In the ever-evolving landscape of technology, HP Inc. (NYSE: HPQ) has long been a prominent player who stands as a symbol of both challenge and resilience. However, the company has faced headwinds in recent times, and the recent fiscal second-quarter (2023Q2) earnings report unveiled a mixed picture for the renowned PC maker. The global powerhouse waited until after the bells on Tuesday, 31st of May 2023, to report a bottom-line beat and a top-line miss, leaving investors looking for a sell button on the company’s share after-market.

As the company navigates through a tumultuous market, investors are left to ponder the future prospects of this iconic brand. With the continuous transformation of the industry and the company’s steadfast commitment to adaptability, driving growth, and improving financial health, a fascinating narrative unfolds—a tale of challenges met with unwavering determination.

Technical

The daily chart shows that the PC maker’s share price has formed a bullish ascending triangle trading pattern, and the bullish sentiment is confirmed by the appearance of the golden cross as the shorter-term 50-day moving average (blue line) crossed over the longer-term 200-day moving average (orange line). The share price is set to open at $29.05/share after a decline of 6.08% after-market, following the company’s mixed second-quarter performance. The pre-market price offers a potential 13.08% upside as the share converges towards its discounted cash flow fair value of $33.42/share, which could entice investors looking for exposure to the share’s gain.

However, should a prudent investor look to maximise their potential return from the share, then the investor should keep a keen eye on the reaction of the share price towards the triangle’s support. A break below the triangle’s support could trigger a selloff towards lower levels, with the $27.02/share and $24.14/share support levels offering the potential for a long opportunity.

Fundamentals:

HP is sailing in choppy waters, with the company’s mixed second-quarter financial performance reflecting the volatility of the market. HP reported earnings per share (EPS) of $1.07/share from a revenue of $12.913 billion against the street’s EPS expectation of $0.76/share on revenue of $13.073 billion. The company beat the street’s EPS estimate by 5.27%, but the top line, which recorded a 21.7% year-on-year decline, fell short of the market’s expectations by 1.23%, spooking the market and sending the share tumbling over 6.08% after-market.

The revenue decline was primarily due to the continued struggles within the company’s largest revenue-generating segment, the Personal Systems business, which accounted for 63.3% of the total revenue. Revenue in the segment was $8.18 billion, down 29.1% year-on-year as the global chip shortage continued to plague the company’s business performance. The consumer segment faced a significant 39% year-on-year slump, declining to $2.25 billion against the market’s expectation of $4.26 billion. In contrast, the commercial segment remained relatively stable, recording a market-beating $5.92 billion vs an estimated $4.20 billion. Although volume declined in both consumer and commercial categories, HP’s focus on diversification and addressing market trends could help restore growth.

The company’s printing business performed better, with revenue of $4.74 billion against the street’s expectation of $4.58 billion; however, revenues were down 4.6% year-on-year as the robust demand for the company’s services failed to offset weakness in the consumer market. The Commercial Printing segment demonstrated resilience with a 5% year-on-year increase to $1.09 billion, while the consumer segment witnessed a year-on-year decline of 19% to $641 million. Despite the softness in the consumer market, HP’s ability to adapt to changing consumer preferences and capitalise on the growing demand for commercial printing presents an opportunity for recovery.

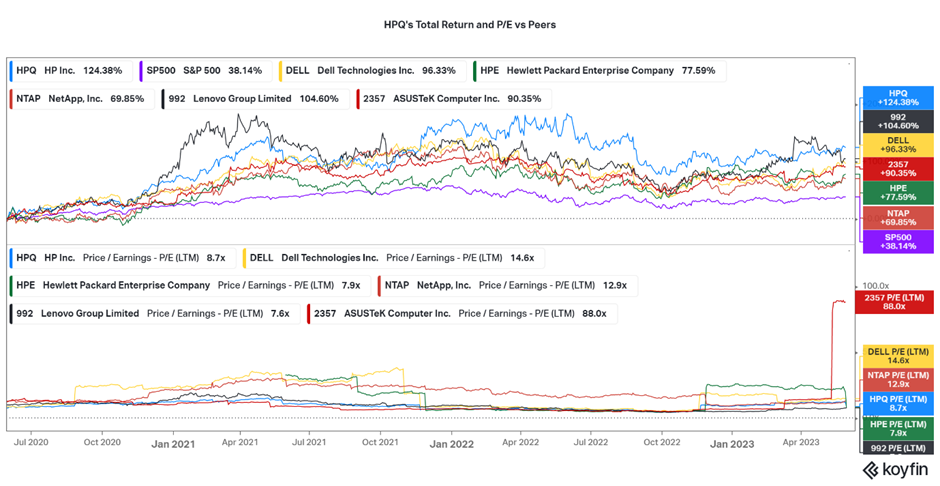

The picture below paints a very welcomed picture of the Technology Hardware and Peripheral industry, which could leave investors itching for some exposure to the industry. The top part of the picture shows that most companies in the industry have outperformed the US stock market’s return of 38.14%, proxied by the S&P 500 Index (purple line), in the last three years. The top performing company within the timeframe has been HP Inc.’s return of 124.38% (blue line). Combining the company’s total return and the price-to-equity ratio (P/E) of 8.7x would suggest that the company’s share is relatively undervalued compared to its peers.

HP is forecasting strong growth for the remainder of the 2023 fiscal year. The company expects its revenue to grow in the mid-single digits for 2023Q3 and the adjusted EPS in the range of $0.81/share to $0.91/share, representing growth in the high single digits, with analysts’ consensus at $0.86/share. The company has also maintained a positive outlook, revising its 2023 fiscal year adjusted EPS guidance to between $3.30/share and $3.50/share, aiming to surpass the prior outlook of $3.20/share to $3.60/share against the market’s expectation of $3.34/share. HP’s expectations to continue expanding its margins in the coming quarters left the market on the edge of its seats, brimming with anticipation for the company’s future.

Summary:

HP’s second-quarter performance demonstrated a challenging period for the company, marked by revenue and earnings declines. However, a comprehensive analysis reveals positive aspects that warrant investor attention. HP’s ability to adapt to market shifts, capitalise on the commercial printing segment, and address challenges in the personal systems division will be crucial for its future success. The company’s revised guidance, improved operational performance, and commitment to innovation indicate a resilient trajectory.

While the market reacted with a 6.08% pre-market decline, this presents an opportunity for astute investors to consider HP as a long-term investment, given its potential for recovery and growth in the ever-evolving technology landscape. However, a prudent investor could wait for a potential pullback towards lower support levels for a long opportunity which could maximise value from the share’s exposure.

Sources: TradingView, KoyFin, Seeking Alpha, HP.

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.