY sent the share tumbling over 7.46% during the Tuesday, 16th of May 2023, trading session. The decline was the most significant intraday decline since the 18th of May 2021, when the share declined 8.88% following a series of disappointing quarterly performances from the company. The company said they expect its cash flows to continue shrinking as its main revenue generators continue to be impacted by the current market conditions after Germany’s service revenue declined by 1.6% year-on-year, leading to a 6.1% decline in the company’s adjusted EBITDAaL.

The company achieved adjusted basic earnings per share (EPS) of 11.45c/share from total revenue of €45.706 billion for 2023FY, which declined year-on-year from the 2022FY’s EPS of 11.68c from the revenue €45.508 billion. The company’s Vodafone Business had good performance year-on-year, which saw the department’s revenue grow by 2.6%. The company’s revenue growth of 0.3% was primarily driven by the tremendous growth in the company’s Africa revenue and the higher equipment sales that helped slightly offset the worrying decline in the company’s European n service revenue and adverse exchange rate movements.

Looking at the broader market that the company operates in sends worrying signs to the company, which once had its’ share trading at £4.0650/share. The telecommunications industry is highly competitive, and Vodafone Group faces competition from both traditional operators and disruptive players. Intensifying competition could put pressure on pricing and margins, potentially affecting the company’s profitability in the long term and with the telecommunications industry subject to rapid technological advancements and disruptions. Vodafone Group would need to continually invest in research and development to stay ahead of emerging technologies and maintain its competitive edge. Failure to adapt to technological shifts could impact its market position.

The company’s CEO has announced a strategic plan to continue to grow the company and regain its market position in the longer term. Margherita della Valle announced that the company would cut 11 000 individuals as the company shifted its focus to “Customers, Simplicity and Growth”. The company plans to reallocate their resources to efficiently deliver the quality services to its customers that once made the company one of the biggest telecommunication companies, not only in Africa but globally. However, the enthusiastic strategy failed to sway the market’s sentiments as investors questioned the strategy, with Vodafone steering down at declining profit and weak cash flow guidance for the new fiscal year and declaring another untouched dividend.

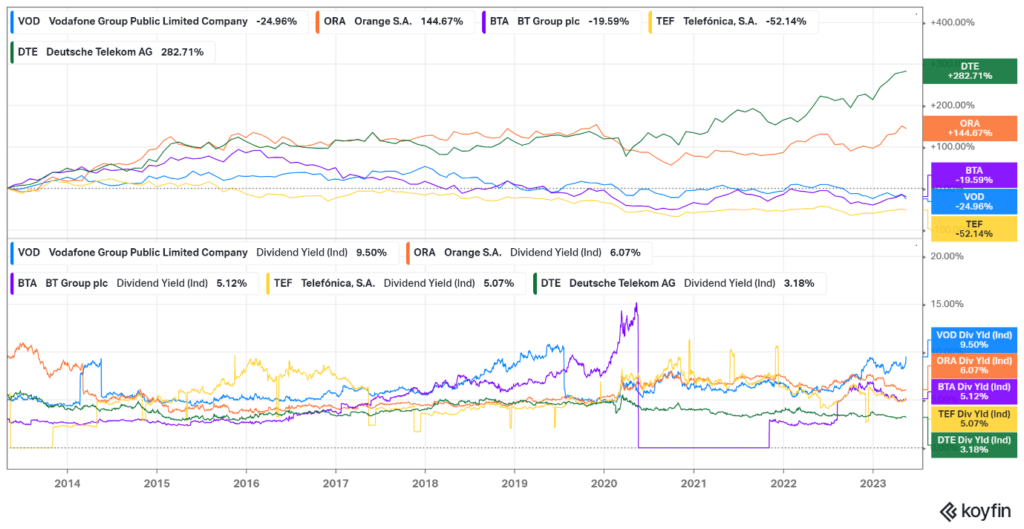

Vodafone Group had a negative share return of -24.96% over the past ten years, indicating a decline in share price during that period. However, it offered a relatively high dividend yield of 9.50%, which could be attractive to investors seeking short-term income. Deutsche Telekom stands out with the highest positive share return of 282.71% over the 10-year period. This suggests substantial growth in its share price. However, the dividend yield of 3.18% is relatively lower compared to the other companies.

Summary

Vodafone Group presents an attractive investment opportunity based on its strong market position, global presence, focus on high-growth areas, and diversification strategy—the company’s cost-efficiency measures and commitment to shareholder value further support the investment case.

However, investors should closely monitor competitive pressures, regulatory developments, and technological disruptions to mitigate risks associated with the exposure to the company.

Sources: TradingView, KoyFin, Seeking Alpha, Vodafone Group, MarketScreener.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.