USDJPY

The USDJPY pair has broken above the key 145.00 level, signaling a possible extension of the prevailing bullish trend. The Bank of Japan (BOJ) has not intervened in the market to support the yen, which suggests that they are not yet concerned about the strength of the dollar.

The easing of restrictions on China’s international travel could support the yen in the short term, but the recent data indicates that the Japanese economy is still struggling, which could weigh on the yen in the long term.

From a technical perspective, the USDJPY pair is still in a strong uptrend. The long-term target of 150.00 from Credit Agricole is certainly within reach. However, traders should keep an eye on the BOJ’s statements for any signs of intervention.

Overall, the outlook for the USDJPY pair is bullish. However, there are some short-term factors that could weigh on the yen. Traders should be prepared for a volatile market in the near term.

DXM: A Powerful Tool for Retail Trader Analysis

The DXM, or “Dump Money Index,” is a valuable tool for traders who want to understand the sentiment of retail participants. The DXM measures the percentage of retail traders who are holding long positions in a particular market.

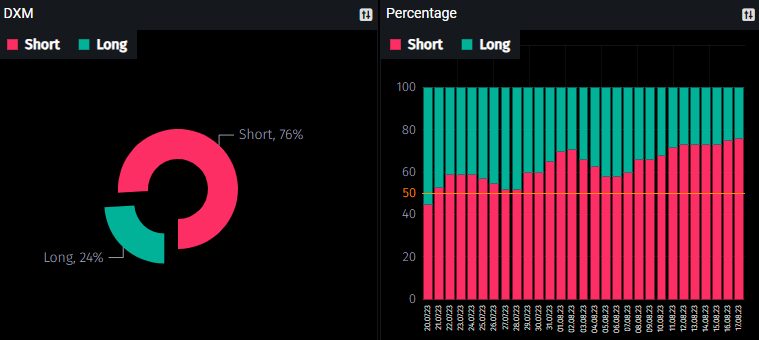

The chart below shows the DXM for the USDJPY pair. As you can see, many retail traders are currently holding short positions (76%). This is a contrarian signal, as it suggests that the market is likely to be oversold.

It is worth noting that 95% of retail traders lose money over extended trading periods. This data suggests that retail traders are often wrong about the direction of the market. Therefore, contrarian traders who take the opposite side of the market as retail traders may have a higher probability of success.

Of course, there is no guarantee of success with contrarian trading. However, it is a strategy that can be used to increase your chances of winning.

Unlocking Trading Insights with COT (Commitment of Traders) Report

The Commitment of Traders (COT) report is a weekly report that provides information on the positions of large traders, such as hedge funds and investment banks. The report is released by the Commodity Futures Trading Commission (CFTC).

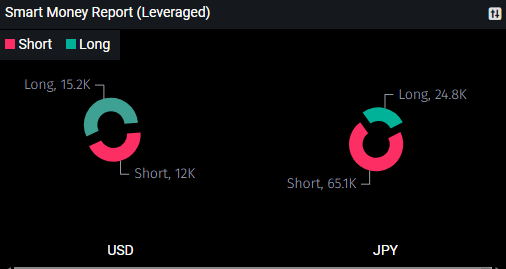

The latest COT report shows that leveraged funds have been heavily short the Japanese yen (JPY) for a long time. As of the week ending August 12, 2023, leveraged funds had a net short position of 65.1K contracts in JPY. This suggests that the “big players” of the market are not interested in buying JPY.

In the case of the JPY, the COT report suggests that the market is bearish. This could mean that the JPY could continue to fall in value. However, it is important to remember that the COT report is just one factor to consider when making trading decisions. Other factors, such as technical analysis and fundamental analysis, should also be considered.

Conclusion: Monitoring the BOJ statement and decision on Yen

The USDJPY pair is facing continuous upward movement. However, the COT report suggests that the market is bearish. All eyes are on the Bank of Japan (BOJ) to see if they will intervene in the market to support the yen. Traders and investors should stay attuned to any updates from the BOJ statement and to consider the bearish projections from industry experts like Credit Agricole.

Author: Jacky.T

Sources: TradingView, PMT, CFTC

DISCLAIMER: This report has been prepared by Fairmarkets International (“The Company”). This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Company has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Company and Fairmarkets International disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Company and Fairmarkets International disclaims liability towards any user and other recipients of this report.