With a focus on innovative technologies, sleek designs, and advanced battery systems, NIO Inc. (NYSE: NIO) has gained significant attention in recent years since its inception in 2014. However, only some of the recent attention the company has gotten from the market has been good, as the company continues to lose market share and customers to competitors such as BYD and Wuling Motors.

The Chinese electric vehicle (EV) manufacturer’s aim to revolutionize the EV industry might have garnered the company fan fair and investors, but its stubbornness to adapt to the rapidly changing industry could be its demise. The EV maker’s share is currently trading at its three-year low and close to its IPO share price of $6/share as the disappointing financial performance and gloomy outlook continue to dismantle the company’s share price.

Technical

The weekly chart shows that the share price of the Chinese EV manufacturer has been under constant bearish pressure that has seen the share slump 16.6% year-to-date as the company continues to shed some of the spectacular gains of 2020. The appearance of the death cross as the longer-term 200-EMa moved above the shorter-term 50-EMA could suggest that the bearish momentum could persist with a breakout below the falling wedge most probable.

The share price has previously established support levels at the share price of $5.66/share and $4.09/share, and with the discounted cash flow giving the share a fair value of $12.27/share, there could be value to be derived from the share. Therefore, should the bearish momentum continue to drive the share price lower, investors could closely watch the reaction of the share price around the 23.60% Fibonacci extension level at $3.30/share. Rejection of the $3.30/share could trigger a significant pullback, and the $5.66/share and $4.09/share levels could provide opportunities for a long from below.

Fundamentals

NIO operates in a rapidly expanding industry driven by increasing environmental awareness and government policies supporting the adoption of EVs. China, the world’s largest automobile market, presents a vast opportunity for NIO. However, the company, which was once dubbed the “Tesla of China”, has failed to capitalize on the spectacular share performance of 2020, where the EV maker’s share rose a staggering 1112.44% as the EV shares frenzy gripped the market. The share price is currently trading at 16.62% from the turn-of-the-year price of $10.21/share as the company continues to add to the 35.00% and 69.22% declines achieved in 2021 and 2022, respectively.

NIO has chosen to remain steadfast in its’ premium positioning, ignoring the discounting and EV price war tactics employed by fellow peers as the company believes that it is well-positioned to continue offering a better user experience with the company’s new NT2.0 platform. NIO’s new NT2.0 platform offers superior digitization, functionalities, and computing power, but it is questionable if prospective clients would be willing to pay a premium in the current economic environment. The company’s decision not to engage in the “price wars” in the face of increased competition in the EV industry has severely impacted the demand for the company’s vehicles.

Investors might welcome the recent report by the company that showed that NIO delivered 10,378 vehicles in March 2023, including 3,203 SUVs and 7,175 sedans, and 31,041 vehicles in Q1 2023, with a year-on-year increase of 20.5%. The company is also planning to install 1,000 Power Swap stations in 2023. It has released NOP+ Beta to vehicles based on NT2.0, with over 30,000 users activating and engaging it and a cumulative mileage of over 15 million kilometres. However, NIO’s monthly deliveries fell by 36% in April, and it is unlikely for the company to double its sales volumes by the end of this year, especially considering its weakened balance sheet.

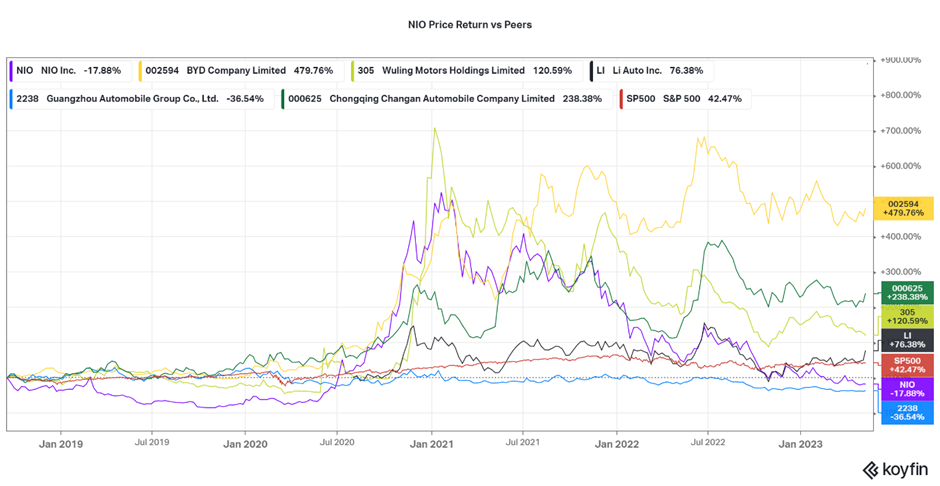

The picture shows that when comparing NIO’s share price return of -17.88% over the past five years to its peers, we can observe a significant disparity in performance. While NIO experienced a negative return, several of its peers achieved positive returns during the same period, with BYD and Chongqing Shangan’s total share price return of 479.76% and 238.38% being the pick of the bunch.

However, NIO’s share price return of -17.88% compared to the S&P 500 Index, which achieved a share return of 42.47% over the past five years, could worry investors. NIO’s negative share price return suggests that the company’s stock performance has not been as strong as the broader market proxied by the S&P 500 Index.

While NIO has underperformed some of its peers and the broader market in terms of share price return, it is crucial to consider the company’s growth potential, innovative technologies, expanding customer base, and efforts to establish a comprehensive ecosystem beyond manufacturing vehicles as these factors can contribute to NIO’s long-term prospects.

However, it is not all gloom and doom for the pioneering company for smart electric vehicles after the company’s shares rallied over 9% after the company announced that it had filed an application with necessary specification changes with the Chinese Ministry of Industry and Information Technology to equip its vehicle models with 150-kWh semi-solid-state batteries. The new batteries will be added to three of NIO’s vehicle models, including two SUVs and one sedan, with the supply coming from Huzhou WeLion Technology. NIO said that customers would have the option to rent the battery pack starting this summer, with plans for future battery pack purchases, which could boost the company’s revenues and growth prospects as the EV maker look to regain the lost market share.

Summary

NIO’s story has been one of the most interesting as the company continues its spectacular free fall from the company’s all-time highs of … as the increasing EV competitors in the Chinese economy continue to erode the company’s market share. The company’s focus on technological innovation, strong delivery growth, expanding charging infrastructure, and a premium brand position well for long-term success could suggest it could be worth continued observation for the investor looking for exposure to the Chinese EV industry.

Sources: TradingView, Koyfin, Reuters, Seeking Alpha, NIO, CNBC.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.