The German multinational science and technology company Merck KGaA (XETR: MRK) has enjoyed a torrid year in 2023. The company’s sales have been primarily affected by the pandemic, and the unstable macroeconomic conditions continue to weigh down the company’s recovery, with the complications in the global supply chain in the semiconductor industry also not doing the company’s performance any favours.

The company CEO Belén Garijo said that the company could be looking to increase M&A activity through several measures, such as an increased number of transformative deals or licencing deals to help catalyse improved company growth in the future. The statement comes after the German pharmaceutical and chemical company delivered disappointing earnings and revenue reports for the quarter that ended on the 31st of December 2022.

Technical

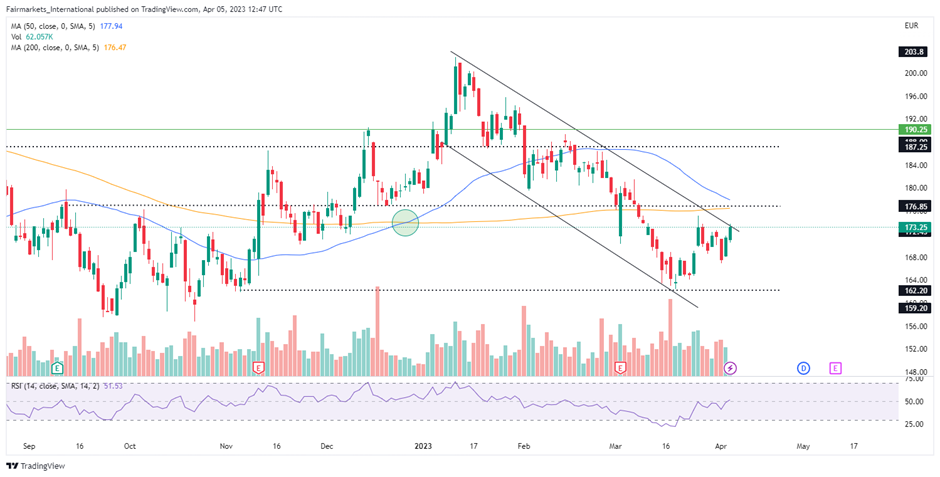

The daily chart shows that the price action of the German’s life-sciences and electronics group has been confirmed within a descending channel since the highs of the 11th of January 2023 as the bears continue to pull the price lower. However, the presence of the golden cross as the 50-day moving moved above the 200-day could give confidence to the bulls that they could soon be afforded the opportunity to drive the price higher.

The share’s current price of €173,25 per share represents an 8.94% discount from the company’s share fair price of €190.25 per share using discounted cash flow model. With the price action trading close to the upper trendline of the descending channel, a failure to sustainably breakthrough the trendline could push the price lower as bears continue their long-term dominance. Thus, as the price action moves below, investors could find a long opportunity at the €162.20 per share support level, representing a 14.74% discount from the share’s fair value.

However, should the recent announcements continue to drive the share’s recovery and the bulls’ run is sustained, then investors could bring the resistance levels above into play. Therefore, investors could look to the €176.85 per share level and the €187.25 per share level at a fair value discount of 7.04% and 1.58%, respectively, for potential long positions.

Fundamentals

The company’s recently reported disappointing quarterly earnings and revenue reports, which saw the company miss the analysts’ revenue and earnings estimates by 1.04% and 6.50%, respectively. The company stated that the primary driver of the poor performance was the slowing global semiconductor industry, and the company warned that the continued struggles within the industry could continue to negatively impact the company’s performance for the 2023 fiscal year (FY). However, investors found solace in the impressive improvement in the company’s bottom, which has seen the German pharmaceutical and technology company grow its’ profit margin by 7.07% after achieving a profit margin of 14.96% for the 2022 FY from the 7.62% achieved in 2018 FY.

The company has been able to continually grow its’ total revenue since the 2018 FY and has achieved approximately 67% growth since the 2018 FY after increasing its total revenue by 12.93% to €22.23 billion for the 2022 FY from €19.69 billion for the 2021 FY. The company’s EBITDA has also grown by a substantial 76.15% from the 2019 FY to the 2022 FY, primarily driven by the impressive improvement in the company’s healthcare and life science segments.

