Electronic Arts (NASDAQ: EA), which has established itself as a global leader in the interactive entertainment software industry, saw its share jump over 3% after the bell as the market welcomed the market-beating fourth quarter (2023Q4) report, primarily driven by the outstanding performance by the EA’s popular franchises including EA SPORTS FIFA and Apex Legends.

Like a well-executed combo move, the EA top-line and bottom-line beats combined with the improved outlook were enough to send investors pressing buy on the share. The share has reached a 2.64% growth year-to-date as EA continues to draw investors and players into the immersive worlds that the company creates.

Technical

Looking at the daily chart shows that the gaming giant’s share has enjoyed a significant rise since the bounce off the 13th of March 2023’s low of $108.61/share. The pre-market price of $128.50/share is currently at a discount of 4.13% from the share’s fair value of $134.03 when using the discounted cash flow model.

With the price action approaching a recent level that acted as a barrier for the bulls’ run, EA investors could look for a pullback towards lower levels for a potential entry. Buyers could hope that the prevailing bearish market sentiment towards the share, supported by the appearance of the death cross and the moving averages hovering below the share price, could pull the price towards the 23.60% Fibonacci retracement level at $125.056, which could offer an opportunity for a long. A breakout below the 23.60% Fibonacci retracement level could trigger a run towards the next support level at $125.056/share, the next level of interest.

Fundamentals

EA’s financial performance has been akin to a high-scoring speed run, achieving impressive revenue growth year after year. The recent street-beating quarterly performance ensured the company stayed true to the captivating storyline that has seen the company’s earnings miss the street’s estimate just three (3) times (3 quarters) in the last (10) years (40 quarters). EA delivered earnings per share (EPS) of $1.493/share on revenue of $1.946 billion versus the expected $1.34/share on revenue of $1.754 billion. The excellent performance was primarily driven by increased net bookings, a record-breaking performance in live services, and solid performance in full games across the company’s portfolio.

Console, mobile and PC, both premium and free-to-play, delivered double-digit growth in net bookings, as the company’s portfolio, particularly its live services business model, demonstrated fundamental strength and the ability to execute in a disciplined manner. Net bookings for the fourth quarter were $1.9 billion, marking an 11% increase (or 15% in constant currency) compared to the previous year. One of the notable highlights is the success of EA SPORTS FIFA 23, which demonstrated significant growth with a 31% increase (or 37% in constant currency) in net bookings year-over-year and surpassed the lifetime sales of its predecessor, FIFA 22, within just six months of launch. Apex Legends continued to engage players globally, and making the base game free to enter resulted in increased engagement. The Sims experienced historic engagement highs, with millions of new players joining the community, bringing the community to over 70 million players globally.

The live services segment contributed significantly to the overall net bookings, with $1.6 billion in the fourth quarter, up 9% (or 13% in constant currency) compared to the previous year. FIFA Ultimate Team experienced a 20% increase (or 26% in constant currency) in net bookings, setting new engagement records. Other titles, such as FIFA Online 4 and FIFA Mobile, also saw substantial growth. Apex Legends rebounded from a competitive third quarter and achieved low single-digit year-over-year growth. The Sims 4 surpassed expectations due to new expansion packs and free base game updates.

For the full fiscal year, net bookings were $7.3 billion, down 2% (or up 1% in constant currency) compared to the previous year. The company’s net revenue reached $7.4 billion, and diluted earnings per share (EPS) were $2.88. The operating cash flow generated was $1.6 billion, and over $1.5 billion was returned to shareholders.

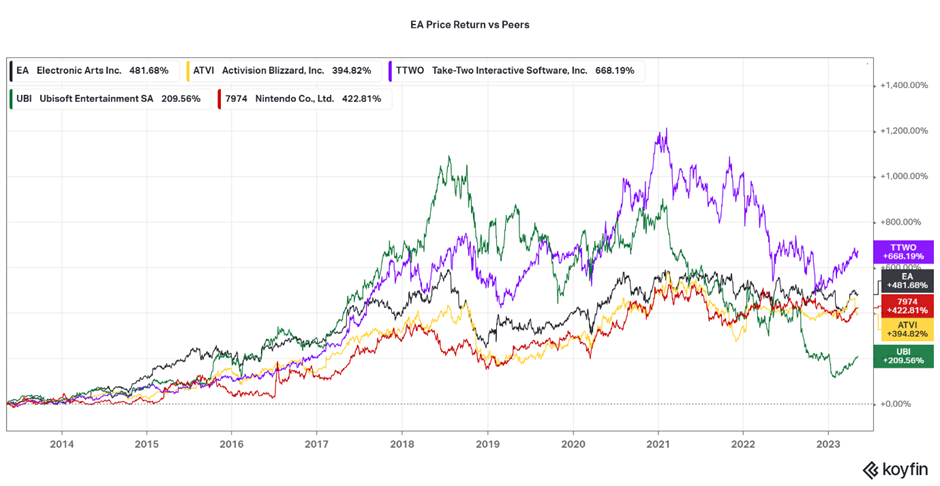

The picture below shows that Electronic Arts’ share price has experienced a substantial growth of 481.68% in the past decade, with Take-Two Interactive (purple line) the only competitor to surpass the company with an exceptional 668.1% price return. EA’s share price has risen significantly, reflecting the company’s strong performance, successful game franchises, and ability to adapt to industry trends. However, it is worth noting that the video game industry as a whole has witnessed significant growth. The increasing popularity of gaming, the shift to digital distribution, and the emergence of new gaming platforms have contributed to the industry’s positive trajectory.

Looking ahead to the fiscal year 2024, EA expects engagement across its portfolio to remain healthy, driven by the strength of its live services business and the growth of its massive online communities. The company acknowledges the competitive market and changing macro conditions, emphasizing the need for focus, discipline, and deliberate execution of strategic priorities.

The outlook for fiscal year 2024 predicts net bookings of $7.3 billion to $7.7 billion, roughly flat to up 5% year-over-year (or up 1% to 7% in constant currency). EA SPORTS FC is expected to deliver low single-digit net bookings growth, building on the momentum from the fiscal year 2023. The cost of revenue is projected to be $1.7 billion to $1.8 billion, reflecting gross margin expansion. Operating expenses are estimated to be $4.3 billion to $4.4 billion, with continued investments to drive long-term growth. Underlying profitability is expected to grow faster than net bookings. The company anticipates operating cash flow of $1.7 billion to $1.9 billion and capital expenditures of around $275 million, resulting in free cash flow of about $1.4 billion to $1.6 billion. EA intends to continue stock repurchases under the current authorization. The net revenue forecast for fiscal year 2024 is $7.3 billion to $7.7 billion, with earnings per share projected to be $3.30 to $3.81.

Summary

EA has a strong franchise portfolio and is well-positioned to capitalize on the growing gaming industry. The expansion of mobile gaming, the rise of esports, and the launch of new gaming consoles present significant opportunities for EA’s future growth. However, the company must navigate intense competition and regulatory challenges while maintaining the success of its key franchises.

Nevertheless, just as a skilled gamer seeks out rare and valuable loot, investors can understand that Electronic Arts presents a compelling investment opportunity given its strong market position, robust financial performance, and favourable industry trends. However, an investor might look to a share pullback for a potential long opportunity that could maximize value for the investor.

Sources: EA, Reuters, Seeking Alpha, TradingView, KoyFin.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.