In the fast-paced world of technology, Baidu Inc. (NASDAQ: BIDU), China’s search engine giant, has been blazing a trail towards the future with its unwavering focus on artificial intelligence (AI). Armed with its latest breakthrough, the Ernie 3.0 Titan, Baidu is primed to redefine the boundaries of AI and capture the tremendous opportunities that lie ahead. As the company harnesses the power of cutting-edge AI, investors have a chance to ride the wave of innovation and potentially reap the rewards.

Technical

The daily chart shows that the Chinese search engine’s share price has formed a bullish rising triangle trading pattern, with the share price trading along the dynamic support after the share’s failure to breakout above the resistance level at $160.89/share, forming a double-top.

With the price action below the weekly pivot point at $129.36/share, the bears could be confident in pushing the price lower, with the dynamic support acting as a significant barrier. Should the bears break below the dynamic support, investors could keep a keen eye on the golden ratio, as the fall of the golden ratio would bring the $107.62/share (S1) and $94.64/share (S2) support levels into play. However, should the bulls regain control in the near future, the market could keep the 23.60% Fibonacci retracement under surveillance. A break above the 23.60% Fibonacci retracement could trigger a run higher, with the resistance level (R1) of $142.34/share offering a long opportunity at an 18.66% discount from the share’s fair value.

Baidu’s current share price of $121.56/share offers an opportunity for an astonishing 44.69% return as price action converges to the share’s fair value of $175.89/share, using a discounted cash flow model.

Fundamentals

Baidu, the Chinese tech giant, has shown promising signs of growth and recovery in its recent first-quarter report. The company’s revenue increased by 10% year-on-year, surpassing analysts’ estimates by $230 million. Adjusted net income also saw significant growth, rising by 48%. Baidu’s first-quarter results, with revenue and net income surpassing expectations, point to a potential turnaround for the company. These positive results have also instilled optimism about Baidu’s future and its potential as a bellwether of the Chinese tech sector.

One of Baidu’s key strengths lies in its dominance of the Chinese search market, controlling 40% of the market share. Its closest competitors, Yandex and Bing, lag behind with 22% and 19%, respectively. Additionally, Baidu’s three main businesses—online marketing, iQiyi (Baidu’s streaming video unit), and non-online marketing—are all experiencing growth. In the first quarter, iQiyi rebounded after a slowdown during the pandemic. Its non-online marketing segment, hosting Baidu Cloud and AI services, is experiencing rising revenues. While Baidu Cloud holds a smaller market share compared to its competitors, the growth potential in China’s cloud infrastructure race presents an opportunity for Baidu.

Baidu’s online marketing revenues have also returned to growth after four consecutive quarters of decline. This turnaround can be attributed to the easing of COVID-19 lockdowns in China, which stimulated growth in key sectors such as travel, healthcare, and local services. Baidu’s online marketing business also benefited from the expansion of its Managed Pages, reducing its reliance on traditional ads.

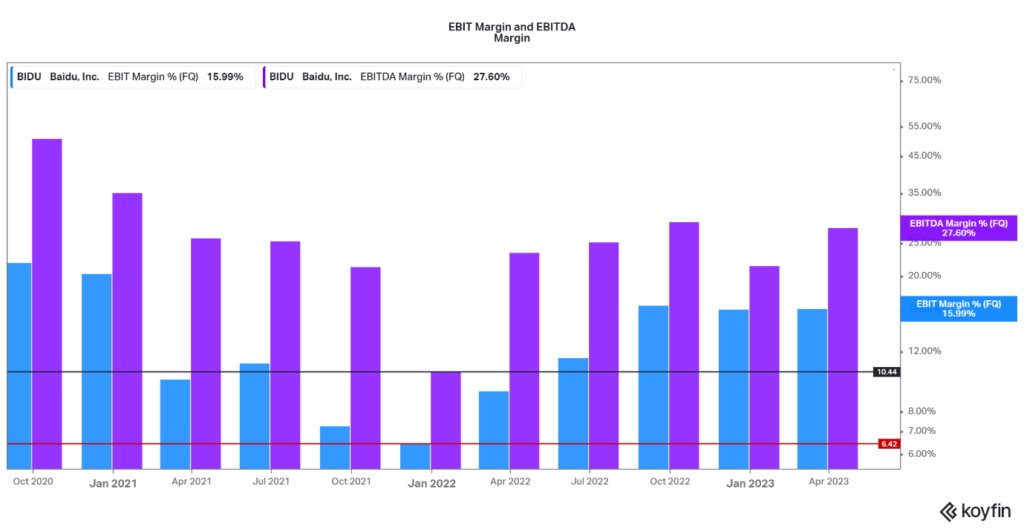

Baidu has strategically focused on optimizing costs while strengthening its advertising business in pursuit of growth and profitability. Through the elimination of lower-margin ventures in Baidu Cloud and the growth of higher-margin advertising, the company has witnessed expanded margins and bolstered adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA). By trimming costs and capitalizing on its AI-driven advertising and cloud businesses, Baidu is positioning itself for sustainable growth. The picture below shows that the company’s EBIT and EBITDA margins have responded positively to the cost-cutting measures, which has seen the company’s margins improve by 9.57% and 17.16%, respectively, in the last six (6) quarters. EBIT margin for the quarter ended on the 30th of April 2023 was 27.60% from the 10.44% for the quarter ended 31st of January 2022. EBIT margin also grew to 15.99% from 6.42% for the same period.