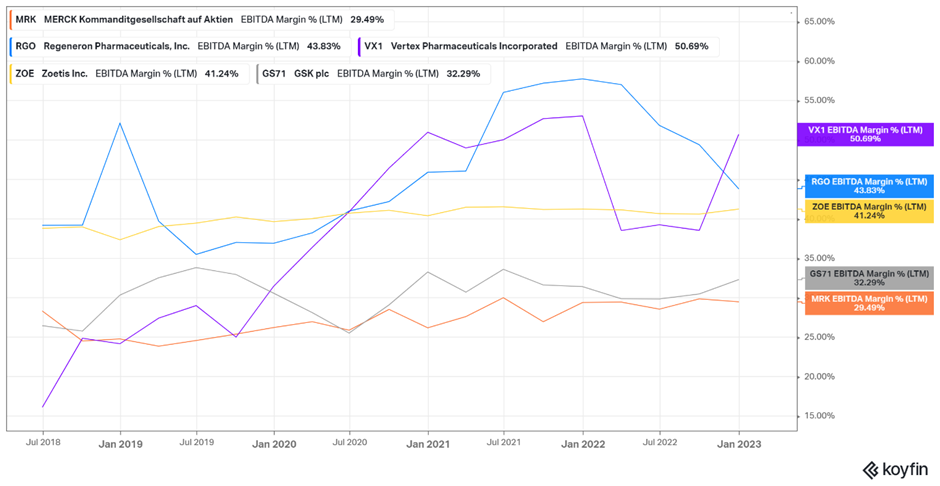

The graph below shows that even though the company has achieved an EBITDA average of 29.49% for the five years from 2018. The company’s EBITDA performance lagged behind its peers, with the closest peer GSK plc achieving a 32.29% and the peer with the highest EBITDA being Vertex Pharmaceuticals Incorporated at 50.69% for the same period.

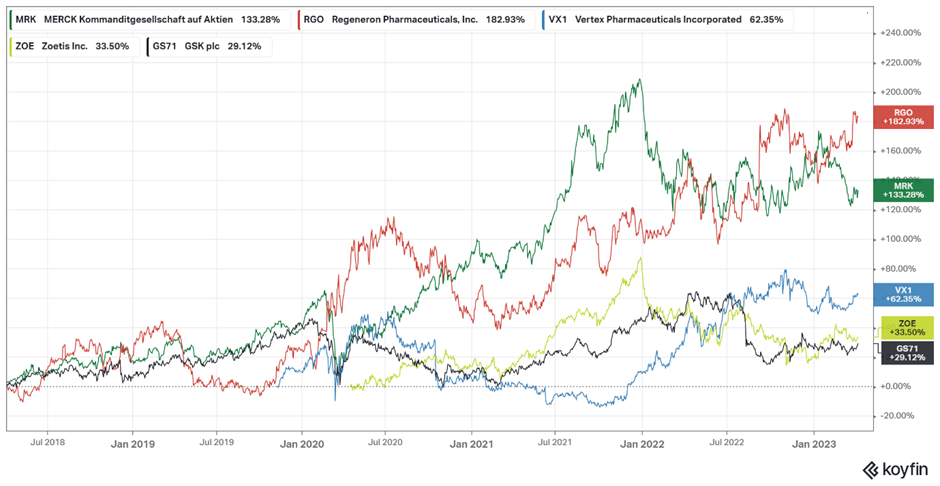

However, investors could find support when looking at the industry’s share total returns for the same five-year period. The company’s share return of 133.28% only lagged Regeneron Pharmaceuticals, Inc’s total return of 182.93% for the same period. Thus, if the company could be able to implement its recovery plans, both the company’s total return and EBITDA could continue improving, which could entice investors who are looking for a long-term opportunity.

The life-sciences and electronics group has spectacularly followed the remarks of increased M&A activity by announcing several deals that could help brighten the company’s outlook. The company announced that it had acquired worldwide exclusive rights to skin cancer medication Bavencio following the termination of the alliance with Pfizer. Following the termination of a nine-year partnership, the company would assume the responsibilities of handling the global commercialisation of the drug, with Pfizer entitled to a 15% royalty on the net sales. This will not be a big task for the company, which already handles every aspect of the manufacturing and supply chain management of the drug that it originally discovered.

The company also recently announced that the company had signed a memorandum of understanding together with Intel to fund three-year academic research that will focus on harnessing and augmenting state-of-the-art artificial intelligence by enabling more sustainable semiconductor manufacturing solutions in Europe. This deal forms part of the company’s plans to increase its footprint in the European and global semiconductor industry and is also in line with the company’s pursuit to be climate-neutral by 2040.

Summary

However, the Merck KGaA share’s underperformance for the year, which has seen share trade at a 4.45% discount from the share’s turn-of-the-year price, could offer the opportunity to buy the share at a discount. Even though the company’s outlook underwhelmed the market, the company could be poised for a rebound in the second half of the year if the recovery plans are correctly implemented. Thus opportunities could exist as the share diverges towards the share’s fair value at €190.25 per share.

Sources: TradingView, KoyFin, MT Newswires, Reuters, Merck KGaA,

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.