The Nikkei 225 Index Futures (CME: NIY) closed the Asian Trading Session on Wednesday 0.31% higher as investors traded cautiously ahead of the CPI report and the FOMC meeting minutes today. The index futures were also boosted by the stronger USDJPY, which helped to give support to the futures in the morning trading session.

The index futures rally was boosted a softer US inflation that sent the US dollar tumbling. The CPI data missed the analyst forecast of 5.2% after coming in at 5%, while core inflation increased to the expected 5.6% in March from 5.5% in February. The data shows that the economy is slowing faster than the analysts had expected, with the CME FedWatch Tool suggesting that around 67% of analysts are pricing in a 25-basis point hike in May from down 74%.

Technical

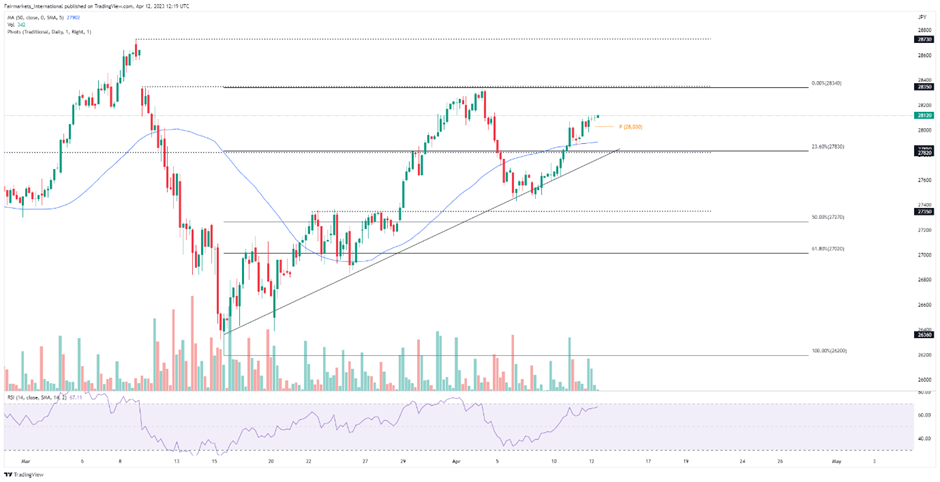

The 4H chart shows that the bears’ failure to break through the support level at 27350 was invitation enough for the bulls to regain control and move the index futures above the 23.60% Fibonacci retracement level. A price action move below the daily pivot point at 28030 would give the bears a run at the 27820 support level around the 23.60% Fibonacci level. A breakthrough below the support level would send a bearish signal and could push the price action towards the 27350 support level.

However, the bulls could be confident in retesting the resistance level at 28350, a level of interest for the bulls. The bulls could fall short of the next resistance level of 28730 if the volume continues to decline with the RSI moving towards the overbought territory.

Summary

The soft US CPI give a boost to the bulls’ rally as more investors bet on the terminal rate peaking at 5%. Therefore, a short-term trading opportunity could exist as the index futures breakthrough the resistance level at 28350 but could fall short in their pursuit of testing the 28730 with the RSI approaching the overbought territory.

Sources: TradingView, Reuters, Bloomberg.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.