The spin-off fever seems to have firmly gripped the Asian market after JD.com, Inc. (NASDAQ: JD) followed in Alibaba’s footsteps in announcing the spin-off of the company’s units on Thursday. China’s largest retailer in terms of revenue shocked the market on Thursday, the 30th of March 2022, after it announced that the Hong Kong Stock Exchange had accepted its proposal to spin off the group’s Jingdong Production and Development, and Jingdong Industry units as the company looks to enhance its efficiency and help the individual units realise their potential.

The company’s share has been on a rollercoaster ever since the announcement, with the initial reaction by investors to the announcement being largely positive, helping the share close the trading session 7.82% higher. However, the share has since shed about 4.55% of those gains as the stock continues its slide that has seen the share price decline approximately 24.46% from the turn of the year’s $57.97 share price. Even though the full details of the spin-offs have not been released to the public, the company did reveal that they will be looking to raise about $1 billion for each unit in the Hong Kong initial public offering (IPO) and would retain 50% equity in the spun-off companies.

Technical

The appearance of a death cross in the weekly chart as the long-term 200-day moving average moved above the shorter-term 50-day moving average suggests that the market is currently bearish towards the Chinese e-commerce giant’s share price. The share’s fair value is currently $68.33 per share using the discounted cash flow (DCF) valuation model.

If the recent IPO announcement pushes the bulls to overpower the bears and push the price action higher, then an initial long opportunity could exist at the resistance level of $48.96 per share, which would represent an approximate discount of 28.35% from the share’s fair value. The bulls could look to a breakthrough above the $64.11 per share to take profit or add to their position at an approximate discount of 6.18% from the fair value of the share.

Suppose the bears continue to tighten their grip, then a trading opportunity could exist as the price action breaks below the $33.17 per share support level, a possible level of interest for the bears.

Fundamental

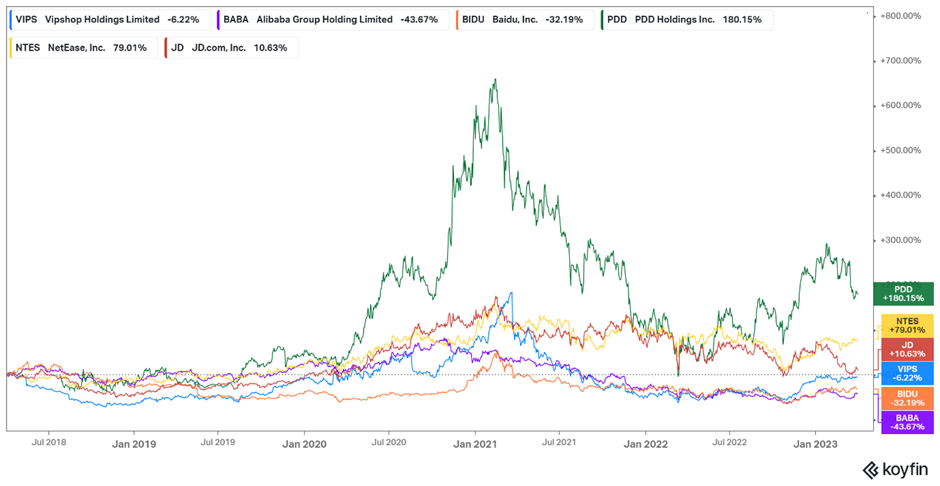

Looking at the company’s total returns against its competitors shows a company which has been able to outperform the more recognisable and larger competitors but significantly struggled against competitors with market capitalisation. JD.com’s share total return of 10.63% for the five years from 2018 outperformed Alibaba’s and Baidu’s -43.67% and -32.19% total return for the same period.

The Chinese e-commerce giants recently posted mixed earnings and revenue reports for the quarter that ended on the 31st of December 2022. The company recently reported 7.1% year-on-year growth in quarterly revenue to $42.825 billion, which was still 0.33% lower than analysts’ forecast of $42.967 billion. The revenue was primarily driven by the group’s retail segment, which grew a modest 3.64% year-on-year and contributed $37.541 billion, which amounted to 87.7% of the total revenue for the quarter. The company’s retail segment growth was stifled by the depressed consumer demand in the Chinese economy due to the prevalent Covid-19 restriction, with the recent reopening of the economy looking to boost the outlook of JD.com’s largest revenue-generating segment.

The investors could find solace in the fact that the company was able to beat the analysts’ earnings forecast by 34.77%. The recent quarterly earnings per share of $0.697 a share beat the analysts’ forecasted earnings per share of $0.517 a share and, in the process, recorded an eighteenth (18) consecutive quarterly earnings beat. The strong improvement in the company’s profitability in the fourth quarter was primarily driven by improved cost management and efficiency of the company’s largest revenue-generating segment, JD Retail, whose operating margin grew by over 3% year-on-year.

Looking at the proposed IPOs, it is worth noting that the company’s two units have already had success in raising funds following successfully completing their respective series B financing in the past. Jingdong Property, the asset management and operational arm of the JD.com group, raised over $800 million in the funding round, primarily led by private equity powerhouses Warburg Pincus and Hillhouse. Jingdong Industrials, the industrial supply chain technology and service provider, raised a modest $300 million for their series B financing round jointly led by Mubadala Investment Company and the Abu Dhabi headquartered 42XFund.

Summary

The company’s planned spin-off is mainly driven by the company’s aim to improve efficiency for both the main group and the two segments. If the planned restructuring provided significant synergies, the company’s share could soar higher and recoup some of the losses experienced recently. Thus, a long opportunity could exist at the $48.96 per share, with $64.11 per share level offering another opportunity to go long and the buy-the-dip opportunity being at the support level of $33.17 per share.

Sources: TradingView, KoyFin, Bloomberg, Seeking Alpha, MT Newswires.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.