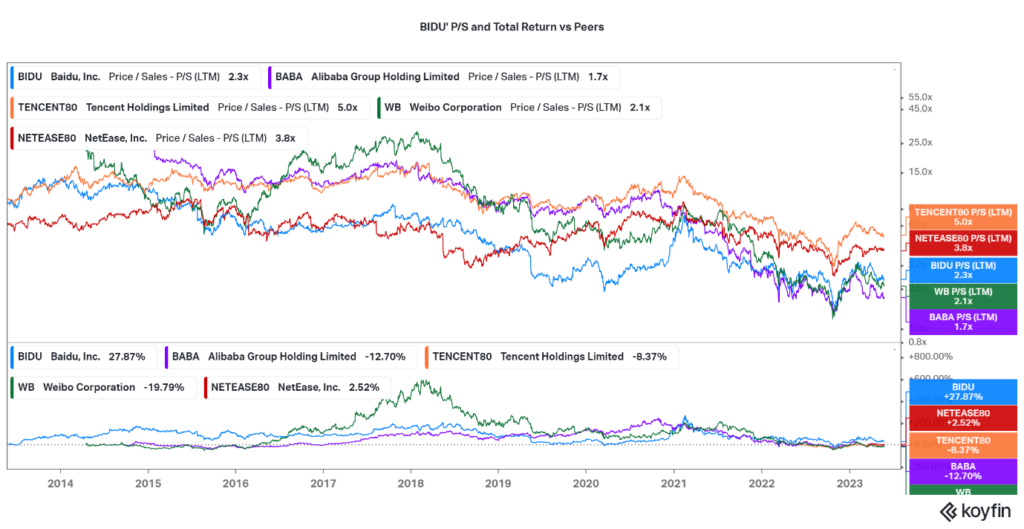

Looking ahead, Baidu’s stock could benefit from the reopening of China’s economy and the resolution of macroeconomic headwinds. Analysts expect the company’s revenue and adjusted EBITDA to rise by 11% and 10%, respectively, for the full year. At current valuations, Baidu appears attractively priced, with a price-to-sales ratio of 2.3x and a total return of 27.87%, for the past decade. The company’s low valuations against its’ peers, combined with the recovery potential of its advertising and cloud businesses, could limit downside risks in the near horizon. However, it’s important to consider the potential limitations on Baidu’s stock performance. Delisting threats for U.S.-listed Chinese stocks remain unresolved, which could impact the company’s upside potential. Investors should monitor developments in this area as they assess the growth prospects of Baidu.

Furthermore, Baidu’s focus on generative AI indicates the company’s dedication to technological innovation. As the world becomes increasingly captivated by the potential of generative AI, Baidu is seizing the opportunity to redefine the boundaries of what is possible. Inspired by the success of OpenAI’s ChatGPT, Baidu is developing its own AI marvel, the Ernie Bot. With pending regulatory approval, Ernie Bot aims to captivate users with its ability to dream up text and engage in human-like conversations. Baidu recognizes the vast potential of generative AI, comparing its impact to the introduction of the internet and smartphones. By leveraging its search, knowledge graph, and dialogue capabilities, Baidu aims to capture the opportunity presented by generative AI. This aligns with the broader trend of Chinese tech giants recognizing the potential of AI technology and investing in its development. Baidu’s progress in this field could contribute to its future growth.

Summary

Baidu emerges as a compelling investment opportunity, fuelled by two powerful drivers: its groundbreaking advancements in artificial intelligence and its impressive financial performance. The company’s commitment to AI innovation, exemplified by the remarkable Ernie 3.0 Titan model, places it at the forefront of the global AI revolution. This technological prowess, combined with its dominant position in the Chinese tech sector, sets the stage for Baidu’s continued growth and success.

While challenges persist in the form of delisting threats, Baidu’s growth potential, attractive valuations, and its pivotal role in China’s post-COVID recovery make it an enticing choice for investors seeking both innovation and financial performance. By capitalizing on the transformative power of AI and leveraging its leading position in the Chinese tech sector, Baidu is poised for a gradual climb in stock value, making it a compelling investment opportunity for the future.

Sources: TradingView, KoyFin, Reuters, Seeking Alpha, Baidu,

DISCLAIMER:This report has been prepared by our Group company. This document is not intended as an offer, solicitation or recommendation to buy or sell financial instruments or to make any investment. The Group has used reasonable efforts to obtain information from reliable sources and the report is provided without representation or warranty of any kind (neither expressed nor implied). The Group disclaims liability for any publication not being complete, accurate, suitable and relevant for the recipient. Specifically, the Group disclaims liability towards any user and other recipients of this report.